Dollar Weakness Continues as DXY Loses Critical Support

News

|

Posted 21/01/2026

|

1558

On 3 December, when the DXY broke structure, further downside was anticipated amid growing technical weakness. While this breakdown persisted, the index attempted to reclaim the former support level last week.

However, that attempt failed, and the DXY has since broken down again from this key level—clearly signalling ongoing technical weakness.

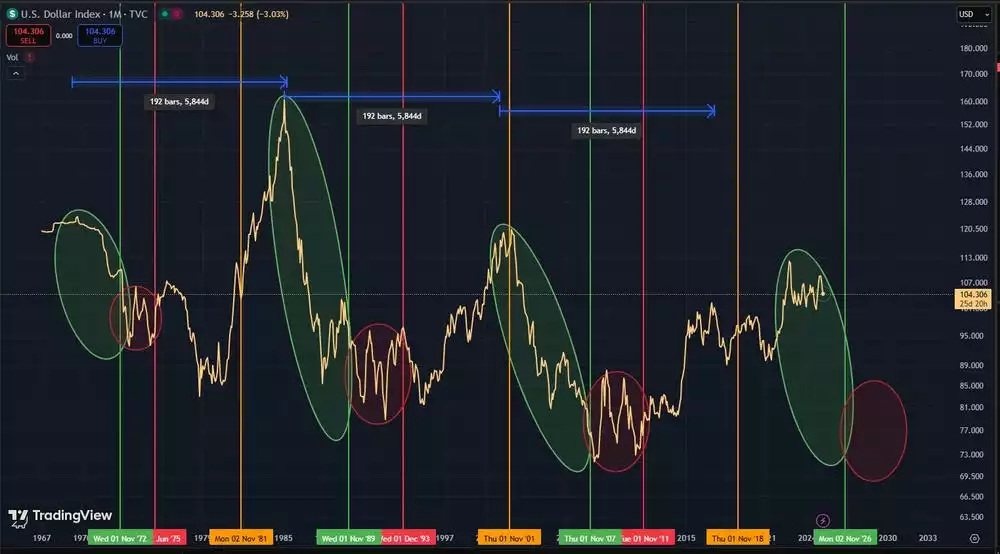

As we approach the final phase of the 18.6-year land cycle, historical patterns show that over the life of the DXY it has consistently experienced sharp declines during this final phase (highlighted in green).

This environment typically favours hard assets as the US dollar loses strength, with gold and silver particularly benefiting due to their role as monetary hedges during periods of rising financial instability.

At the same time, we are approaching the peak of this cycle amid a broader trend of de-dollarisation, coinciding with the latter stages of an 80-year socio-economic cycle. The previous cycle ended with the Great Depression and World War II, transitioning into the current one alongside the establishment of the gold standard. Historically, the transition from one 80-year cycle to the next has involved the emergence of new financial systems, often amid significant economic and geopolitical disruption. During such transitions away from man-made systems, investors have tended to gravitate towards enduring, time-tested assets such as gold and silver.

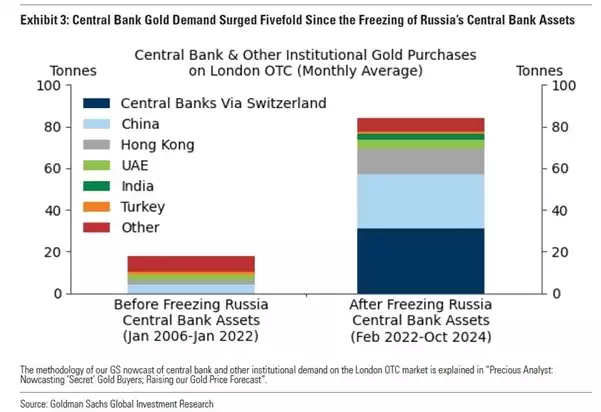

It is therefore notable that, for the first time in recent history, central banks are purchasing more gold than US Treasury bonds. Since 2022, central banks have been buying gold at roughly five times their long-term average rate.

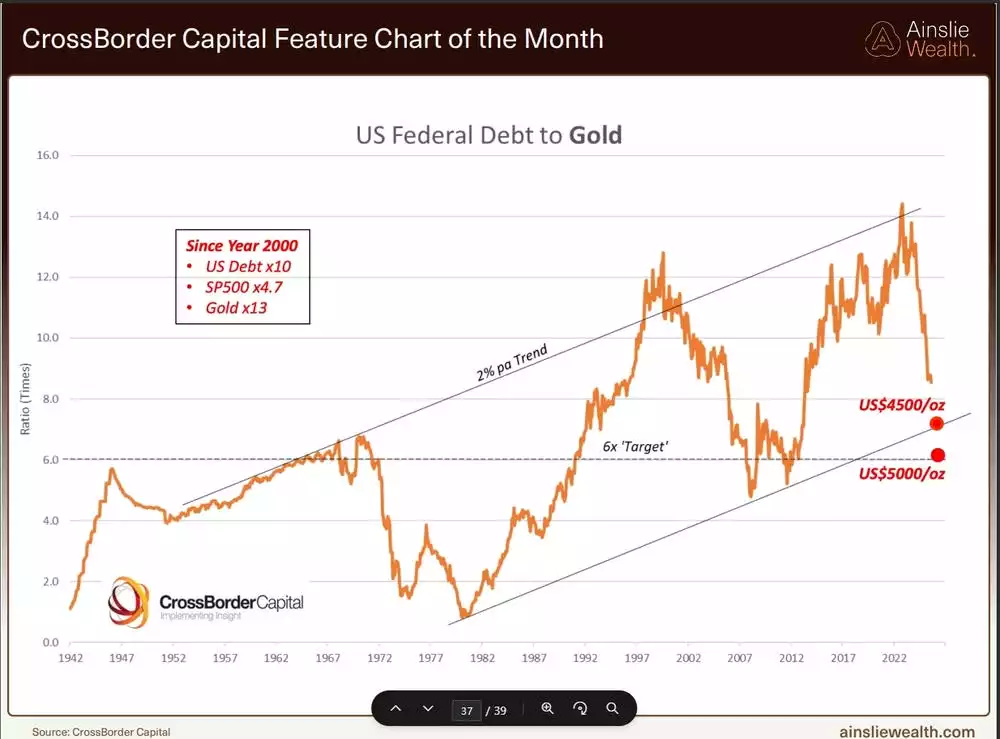

With US government debt reaching eye-watering levels, the stability of the current financial system appears increasingly strained. The price of gold has effectively been acting as a barometer for US government debt: the higher the debt burden that must be serviced, the greater the pressure to weaken the dollar—thereby increasing the relative value of gold. In simple terms, as debt rises, so too does gold.

A gold price of around USD $5,000 per troy ounce in the medium term (as illustrated above) broadly aligns with many analysts’ projections. Extending this model out to a 15-year timeframe, however, suggests a valuation closer to USD $20,000 per troy ounce.

Using the 100-year average gold-to-silver ratio of 50, a gold price of USD $20,000 per ounce would imply a silver price of approximately USD $400 per troy ounce over a similar timeframe.