Dollar Cost Averaging & Bamboo

News

|

Posted 01/09/2020

|

10959

Emotion and investment are very hard to separate and yet they should have no common ground in the quest for preserving and growing your wealth. The best investors are those who can stick to a well considered plan, adjusting on changes in fundamentals not on FOMO (fear of missing out) or TTID (this time is different). An alternative is simply not to try and understand the ‘best timing’ but to average your way in on regular set times irrespective of what is happening in the market. So called ‘dollar cost averaging’ or DCA removes emotion but of course you need to understand and believe in the investment per se. We post news daily to educate you on how and why we are in an unprecedented macro economic era. What is going on in our world now has some of the greatest macro economic analysts more unanimously bullish on gold, silver, Bitcoin and Ethereum than ever before. Below we explore how it performs but first some exciting news….

As many will know we have been big supporters of the Aussie round up and dollar cost averaging app Bamboo for a couple of years now. Bamboo is a beautifully simple but effective way of easily acquiring Bitcoin, Ethereum, Gold and Silver through just your mobile phone and bank account. We are proud to provide the gold and silver through our Gold Standard (AUS) and Silver Standard (AGS) tokens. The app lets you round up payments out of your bank account and credit card, dollar cost average through recurring purchases, and easily ‘top up’ anytime, anywhere when you see a dip opportunity or come into some money you want to quickly invest before you waste it. So beautiful, simple and intuitive is the user experience they received a nomination from the Nominee Jury of the internationally respected A’Design Award & Competition 2021.

On Sunday we saw the exciting news that Perth-based investment fund manager Digital Capital Management (DCM) had acquired the company after having been seed investors since its inception. They have also teamed up with Mine Digital, with their CEO Grant Colthup joining the board and Mine Digital will ensure wholesale pricing of assets as well as providing Bamboo licensed and insured digital wallet infrastructure with BC Group in whom it is worth noting that Fidelity Group recently acquired a stake in. Mine Digital has strong international relationships and will be looking to bring additional strategic partnership to the business for the benefit of Bamboo customers.

One part of the announcement that will have many rejoicing is the long awaited addition of Android to the platform.

Bamboo offer integration with an incredibly long list of Aussie banks, building societies and super fund accounts. As Bamboo point out in the press release, compared to the returns on money in those banks for the year to date they have seen the 4 assets offer the following returns:

- Bitcoin — up 61.25%

- Ethereum — up 226.43%

- Gold — up 23.73%

- Silver — up 48.57%

With the new ownership comes some exciting and imminent expansions of the offer. The combination of the ‘closed circuit’ nature of the platform linked directly to your bank account, security, reporting transparency and the infinite audibility of the blockchain make this the perfect vehicle for self managed super funds. And so not surprisingly that is due to roll out this month as can be seen in the roadmap of exciting new prospects laid out below:

- Integrate with Mine Digital to provide wholesale cryptocurrency prices to customers (August 2020)

- Enhanced Trading Reports (September 2020)

- Enable access and compliance requirements for Self Managed Super Funds (September 2020)

- Access to earn interest on your investments (December 2020)

- Advanced portfolio rebalancing (December 2020)

- Revamped tokenomics (December 2020)

As mentioned above, one of the key benefits of an app like Bamboo is the ability and (auto) discipline of dollar cost averaging. Crypto markets in particular are volatile and volatility often brings human emotion in the form of FOMO in to play. That inevitably sees people piling in at the top and steering clear at the bottom. That’s not a great formula for making money. Forbes ran an article earlier this year on exactly this topic. They gave the example of the following tweet:

Poor Hayden went ‘all in’ at peak FOMO. From Forbes on what is DCA?:

“The goal of such a strategy is to increase your exposure to an investment asset slowly over time instead of all at once. This allows an investor to reduce the risk associated with purchasing an asset that is highly volatile on a day-to-day basis while gaining exposure to the long term trends of the asset.

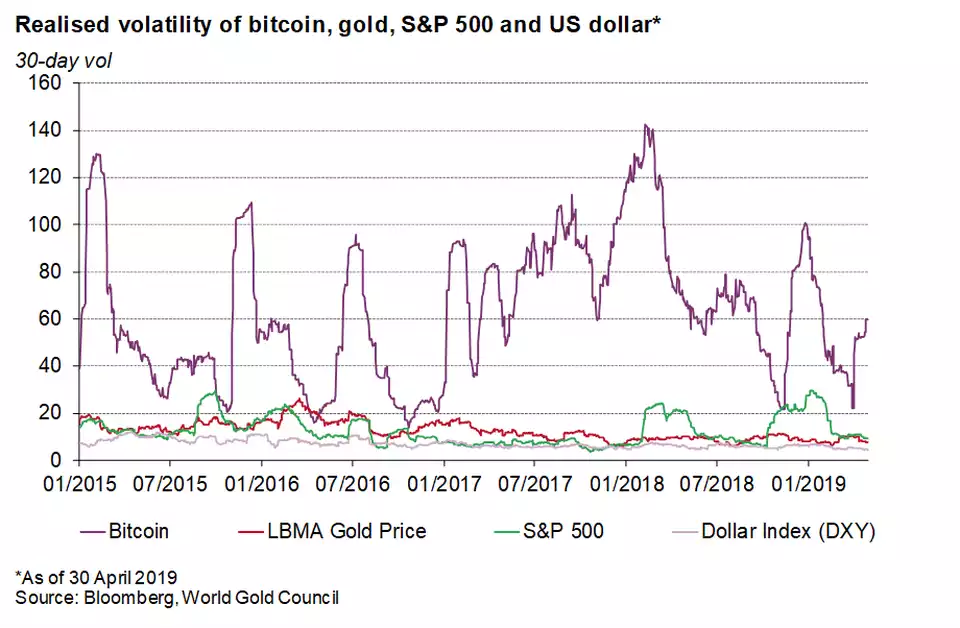

And indeed, bitcoin is very volatile. A 35% drop in 4 days is quite significant. As you can see from the graph below, Bitcoin is significantly more volatile than gold, the S&P 500 and the USD.”

“So how exactly would a bitcoin dollar cost average affect an investment? If we look at what @ProudMoole’s investment would look like on February 17, 2020, he would have $37,400. A 50% loss since December 2017.

Using the bitcoindollarcostaverage.com calculator, if he would have put $1500 with every bimonthly paycheck –– starting on December 17th, 2017 –– he would have spent $76,500 and would have $113,677.48 worth of BTC on February 17, 2020. This is a 45.74% gain since December 2017.

But the benefits of dollar cost averaging are not just capital related. By steadily increasing your investment exposure, dollar cost averaging may also reduce stress related to having too much money concentrated in a single asset and curb emotional urges that may result in buying or selling your investments in a panic. And when you feel you have had enough exposure, all you have to do is turn off your dollar cost averaging service.”

In other words, in the right investments DCA can see your wealth grow and flourish like, well, bamboo…

You can learn more about Bamboo here.

You can download the app via PlayStore at the following link while the iOS app can be found here.