End of the Road – US debt spikes, interest to exceed $1trillion

News

|

Posted 17/07/2023

|

4595

After Friday’s very long but essential reading today is short and sweet but a salient reminder of the very Ponzi scheme outlined last week together with the threat of the USD through outright issuer abuse.

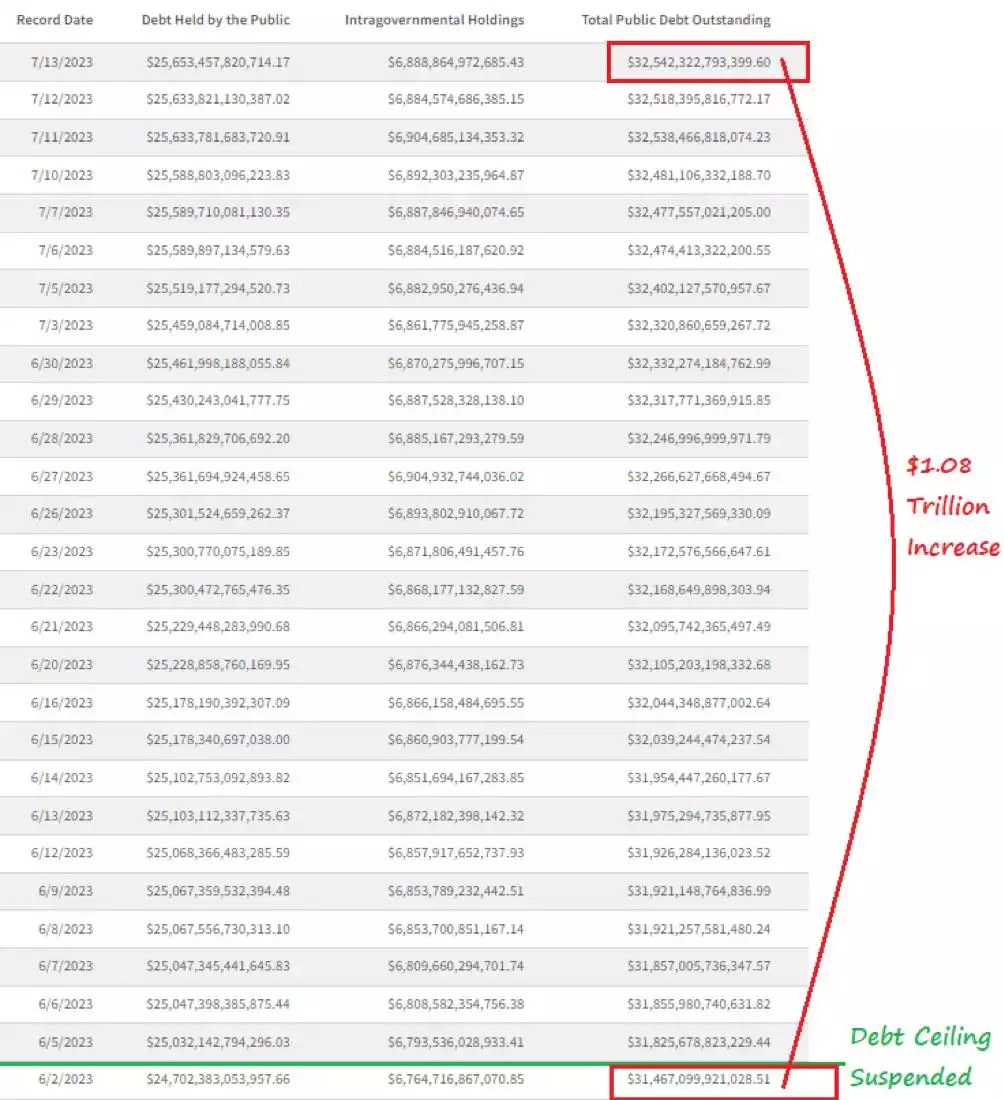

You may recall the recent hoopla around the US debt ceiling limit and the outcome of lifting it with the pinky promise they would try harder to reign in deficit spending. So, just 1 month later, how’s that going exactly?

Yep, $1 trillion extra debt in just one month.

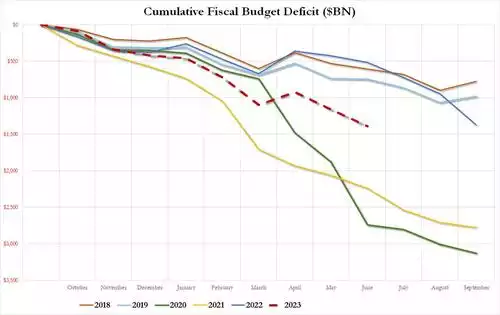

Looking more broadly at the US budget (who’s fiscal year is 1 October to 30 September), we are looking at the biggest deficit fiscal year to date on record this year outside of the COVID crisis spending…

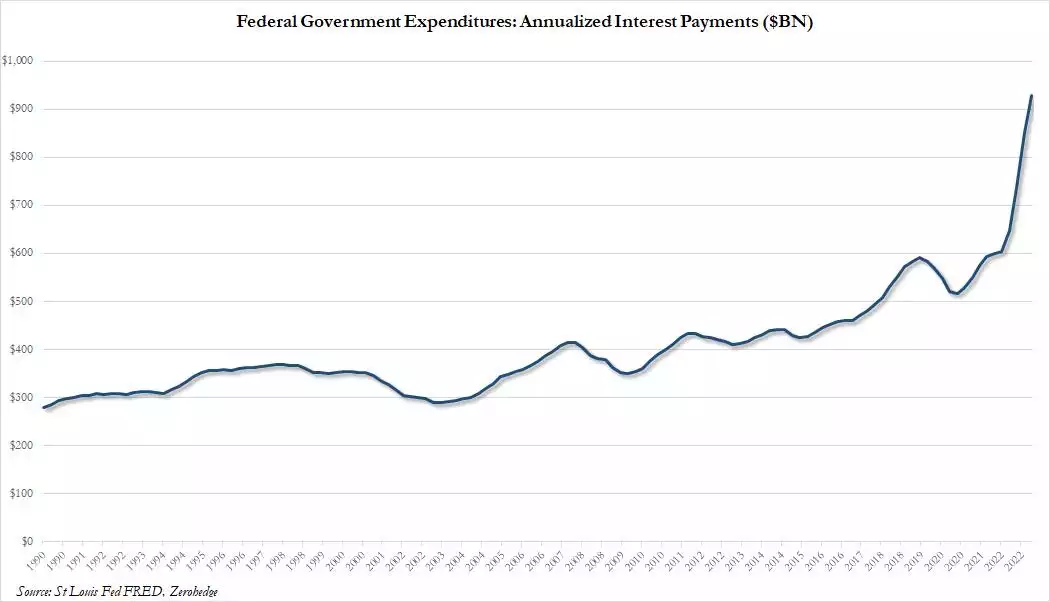

Now this of course, as you can see from the table above, means a whole lot more debt. Debt that must be serviced. So let’s talk about that quickly. As many people around Australia are feeling right now, and about to get worse as fixed interest periods end, the unprecedented speed of interest rate rises has dished up an eye wateringly higher interest cost as we see the culmination of highest debt levels with higher interest rates paying for it. The US government, albeit on a slightly larger scale, is in the same boat…

To put the above chart into context, courtesy of ZH:

“Soaring interest rates, driven by the panicked Fed's scramble to undo its epic policy failure of 2020 and 2021 when the Fed kept rates at zero for far too long while injecting trillions into various asset bubbles, have been the key driver of the deficit, with the Federal Reserve boosting its benchmark rate by 5% since it began hiking in March last year. Five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt: that's right - even when the Fed starts cutting rates, due to the delay of rolling over maturing debt, actual interest payments will keep rising for the foreseeable future.

For context, the weighted average interest for total outstanding debt at the end of June was only 2.76%, a level that’s not been surpassed since January 2012, according to the Treasury. That’s up from 1.80% a year before, the department’s data show, and if the Fed indeed keeps rates "higher for longer", the blended rate on the debt will surpass 4% in one year.

That would be a complete disaster for the US, and it would mean that interest payments on total US debt of $32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

But we don't even have to wait that long until the exploding interest on US government debt becomes a major talking point ahead of the coming presidential elections. According to the St Louis Fed's FRED and the BEA (chart above), the interest payments by the Federal Government have now surpassed $900 billion for the first time ever, and within a quarter will hit probably rise above $1 trillion, a historic benchmark that will probably begin the countdown to the US Minsky Moment.”

Last week dished up more and more evidence of inflation plummeting in the US. PPI (inflation at the factory door) hit just 0.1%. Global Macro Insider below overlay current US CPI against the average of 5 of the similarly large outbursts of inflation we’ve seen in the US between the 40’s and 80’s as an indicator of the forward trajectory….

And so surely one would think the Fed will stop hiking given a. they are setting up an unprecedented interest cost for the US; b. many an indicator showing recession dead ahead, and c. the ‘kill inflation’ project is surely done and dusted…

But no. Late last week the voting Fed member Waller said the Fed will likely need two more 25bps hikes this year and that he personally will be voting for a rise at the July FOMC meeting. He says he is increasingly confident that banking stress won't derail the economy. Acknowledging the drop in inflation he said whilst welcome, they need to see if it is sustained and he doubts core inflation is structurally lower. He believes the September Fed meeting is a ‘live meeting’ for monetary policy.

The US Fed have a near perfect record of hiking into a recession or until ‘something breaks’.

Brace…