ETH All-Time-High, BTC Mid Cycle Low

News

|

Posted 02/11/2021

|

9510

Following an exciting week that set a new all-time high for Bitcoin, the closing days of October have seen the price pull back and consolidate, with a weekly low of $58,208 USD and a high of $63,698. Despite the market softening from the highs and price dipping briefly below $60k, Bitcoin is still up an amazing 40% in October, motivated in part by excitement over the launch of the ProShares Bitcoin Strategy ETF ($BITO). That mark of +40% is the highest single month of gains for BTC since December 2020. The total price range of October's monthly price candle was $23,205.

Bitcoin hasn't been the only performer— Ethereum also made a new all-time high this week of $4,455, eclipsing the previous high-water mark of $4,362 set on May 12.

When new highs are made, the behaviour of holders and the profit-taking activity of investors can inform us about the health, and sentiment of the market. SOPR (Spent Output Profit Ratio) is the profitability of spent Bitcoin relative to the realised value daily.

The current levels of spent profit-taking on-chain are mild considering the all-time high was broken ten days ago, and resemble the activity of an early bull market. It appears that current holders are by and large unwilling to move their coins here, and are waiting for higher prices. Positive SOPR during consolidation or upwards price action is constructive as it suggests the market can absorb the sell-side whilst maintaining price support levels.

A lot of attention is paid to the Long-Term Holders, but their high time preference counterparts (the Short-Term Holders) can also inform us about market conditions.

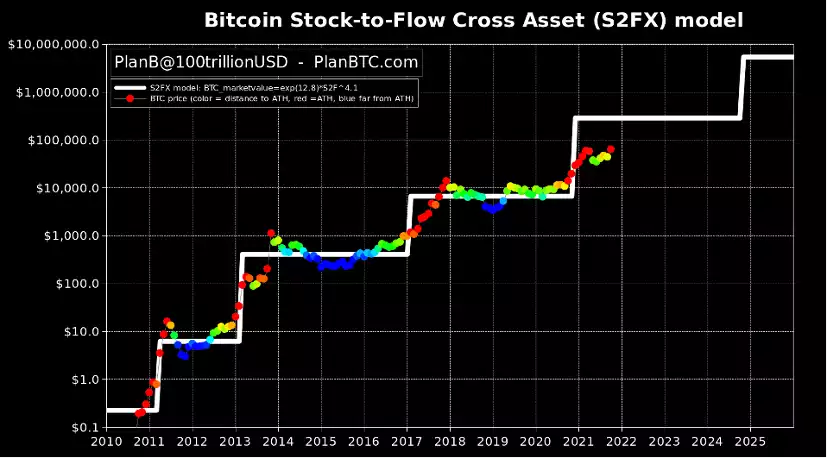

The Stock-to-Flow creator PlanB put out a tweet yesterday proving how accurate the BTC price model has been for the last few months. The Dutch former institutional investor with decades of experience in financial markets said that his “worst-case scenario” for Bitcoin was “Aug>47K, Sep>43K, Oct>63K, Nov>98K, Dec>135K.”

A reminder of where the S2F model predicts the BTC price to be…

Goldman Sachs analysts have also predicted that the Ethereum price would break out within the next two months. The altcoin closed October up over 40%. In a note circulated by Goldman Sachs Global Markets managing director Bernhard Rzymelka, he states that cryptocurrencies have traded along a line with inflation breakevens in between for nearly two years now. The director refers to the Bloomberg Galaxy Crypto Index, which compares inflation to the USD 2-year, 2-year forward inflation swap. Analysts hint at the Ethereum price rally and set a target of $8,000 for ETH within the next two months if the historical correlation with inflation persists.

Nearly $3 billion worth of ETH tokens have been burned since the implementation of EIP-1559. Consistently higher burn is expected to drive ETH deflation and Ethereum prices higher.

When combining the observations of increased old coin activity with the muted levels of profit-taking covered earlier, a bullish on-chain portrait is being painted. If crypto can maintain an environment of low selling, prices may find themselves back in price discovery before long…