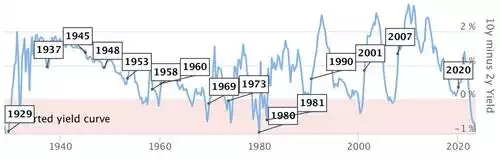

Deepest US Yield Curve Inversion in 42 yrs portends Recession Dead Ahead

News

|

Posted 24/07/2023

|

2543

Last week saw the ‘fail safe’ recession indicator of the US Treasury yield curve fall to its deepest inversion since 1981. This was on the back of one of the worst weeks for Bloomberg’s US Economic Surprise Index in some time, and Moody’s reporting that here in July, there have been more corporate debt defaults in the US than all of last year. All this amid ultra low unemployment has many scratching their heads as the ‘most hated’ sharemarket rally continues near unabated and gold holds strong.

First, the chart below is for the common 10yr / 3month US Treasury yield spread since 1982:

Looking back to the last 2 times the yield curve was as inverted as now, we need to see the Great Depression of 1929 and 1980, the latter considered the worst since WW2.

You will note the uncanny knack it has of predicting practically every recession. For those looking closely, yes it inverted mid 2019 but the literally unprecedented amount of liquidity pumped into the system by the Fed during COVID masked what many, and indeed most, economists were predicting to be a recession on fundamentals. You will also note recessions don’t immediately follow the inversion but rather there is a lag of around a year before recession hits. Looking back too, you will see nearly every recession is preceded by a low in unemployment, so the low unemployment number in the US now is not a ‘this time is different’ indicator, but the norm. What it means though, is the Fed will be, and has outright stated, hesitant to hold let alone cut rates whilst unemployment is so low and threatens wage inflation.

And so the tug of war continues for our hapless Fed who have also, near perfectly, hiked into a recession each time. Last week’s Bloomberg’s US Economic Surprise Index was a shocker as things turned worse than analysts predicted against a whole basked of economic metrics. Indeed it was the worst turn since… you guessed it… 2019.

As mentioned above Moody’s came out reporting a surge in bankruptcies as companies who borrowed on cheap rates now have higher repayments and banks getting tougher:

“Banks are battening down the hatches, hogging their bailout money instead of lending it out,” said Pete St. Onge, a Heritage Foundation economist, in a recent podcast.

“That credit crunch means not only do we get bankruptcies like in any recession, on top of that, we get a lending wall that cuts off even the healthy businesses. Of course, their jobs go down with them.”

The sharemarket, and NASDAQ particularly (and as we wrote here almost exclusively), is rallying in the face of this in the belief the Fed will come to the rescue soon with more QE and cutting rates. That of course would be very constructive for the gold price should it happen but until we see evidence of that, gold is holding strong as it is the safe haven, the hedge or insurance for those going long equities should the yield curve inversion again prove right. It inverted this time in November last year so we are 7 months in. History tells us we have maybe 6 months before the recession properly hits.

Are you ready?