Do they really want to reduce inflation?

News

|

Posted 26/10/2022

|

12767

Markets rallied last night on yet more poor economic data out of the US in the predictable trend now of ‘bad news is good news’ as the Fed will ‘surely’ reverse course and liquidity returns with force. There seems to be a widely held view that we will see a moonshot reversal when that happens. But lets explore that a little more.

We have for years reminded readers that there are just 3 ways to address this record pile of debt. 1. Strong economic growth to pay it off. No one but no one is expecting strong growth for years. All the talk is recession not growth. 2. Default on it. We are at an extraordinary geopolitical juncture where such globally coordinated debt forgiveness is virtually impossible. 3. Inflate it away. Reduce the relative size of the debt burden by making everything else more expensive.

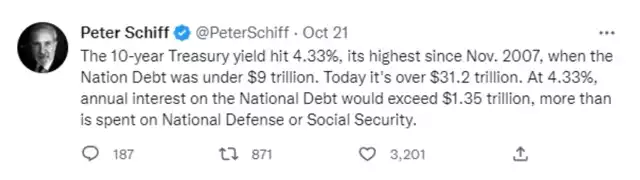

The 3rd option is literally the only thing on their table right now and if one were to look at past claims of “its just transitory” and the likes of RBA’s surprise easing of the pace of hikes last month, one can’t help but wonder just how committed they will be to reducing it all the way to the 2% target. Now that’s not to say they don’t need to reign it in as if they lose control there is a much bigger issue of how on earth you service it all at too high rates. Topically Peter Schiff just last week tweeted:

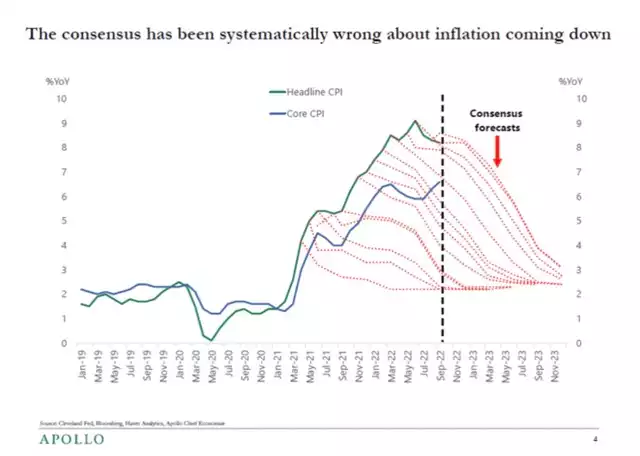

It’s worth looking at the evidence of just how incredibly wrong ‘consensus’ has been in forecasting the easing of this very not ‘transitory’ inflation. VERY:

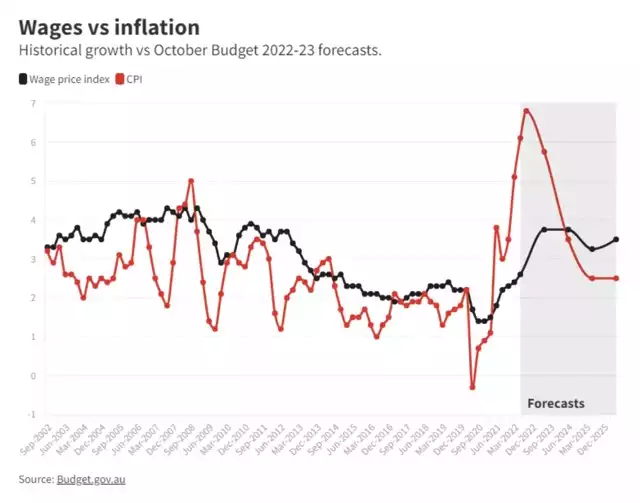

Our own Aussie government in last night’s budget has a similarly hopeful view of plummeting inflation next year:

As you can clearly see Aussies have a hard time ahead with wages severely lagging the cost of living.

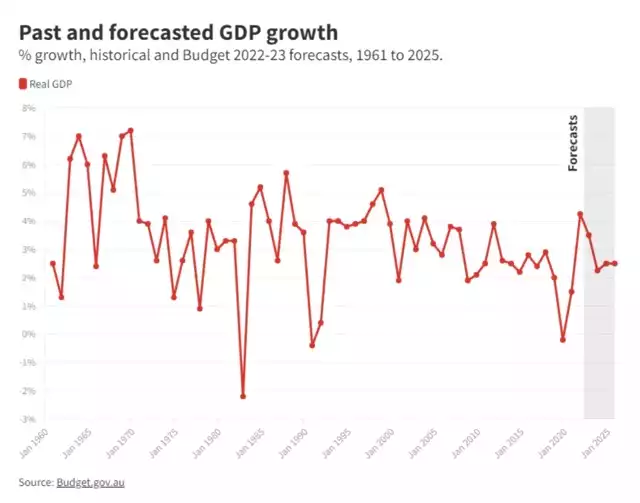

Somehow, despite forecasts of near recession and rising unemployment its going to miraculously come good. They also have a terrible track record of forecasting economic growth so the following forecast of a near miss of an recession in Australia may not eventuate, particularly with their own acknowledgment that this solely relies on strong commodities markets whilst China is looking like slowing down. Throw in that Aussies have most of their debt in a property market that is staring headlong into the effect of highest in world debt levels, rocketing interest rates to service that, rocketing costs of living reducing repayment buffers, sky high valuations, and cracks already very apparent of possible substantial price drops, not helped by the announcement in the budget of a pile more houses being built with government assistance.

But lets return to the more global economic setup and the question of inflation being allowed to stay a little higher than most expect it to revert to, to deflate that debt.

We have had periods in the past where extended periods of high inflation and low growth have seen financial markets track sideways for many years. It wasn’t long ago Wall Street legend Stanley Druckenmiller predicted exactly that:

“There’s a high probability in my mind that the market, at best, is going to be kind of flat for 10 years, sort of like this ’66 to ’82 time period.”

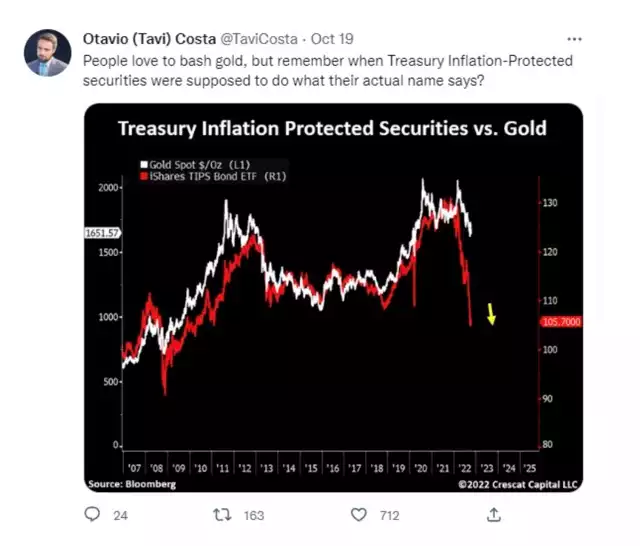

People have sought protection against inflation from bond instruments in the past but their performance has left a lot wanting:

There are no safe assumptions when markets are so grotesquely distorted as they currently are. Central banks and governments alike know they have a debt issue and know of the 3 options. Don’t discount the possibility of there being no real intention to return to 2% inflation and what that means for your wealth.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************