Double-dip Recession? Not Even a Death-Penalty Can Enforce Price-Controls

News

|

Posted 29/06/2023

|

10031

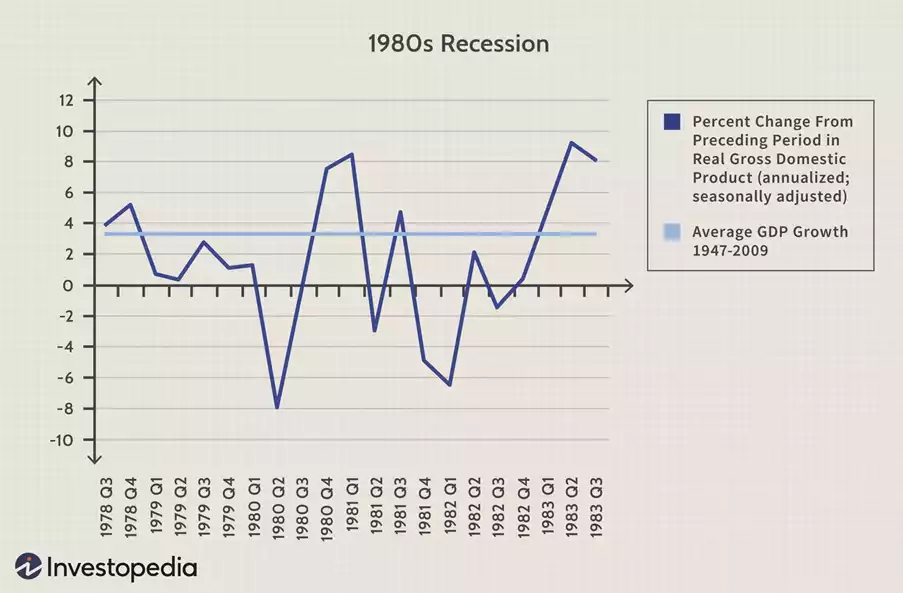

"A double-dip recession refers to a recession followed by a short-lived recovery, followed by another recession. For whatever reason, after the initial recession has passed, the recovery stalls and the second round of recession sets in just as, or even before, the economy has fully recovered from the losses of the initial recession." - investopedia

One major cause of double-dip recessions is lower demand. China has recently been visibly struggling to deal with lower demand around the world. According to Reuters, missing targets in their retail sales and May industrial output has led to several major banks cutting their 2023 GDP forecasts for China. This is a clear reflection of lowered demand globally hurting the main production hub for the world.

A major cause of that lower demand is inflation. What is happening now is a textbook example of what was happening leading up to the double-dip recession of the 1980s. Inflation went from 2% up to 13% by 1979 and it took an 18% Federal funds rate to reduce the money supply enough to create a recession in 1980. This was a surprisingly short-lived recession and a recovery started happening later that year. But, in the very next year the Federal funds rate was pushed to 19% which triggered a surprise second dip in 82.

There has been an army of central bank speakers this week, and it appears that most of them are keeping more rate hikes on the table. Is this just a bluff to quell overheated markets? Think again to the surprise push in 1981 which knocked down risk markets again. If inflation is still hurting consumer confidence, and production is reducing, the central banks have a large incentive to push a bit harder and eliminate both of these issues at the same time.

The reaction: Nixon targeted gold and pushed for price controls. If we do get an 80s-style double-dip recession, one could expect the same actions to come from global leaders again. Gold and other precious metals become a clear issue in these scenarios, as they are some of the only things that can hold value and be stored away. If interest rates whiplash risk markets and bankrupt companies, it has no effect on physical precious metal holdings. They also shine a light on the devaluation of currencies that follows recessions, once the money supply is allowed to freely increase again and further erode the wealth of those who do not notice.

Price controls, put simply, have never worked. Long before Nixon tried to utilise them, the Roman Emperor Diocletian set a death penalty for merchants who tried to raise their prices on over a thousand products. These controls were almost completely ignored by the Romans, even in the face of death. The Emperor even tried to arbitrarily reprice the currency in an attempt to conquer inflation, which the market forces of supply and demand quickly rectified. This points to how clearly the money supply causes inflation, and it's the same reason analysts this week have been hanging on every word of global central bankers.

History shows that banking policies that do not remedy the real cause of inflation can only temporarily influence markets. The only thing they typically do is lead to boom-and-bust cycles that mostly hurt retail investors. Emperors, Presidents, regulators and even death penalties have all failed to even paint a veneer over this fundamental problem, meanwhile gold and silver have never gone bankrupt (because they can't).

The best thing for a failing banking system could hypothetically be to buy record amounts of gold to protect themselves from inflation and hope that retail investors do not copy them.