EU & Japan Double Down

News

|

Posted 28/05/2020

|

20926

You can now listen to the article and all our daily news, via YouTube and Anchor

The race to inflate took a giant leap forward in the last couple of days with the European Union and Japan announcing massive monetary stimulus programs in the face of the worst recession in memory. It was less than a week ago that we saw the Bank of America release a report quantifying the global central bank monetisation at nearly $2.4 billion every hour for the last 2 months. And of course it’s driving up sharemarkets and in no way fixing the core issue of solvency nor keeping up with the demand for USD. From TheStreet –

“The bank's weekly Flow Show report notes that around $4 trillion in financial assets -- from government and agency bonds to corporate and mortgage debt -- have been hoovered up central banks from Tokyo to Washington, helping drive a $15 trillion surge in global equity market value over the past two months.

That surge, however, belies the fact that nearly 75% of the world's 3042 globally listed stocks are trading in the bear market territory (or 20% below their recent peak) and that "policymakers causing "immoral hazard", forcing investors to buy, banks to lend, corporate zombies to issue in 2020."

"Government and corporate bond prices have been fixed by central banks," Flow Show analysts wrote. "Why would anyone expect stocks to price rationally?"

Some $17.8 billion has found its way into bond markets over the past week, the biggest move in more than three months, while some $3.5 billion has been invested into gold, the second largest on record.”

However we now have a step change before us since that report was done with Japan announcing a new $1.1 trillion stimulus package that will include direct spending and taking their total response since the virus to $2.18 trillion which is a staggering 40% of the GDP and taking their already world leading debt to GDP to over 250%. Just dwell on that number for a bit. 2.5 times their entire output. Consider too that $2.18 trillion in the context of the US Government’s entire $2.3 trillion to date…

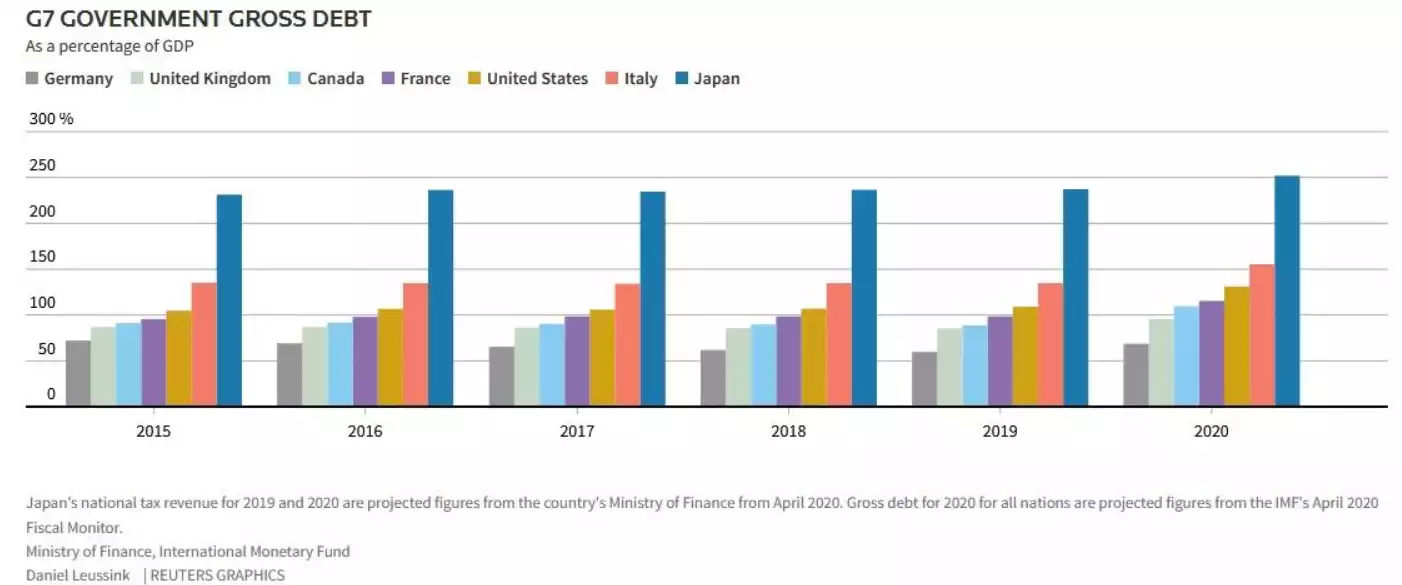

Japan is the world’s 3rd biggest economy and yet look at how its gross debt compares to the rest of the G7…

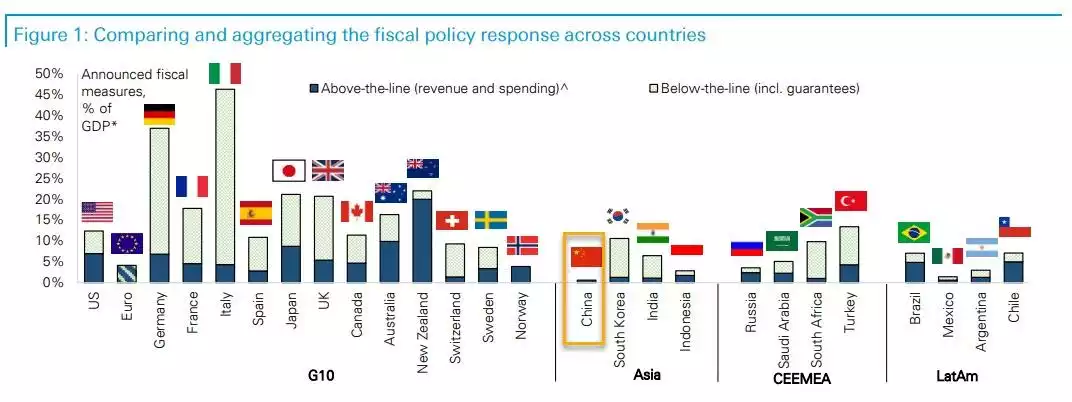

However Japan started at a very high base of debt to GDP and when compared to other countries this additional stimulus package “only” takes them to a comparable additional 35-45% of GDP that we’ve seen from Germany and Italy respectively already. The chart below shows the fiscal stimulus responses from Governments around the world. Note Australia sits in the 15-20% zone.

And that is the perfect segue to the other big news, and that is the announcement from the European Commission of a proposed $2.6 trillion rescue package. From Bloomberg:

“The European Union has stepped back from the brink. Again.

Unprecedented in nature and ambitious in scope, the 2.4 trillion euros ($2.6 trillion) in total recovery spending unveiled by the EU -- anchored by 750 billion euros of joint debt issuance -- has already started to calm jittery markets and it might just restore a sense of unity to a bloc under severe strain.

With the economic pain spread unevenly across the continent, the initiative will mean a big step toward real fiscal union for the 27 member states and aims to recast the EU as a force for good rather than an irritating meddler.

Facing its worst recession in living memory, the EU has crossed a new bridge: It will harness its collective strength to raise massive amounts of money that won’t need to be repaid by the recipient countries.”

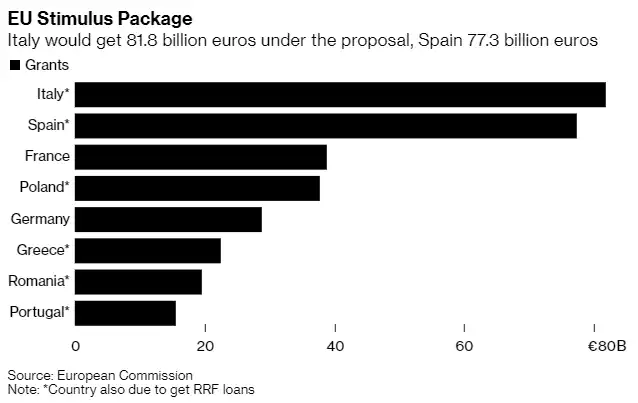

Catch the difference there? They are not even calling it debt. It’s a grant that doesn’t even need repayment. It’s also a landmark proposal in that it is a giant step to try and fix the fundamental flaw in the EU concept – a common currency but not a common fiscal account. After all the resistance to bail out Greece in 2012, it is ironically Merkel herself together with Macron leading this push that sees funds deployed as follows:

However it is far from a done deal with the so called "Frugal Four" - Austria, Denmark, the Netherlands and Sweden — which have been pushing for a "loans for loans" with an expiry of 2 years approach rather than straight out grants.

This is a critical space to watch as the failure of the EU experiment has been a key element in some of the forecasts of where the COVID-19 recession ends.

Remember too this article only speaks to the Government stimulus and we have the incredible amount of central banks stimulus on top of that.

One thing is certain though, the Japan and Euro announcements are a doubling down of an already eye watering accumulation of debt all around the world. Dressed up as stimulus to save the day, the reality is likely this will do little to plug a much bigger hole, not prevent a huge deflationary event, but set the stage for massive inflation on the other side of the inevitable response. On any dispassionate look at this from a macro level, it is hard to see any way out of this barring the huge debt deflation we spoken of over the last few weeks. Think long and hard about where you want to park your hard earned wealth.