Digital Assets Sitting Still

News

|

Posted 18/10/2022

|

11453

The Bitcoin market is primed for volatility, with both realised and options implied volatility falling to historical lows. Futures market open interest has hit new all-time highs, despite liquidations being at all-time lows – a sign that the market is heavily shorted, creating the chance for a short-squeeze to occur. Volatility is likely on the horizon, and Bitcoin prices rarely sit still for long.

Bitcoin markets continue to consolidate into a tight price range, with almost all the extreme prices of the weekly range reached during a 24hr window. In response to US inflation data coming in slightly hotter than expectations, BTC prices traded down to US$18,338, followed by a quick rally to a high of $19,855, before completing a round trip to the weekly open price.

In our last few updates, we have highlighted how resilient and stable crypto prices have been, something uncommon for the industry. As currencies and equities experience historical levels of volatility, BTC and ETH have remained within a tight price band for over a month.

It is very uncommon for BTC markets to reach periods of such low realised volatility, with almost all prior instances preceding a highly volatile move. Historical examples with 1-week rolling volatility below the current value of 28% in a bear market have preceded significant price moves in both directions – meaning that we are overdue for some price action.

The compression can be seen within the aSOPR metric which measures an average realised profit/loss multiple for spent coins on any given day.

- aSOPR of 1.0 in a bullish trend often acts as support, as market participants tend to increase their position at their cost basis, manifesting as buying the dip.

- aSOPR of 1.0 in a bearish trend often acts as resistance, as investors seek exit liquidity around their cost basis, with investors seeking any available exit liquidity.

A large divergence is currently forming between price action and the aSOPR metric. As prices trade sideways or decline, the magnitude of losses that are being locked in is diminishing, indicating the exhaustion of sellers within the current price range.

As the weekly average of aSOPR approaches the break-even value of 1.0 from below, it is increasingly likely that volatility is on the horizon, potentially as a breakout.

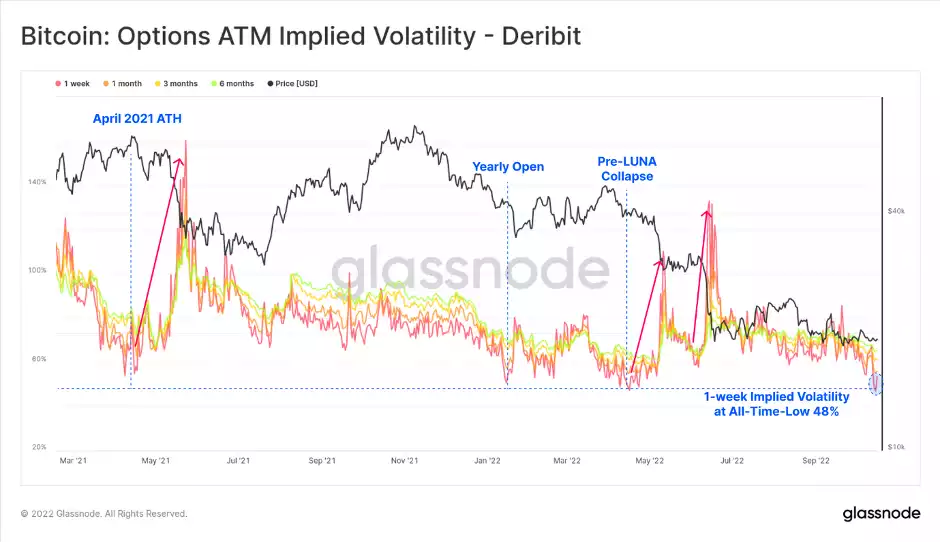

In the off-chain domain, volatility is also brewing in the derivatives markets. Options pricing of short-term implied volatility (IV) has reached an all-time low of 48% this week. Several prior instances of such low IV have preceded violent moves, often compounded by the de-leveraging of derivatives and DeFi markets.

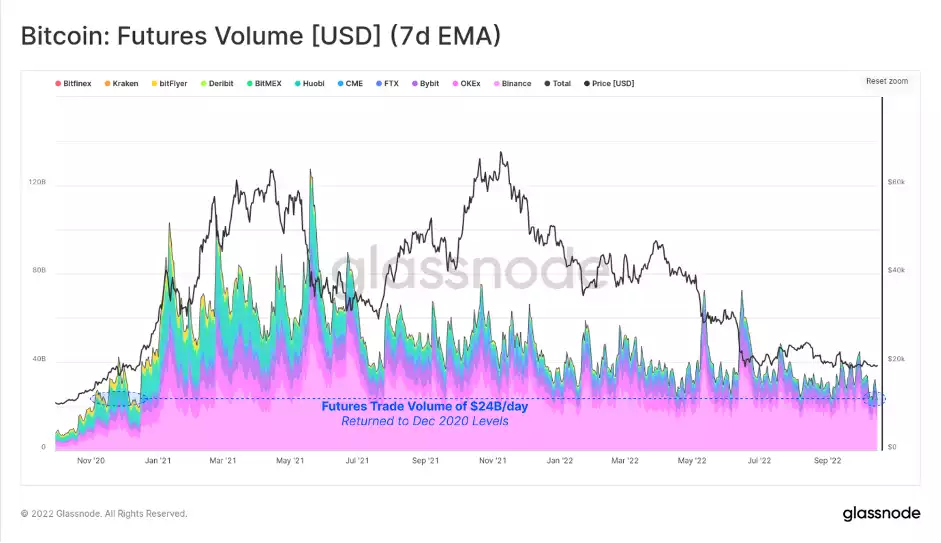

Trading volumes in futures markets have also declined to multi-year lows of $24B per day. This returns to levels last seen in December 2020, before the bull cycle had broken through the 2017 cycle at $20k ATH. This may signal a lower liquidity trading environment – something which will fuel a short squeeze, remembering we have all-time high open interest.

To summarise, the digital assets market is primed for volatility, with both realised and options implied volatility falling to historical lows. On-chain spending behaviour is compressing into a decision point, where spot prices intersect with the Short-Term Holder cost basis.

Previous instances where this set of conditions was prevalent have preceded violent price moves, with examples in previous bear cycles favouring the bulls – closer to the bottom than the top. There remains little apparent directional bias in futures markets, despite open interest pushing to new ATHs and volve to multi-year lows, creating a potential short squeeze.

Volatility is likely on the horizon, and crypto prices are not known to sit still for very long. Will it be another quiet week, or will it all kick-off?

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************