DeepSeek AI Tech Rattles Markets

News

|

Posted 28/01/2025

|

1189

What is DeepSeek?

DeepSeek is a Chinese Artificial Intelligence startup founded in 2023. It began attracting more attention in the AI industry last month when it released a new AI model that it claimed is on par with similar models from U.S. companies such as ChatGPT maker OpenAI and is more cost-effective. Then, on the same day that President Trump was inaugurated, the company published a research paper about their new AI model called R1 that showed advanced "reasoning" skills — such as the ability to rethink its approach to a math problem — and was significantly cheaper than a similar model sold by OpenAI called o1.

The purported ability of the DeepSeek AI model to perform at the level of OpenAI’s market-leading models while requiring less processing power from microchips has an immediate and significant impact on markets.

Market Reaction

It should come as no surprise that the biggest hit was taken by Nvidia Corp., which experienced the largest sell-off in U.S. stock market history. NVIDIA has been a stock market darling that manufactures graphics processing units (GPUs), AI hardware and software, and other computer chips. The company has experienced significant growth on the back of the AI boom, but the alternative model from DeepSeek that requires less of their products to do the job scared investors to a sell-off that resulted in a 17% drop in the share price. Significant drawdowns aren’t new to Nvidia, but today is the biggest ever single-day fall in market capitalisation the stock has seen at US$589b.

The S&P 500 fell 1.5% and the Nasdaq 100 tumbled nearly 3% today, and trading for the rest of this week will be one to watch as we try to understand if it was an overreaction or if further selling continues.

U.S. Policy Under the Spotlight

The recent research publication made by DeepSeek was released during Trump’s inauguration, and that timing seems to be just a coincidence. The attention on DeepSeek threatens to undermine a key strategy of U.S. foreign policy in recent years to restrict the sale of American-designed AI semiconductors to China. On Trump’s first day of his second term in office, he signed an order that said his administration would "identify and eliminate loopholes in existing export controls", signalling that he was likely to continue and harden Mr Biden's approach. However, it appears likely that sanctions haven’t hindered China’s emerging AI capabilities. American venture capitalist, Marc Andreeson, described DeepSeek's R1 model as “AI's Sputnik moment” – a reference to the 1957 satellite launch that set off a Cold War space exploration race between the Soviet Union and the U.S.

Stability in Volatility

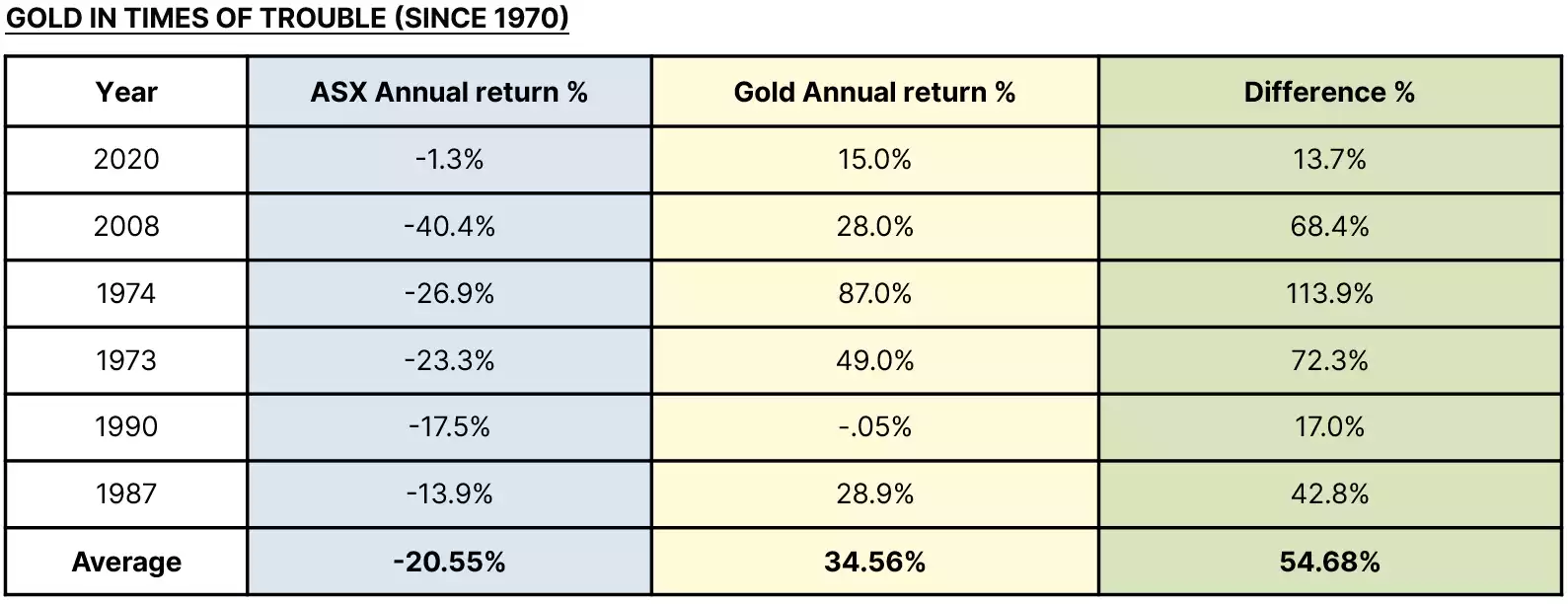

As events like the DeepSeek AI disruption rattle global markets, gold's enduring strength serves as a testament to its role as an anchor in the face of volatility. Gold has consistently demonstrated its stability as a safe haven asset during turbulent times, providing investors with a reliable store of value amidst market uncertainty as seen in times of trouble since the 1970’s.