Digital Assets Resilient as Traditional Currencies Collapse

News

|

Posted 27/09/2022

|

10435

It’s shaping up to be a big week for the global economy, with traditional equity markets and global currencies falling to multi-year and multi-decade lows over the last few trading sessions. Crypto, however, has remained resilient.

Crypto markets resilience is interesting given its tendency to trade in concert with the Nasdaq Composite, which is down 0.8% Monday. In the last 24 hours, crypto has increased by approximately 2%.

Traditional financial markets traded lower largely because of global recession fears. The British Pound (GBP) declined to record lows following news that the Bank of England may raise its interest rates aggressively. We discussed the topic of the Pound in detail in yesterday’s Insights Video here.

BTC and ETH still appear decidedly neutral and are essentially trading where they were in mid to late June. As the world appears to be flocking to the USD, the last remaining crypto HODLers stay true to the cause. On-chain data shows that both short-term and long-term holders are now underwater – with the price below their cost basis. Historically, this on-chain dynamic correlates to macro-scale lows in digital assets.

BTC's current on-chain cost basis is currently approximately US$21k – the psychologically significant price range that the currency has been trading around since June 2022.

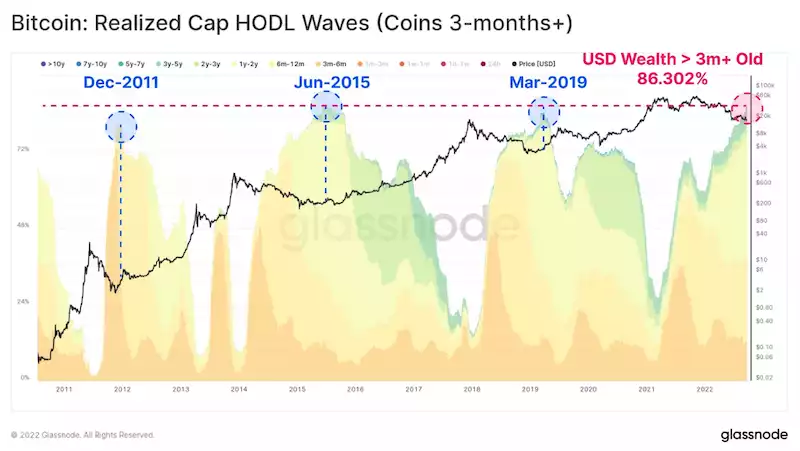

The total volume of Bitcoin coin-days destroyed in the last 90-days has also, effectively, reached an all-time low. This indicates that coins that have been HODLed for several months to years are the most dormant they have ever been.

This is further reflected in the Bitcoin Realized Cap HODL Waves. Coins aged 3 months or older now account for an all-time high of 86.3% of all USD wealth held by the BTC supply. Bitcoin HODLers appear to be steadfast and unwavering in their conviction.

The attention now is turned towards the denominator which is the US Dollar. The greenback extended its bull trend by 1.11% in the last 24 hours. This historic strength may be why crypto is resilient – investors want a currency without counterparty risk (out of the system) before the USD wrecking ball starts knocking things over. Investors may also be seeing an asymmetric risk/reward in crypto at the moment – the last time we saw the USD cool off (from the 7th-12th of September), Bitcoin rallied 20%...