Debt, Doom and Demographics

News

|

Posted 13/11/2024

|

1330

China is currently facing the 3Ds - Debt, Doom and Demographics, the question is how will the government react to the pressure of these? On Friday, The National People's Congress of the People's Republic of China announced their stimulus package after concluding its 5-day National People’s Congress Standing Committee meeting. The announcement introduced a US$1.4 trillion package, that met expectations but disappointed financial institutions that had hoped for a larger stimulus following last week’s confirmed election of Trump and the potential imposition of 60% tariffs. With the threat of these tariffs over the top of the Chinese economy, some analysts had anticipated a bigger package to help stimulate an economy burdened with high debt, a lot of doom, and failing demographic trends stemming from the one-child policy of the 1980s.

Debt and Fiscal Anticipation

Reuters had already reported that the Standing Committee would likely clear the issuance of US$1.4 trillion in extra debt to revive the failing Chinese economy. When this fell short, most markets dropped on the back of strengthening U.S. dominance.

Local Government debt will be increased by US$836 billion over the next 3 years, funds will be used to repay debt accumulated through local government financing vehicles. Local government budgets were decimated by the property crisis that began in 2021, with residential land auctions being one of their main sources of income.

To fund local governments, authorities had been raising ‘hidden debt’ otherwise known as Local Government Financing Vehicles to circumvent the government-imposed debt limit, albeit at higher interest rates. Additionally, reckless local government borrowing would be investigated and held accountable.

Local Governments who had been facing high debt and falling revenues, had been cutting civil servants' pay, choking local economies even further and creating even more deflation.

China has estimated the ‘Hidden debt’ to be around 14.3 trillion yuan, but the IMF has a much higher estimate of 60 trillion yuan or 47.6% of GDP. With official debt

The finance ministry estimates that hidden debt was at 14.3 trillion yuan at the end of 2023. Authorities plan to trim that to 2.3 trillion yuan by 2028, with officials saying roughly 2 trillion yuan in past debts accumulated for shanty town renovation programmes will also be repaid by 2029.

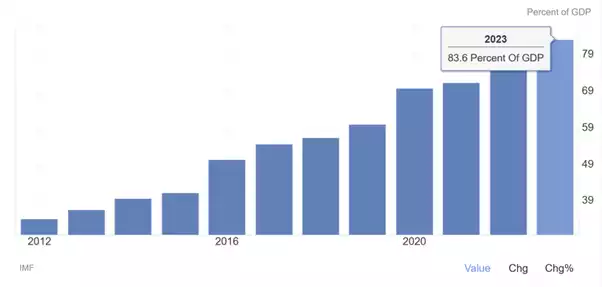

The International Monetary Fund, however, estimates LGFV debt amounted to 60 trillion yuan at the end of 2023, or 47.6% of gross domestic product. With official debt reaching 83.6% of GDP in 2023, the hidden debt lifts this above 130% of GDP. To put this in perspective – Australia’s debt to GDP is 44%, Japan is 255% and the U.S. is 120%.

DOOM and past stimulus packages

Doom in the Chinese economy is causing deflation, and the stimulus package fell well short of dealing with this. Unlike previous large stimulus packages, this package marked a departure from previous packages that were directed towards the private sector – mainly urbanisation and infrastructure – creating the current property crisis.

Arguably the reason for this is because those past programs were what led to the debt spike in the first place.

Finance Minister Lan Foan said on Friday 'more support is coming, the big question is when - with the deflationary cycle in China still ensuing'.

The proposed support is to reduce the inventory of unsold homes and repurchase land, recapitalise state banks and expand subsidies to factories. In the face of 60% U.S. tariffs and pressure from the EU on EVs and solar panels, these subsidies being the main reason, expanding these may cause even greater retaliation overseas.

With Trump yet to enter the Whitehouse – these measures may be held in reserve as ammunition for when he does.

Demographics and China’s net population loss

In 2022, China experienced its first population loss in more than 6 decades. In 1959-1961 the Great Leap Forward famine caused a sharp mortality spike, taking nearly 30 million lives with it. Following these deaths, an ensuing baby boom saw the population quickly rebound. It appears the 2022 COVID-driven population loss will likely not see the same rebound, with the current downturn, both deep and long-lasting with fertility remaining well below replacement level for 3 decades. With life expectancy growth increasing 10 years between 1990 and 2020, from 68 to 78, the Demographic issue was masked by an aging population and not enough babies, coming to a head during COVID.

So big is this issue that the UN is projecting that China could lose 45% of its population by the end of the 21st Century. But this is only part of the story, the aging of the population has seen 5% of the population in 1990 being 65 or over and in the next 25 years this is estimated to hit 30%.

The Three-Ds

As demographic shifts drive a downward cycle, the additional debt and resulting deflation are creating a complex dilemma that’s difficult to unravel. Will the Trump administration contribute to this cycle, and how might China respond to counteract it?