Discovering the Exciting New Frontier in Bitcoin: The Emergence of Ordinals and Inscriptions on the Blockchain

News

|

Posted 14/02/2023

|

8979

The digital asset market has recently suffered its first major setback of the year, which has been linked to a combination of US regulatory moves and increased scrutiny by the SEC. Despite these challenges, the market is still witnessing unexpected demand for block space, underscoring its continued growth and evolution as well as increasing interest and investment from both individuals and institutions.

The recent pullback in the digital asset market, from a weekly high of $23.3k to a low of $21.5k, followed a January rally. This move is due to regulatory news from the US, including a fine issued by the SEC to Kraken for its staking services and legal action against Paxos for issuing the BUSD stablecoin. The SEC has also taken action against crypto banking partners and payment providers. Despite these challenges, it's worth noting that these regulatory moves serve to emphasise the importance of having a trustworthy crypto partner for trades and storage. With a secure custody solution such as an Ainslie Storage Account, investors can have peace of mind regarding their investments in the digital asset market.

On the positive side, the NFT world has recently seen an exciting development with the launch of NFTs hosted on the Bitcoin blockchain, such as Ordinals and Inscriptions. With over 69k Inscriptions already created, this new development has caused a surge in Bitcoin network activity and rising fee pressure. This presents an opportunity to examine investor behaviour during the recent pullback from the local high and the impact of Ordinals on on-chain activity and fee market pressure.

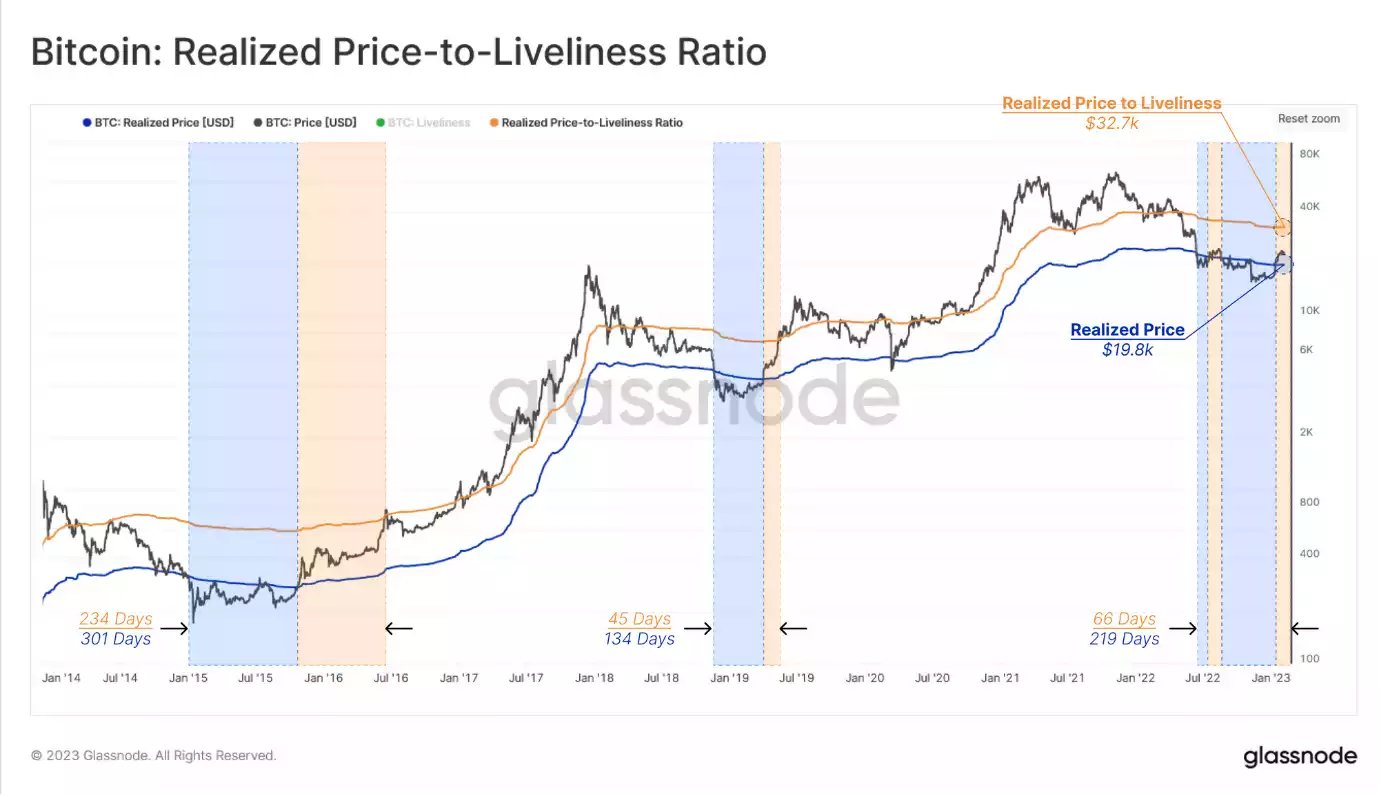

The spot price of Bitcoin broke above the Realised Price, signalling that the market has entered a macro transitional phase. This phase is bounded by two pricing models: the lower band, which is represented by the Realised Price ($19.8k) minus the average on-chain acquisition price, and the upper band, which is represented by the Realised Price to Liveliness ratio ($32.7k), a variant of the Realised Price that reflects an "implied fair value" weighted by the degree of HODLing activity. It is worth noting the similarity between the present market and the re-accumulation periods of 2015-16 and 2019.

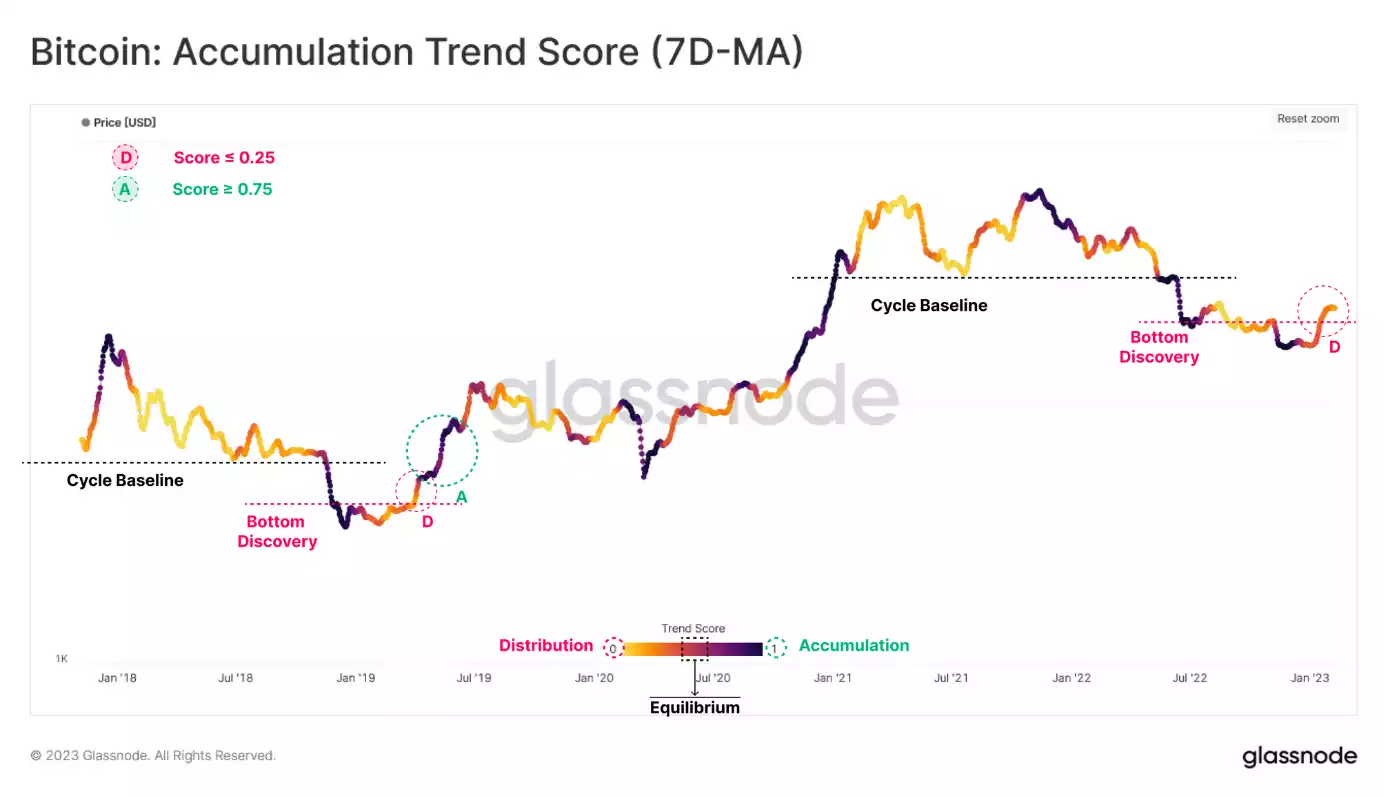

The recent price rally has temporarily halted at a local high of $23.6k, providing a chance to analyse investor behaviour through the Accumulation Trend Score. This score reflects the aggregate balance change of active investors over the past 30 days, with a higher weight given to larger entities like ‘whales’ and institutional-sized wallets. A value of 1 (represented by purple below) indicates that a wide range of investors are adding substantial amounts of Bitcoin. In previous bear markets, similar rallies have led to some distribution by entities that accumulated near the lows. The recent rally is no exception, as the Accumulation Trend Score has dropped below 0.25. The sustainability of the rally will depend on whether larger entities continue to accumulate, pushing the Accumulation Trend Score back towards 1.0.

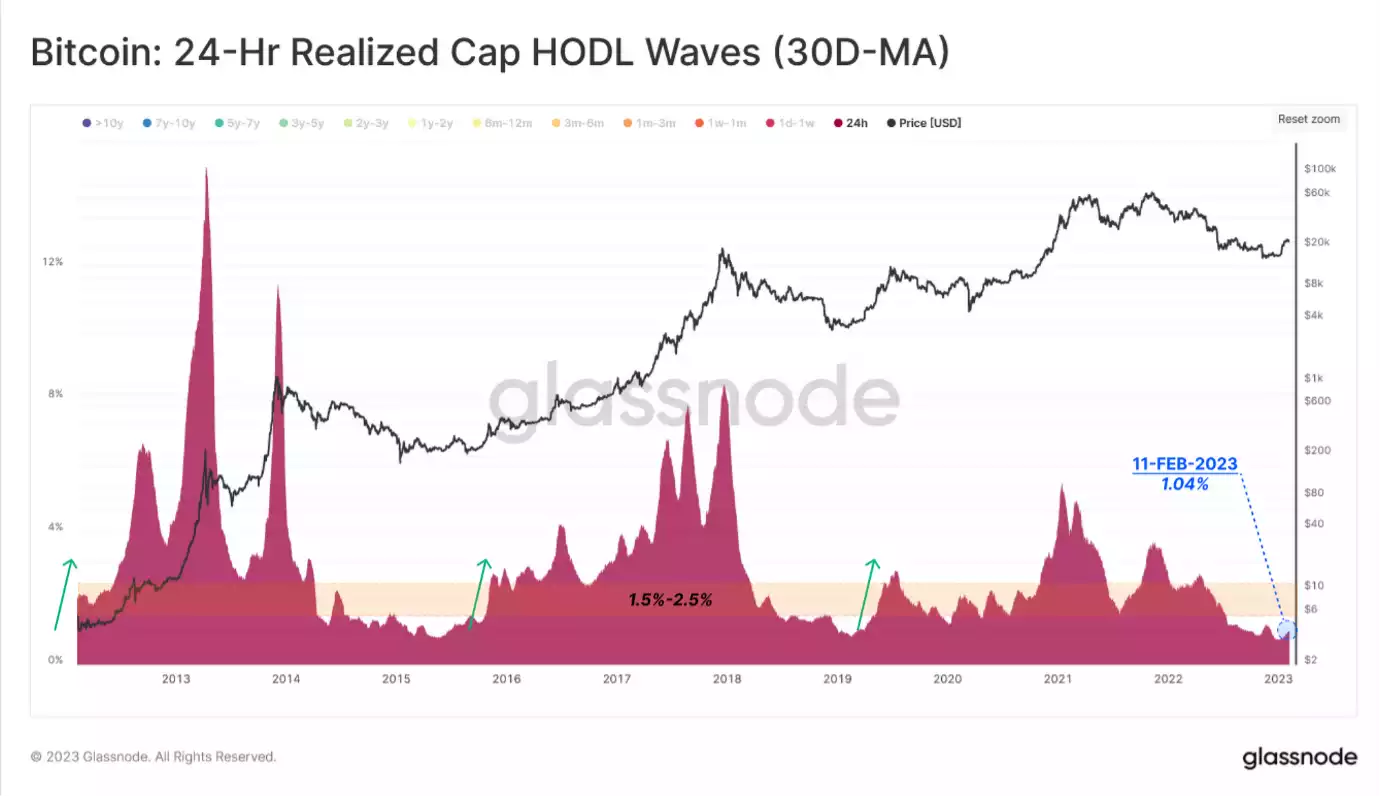

The aforementioned emergence of Ordinals and Inscriptions on the Bitcoin blockchain has resulted in a rise in on-chain activity metrics. Although the impact on total supply moved may be minimal, the magnitude of wealth moving daily can be tracked through the 1-day band of Realised Cap HOLD Waves. This metric captures the relative share of USD wealth changing hands. High demand and large volumes of wealth changing hands are identified when there is a substantial increase above the 1.5% to 2.5% level. The latest rally has seen a modest increase in this metric, from 0.75% to 1.0%. This suggests that network activity is increasing, but not yet correlated with a large revaluation of coins, as the volume of coins changing hands remains low.

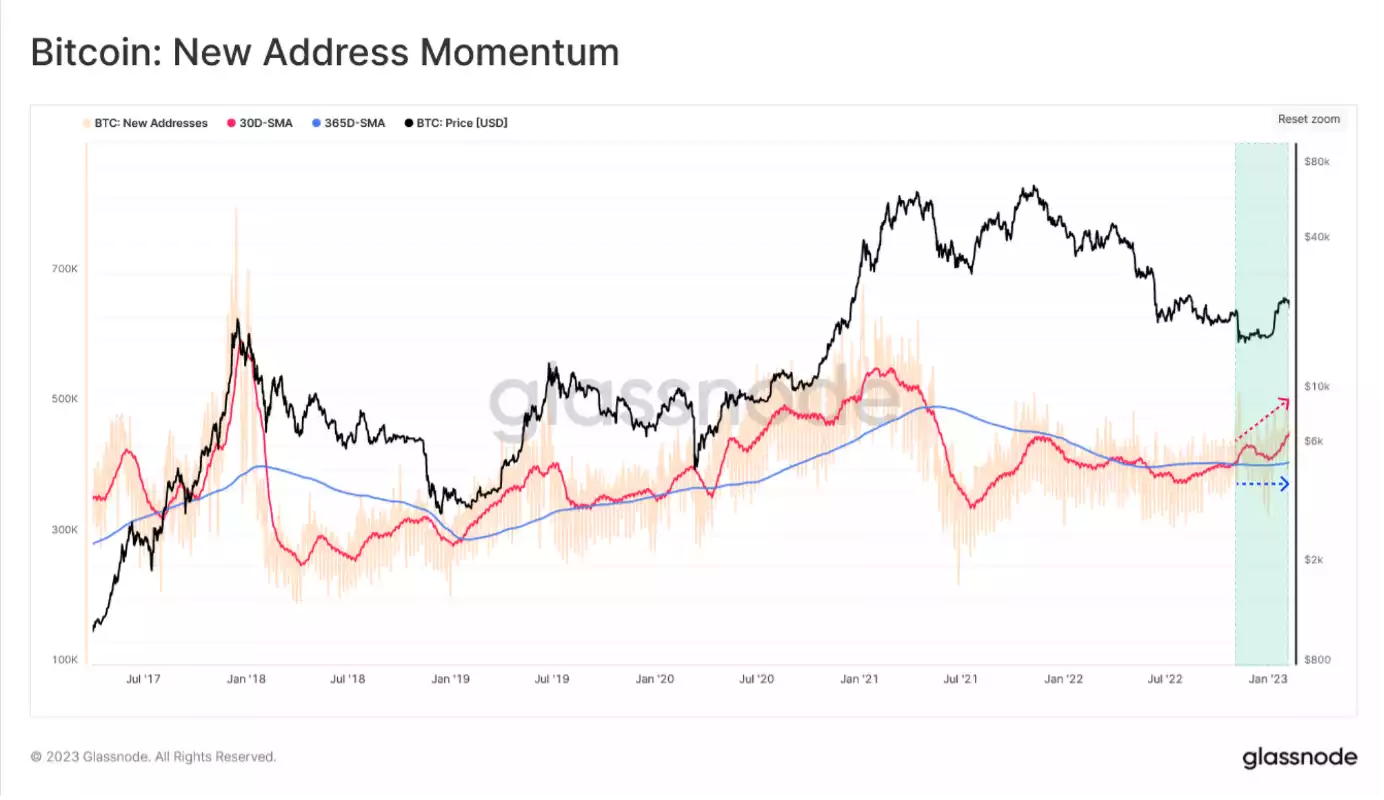

That said, there has been a significant change in the number of both New and Active on-chain Addresses, providing insight into macro changes in network activity. Analysis of this metric compares the monthly moving average (in red) with the yearly moving average (in blue). The monthly average of New Addresses joining the network has surpassed the yearly average since the capitulation event triggered by the FTX bankruptcy. This is a positive sign and marks the second significant increase in the metric this week. However, it's important to note that the longer-term moving average remains flat, indicating that the activity increase is still in its early stages. Nevertheless, this development is worth paying attention to as it could provide valuable insight into the future direction of the network.

In summary, the Bitcoin network and digital assets have gone through numerous narratives, innovations, and events over its 14-year history. The recent emergence of Ordinals and Inscriptions is an unexpected development that has created a non-trivial increase in demand for block space, generating network activity without a traditional transfer of coin volume for monetary purposes. This growth in the user base and upward pressure on the fee market from usage beyond investment and monetary transfer use cases showcases the versatility and adaptability of the Bitcoin network. Ordinals represent a new frontier in Bitcoin. This is an exciting time for the Bitcoin community and it will be intriguing to see how this new development continues to shape the future of the network.