Digital Asset Industry Shows Resilience and Growth Despite Challenges in 2022

News

|

Posted 13/12/2022

|

11633

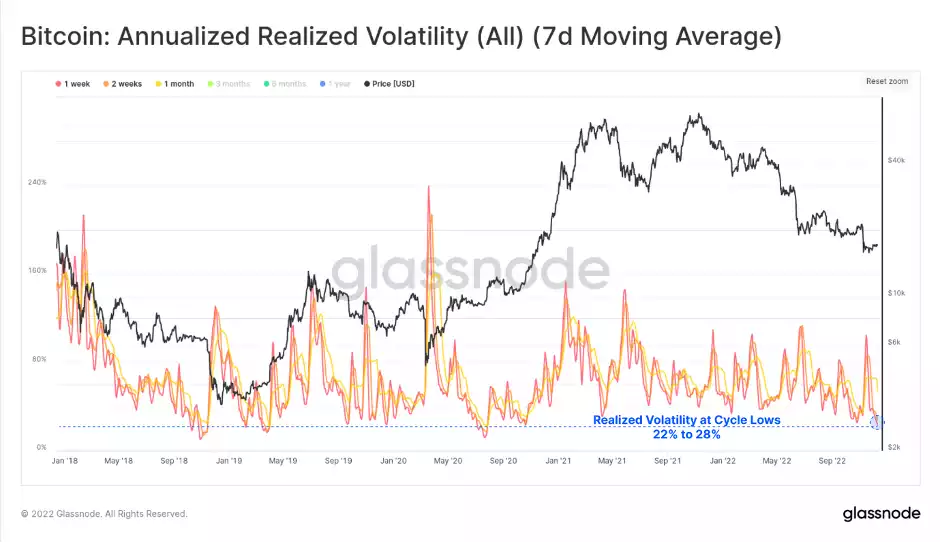

This year has been a tumultuous one for the digital asset industry and the wider financial market. Tightening credit conditions and shifts in central bank policy have caused significant drawdowns across various asset classes. Despite this, the Bitcoin market has remained relatively stable, with short-term realized volatility reaching multi-year lows.

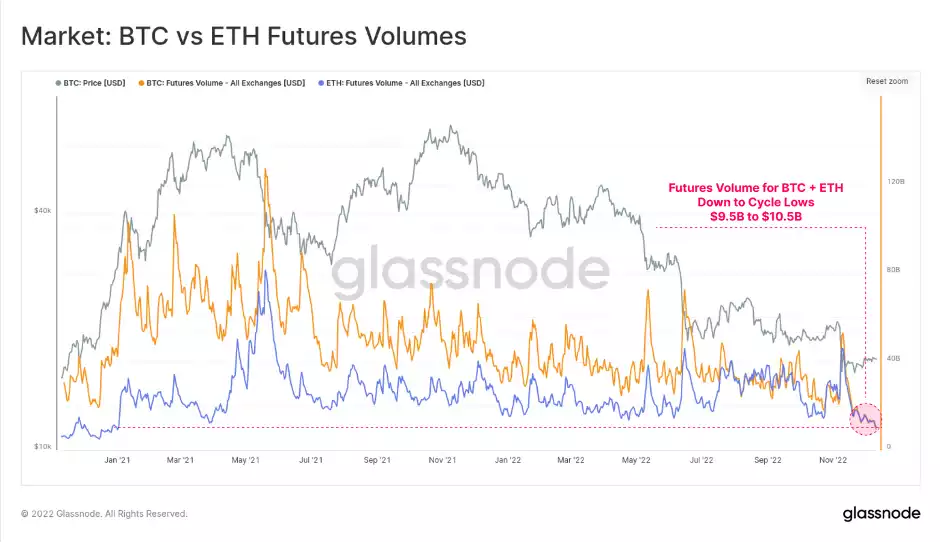

Futures volumes are similarly depressed, with both BTC and ETH markets trading at similar volumes of between $9.5B and $10.5B per day. This shows the impact of reduced liquidity and the impairment of many lending and trading desks in the space.

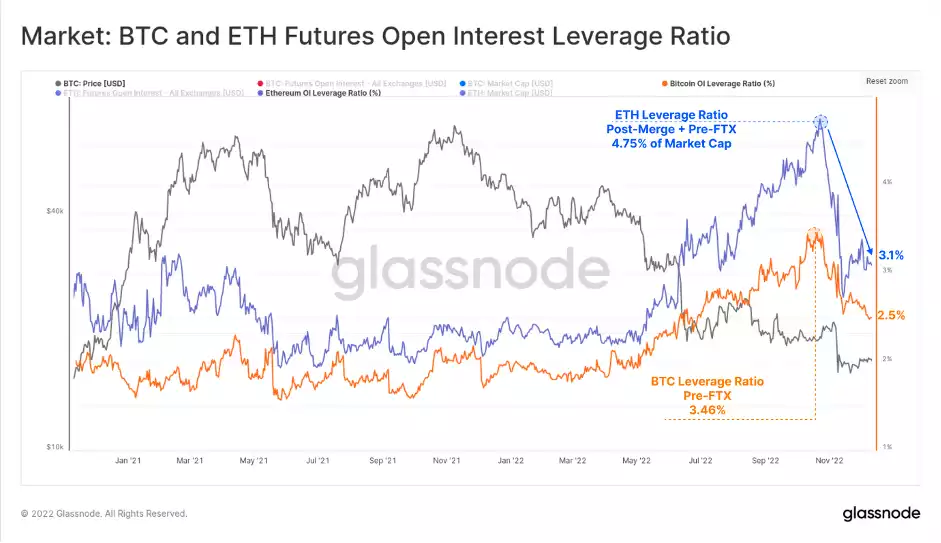

Open interest in futures markets has decreased significantly, particularly following the collapse of FTX. In November, ETH open interest fell from 4.75% to 3.10% of the market cap, while BTC peaked a week earlier and has since declined from 3.46% to 2.50% over the last month. This indicates a decline in speculative activity and a reduction in liquidity in the market.

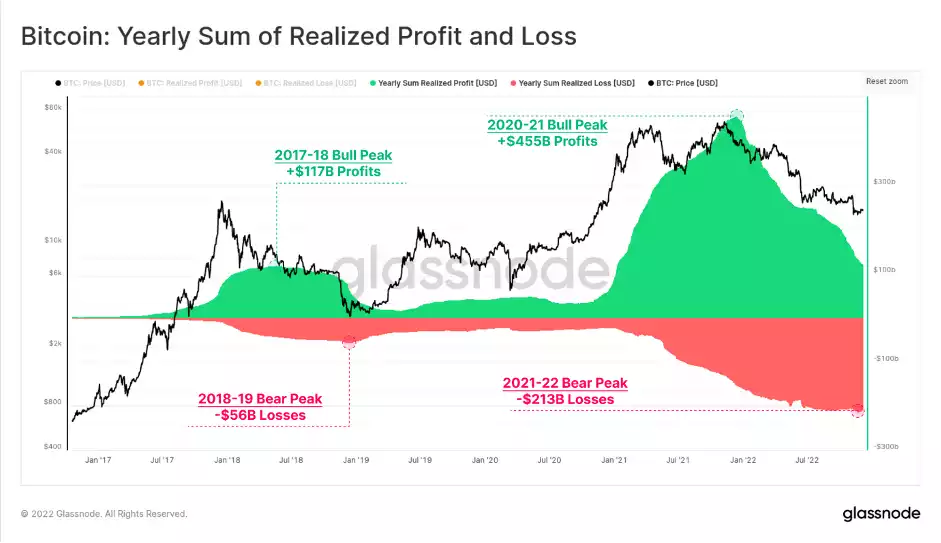

In the 2020-21 financial year, the abundance of liquidity from loose monetary policy led to record-high realized profits on the Bitcoin market. Investors moving funds on-chain took in over $455 billion in yearly profits, with the peak occurring shortly after the November 2021 all-time high. Since then, the market has entered a bear phase, resulting in a loss of over $213 billion, equivalent to 46.8% of the bull market profits from 2020-21. This is similar in magnitude to the 2018 bear market, where the market lost 47.9% of its value.

Long-term holders (LTHs) have experienced some of the largest losses in history during this cycle. In November, LTH losses peaked at -0.10% of the market cap per day, comparable only to the lows of the 2015 and 2018 cycles. The sell-off in June was also significant, reaching -0.09% of the market cap per day with LTHs heavily dominating the market and experiencing losses of -50% to -80%. Despite these large losses, the age of the coin supply and the propensity for holding by those who remain has continued to rise. Long-term holder supply reached a new all-time high of 13.908 million BTC (72.3% of circulating supply), reversing the panic spending after the FTX incident. This indicates a continued belief in the potential of the digital asset market and the resilience of the industry.

The digital asset industry has faced significant challenges this year, with both BTC and ETH experiencing drawdowns of over -75% off their all-time highs in November. This has been punctuated by a wide-scale deleveraging event since May, leading to significant credit contraction and bankruptcies. However, the industry has continued to evolve and grow, with the successful execution of the Ethereum merge and the growing adoption of stablecoins providing positive signs for the future.

Looking ahead, it will be important for companies in the digital asset industry to continue to innovate and find ways to drive adoption and growth. This may involve the development of new technologies, such as decentralized finance (DeFi) platforms, or finding ways to improve the user experience and make digital assets more accessible to a wider audience. Despite the challenges of the past year, the digital asset industry has shown its resilience and adaptability. This trend will likely continue as the industry continues to evolve and find new ways to thrive in a rapidly changing market.