Digital Markets Feeling the Pressure of Fed Liquidity Handbrake

News

|

Posted 30/08/2022

|

9930

Near-term weakness continues to haunt numerous Bitcoin fundamentals, with prices faltering amidst minimal excess sell-side pressure. Investors who are spending appear to be taking advantage of exit liquidity.

It has been another tough week for asset markets, with Bitcoin, equities, forex, and bond markets experiencing volatility, and general price depreciation. The Euro has once again traded below USD parity as the European energy crisis worsens, and the DXY Dollar Index has punched up to a new twenty-year high above 109.30.

With the US Federal Reserve governors continuing to signal a hawkish stance on inflation at Jackson Hole, Bitcoin, as a developing index for global liquidity, reacted accordingly. Prices traded lower this week, coming off a high of $21,781, and hitting a multi-week low of $19,611.

The 2022 bear market carries on and has taken a toll on the aggregate Bitcoin investor base. Despite not seeing any widespread loss of conviction amongst the HODLers, as signalled by lifespan metrics in decline, the bulls still cannot establish a meaningful uptrend. That being said, they are supporting key levels.

The psychology of investor spending patterns remains firmly in the bear market territory, as rallies are sold, and exit liquidity is taken at or around cost basis levels. Given the current remarkably low active user base, it could be considered impressive that the $20k level has held up to date, signalling that long-term holder confidence remains.

It also remains plausible that Bitcoin is in a bottom formation range and would be historically similar to all past bear markets. We can see this in the on-chain data, which shows how BTC, and other crypto markets, are hanging on right now.

Starting with the lifespan metrics, which broadly describe the age of coins that are being spent on-chain. Generally speaking:

- Lower lifespan values signify younger coins dominate transactions. It is usually encountered as the bear market grinds lower, and speculators are purged from the market.

- Higher lifespan values signify older coins dominate transactions. It is usually experienced during bull markets as profits are taken, but also during bearish capitulation events, due to panic selling.

ASOL tracks the average age per spent output but ignores coin volume. It has been in a macro decline since Jan 2021, coincident with the prevailing bear. It spiked higher over recent weeks, as a group of older coins were spent, however, this was only for a fleeting moment.

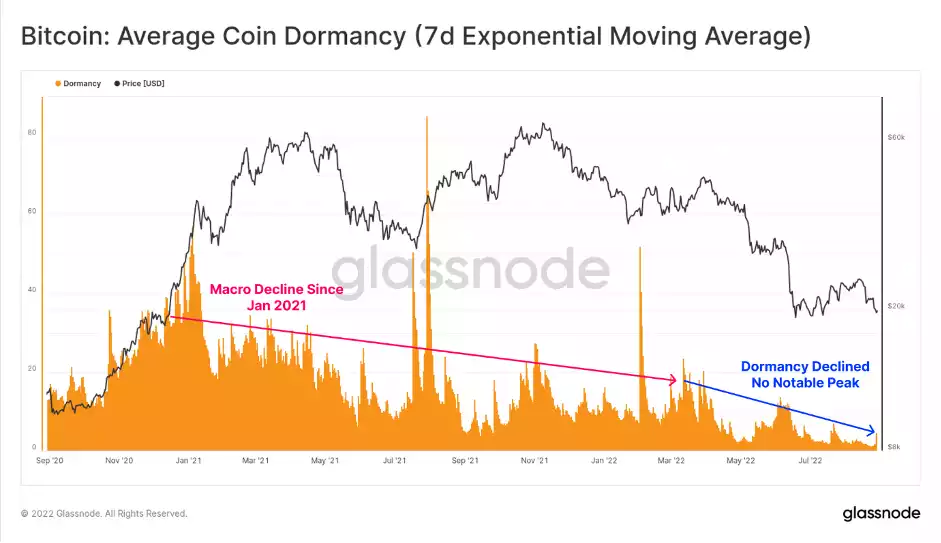

We can further inspect this by looking at Dormancy, which is the average age per unit coin moved. This metric does account for spent coin volume. Here we can see that the average age per coin is near multi-year lows, which means the ASOL spike was very light on BTC volume.

This could be a very constructive signal, as it shows older coins are staying dormant.

At a macro scale, the Coin-Years Destroyed metric continues to push lower, reaching a relatively significant low. This metric aggregates the total lifespan destroyed (in years) over the last 365-days, and similar to dormancy, low levels are usually constructive and typical of late-stage bear markets.

It remains plausible that the Bitcoin market is trading within what may become a longer-term bottom formation pattern.

it is quite clear that no widespread loss of HODLer conviction has taken place. The decline in lifespan metrics bodes well for the longer term, as it indicates old coins are stationary, and declining prices have a little psychological impact on this cohort's conviction.

Whilst the resolve of the strong hands remains rock solid, it simply appears that their available demand inflows have not yet rebuffed the bears, who have driven the bulls back to the $20k line.

**********************************************************************************

This afternoon, the Gold & Silver Standard Insights team will be breaking down the charts and providing technical analysis for the precious metals and crypto markets.

SUBSCRIBE to the YouTube Channel to be notified when the Gold Silver Standard Insights video is live.

**********************************************************************************