Debt Ceiling Crisis Continues: Catastrophe Awaits

News

|

Posted 10/05/2023

|

10759

In light of US Congress being in the most impactful policy deadlock in over a decade, Treasury Secretary Janet Yellen warned the public yesterday of an economic catastrophe in the event of the US failing to raise its debt ceiling.

Last month the House of Representatives passed a bill to raise the debt ceiling to 120% of the country’s annual economic output.

A series of cuts to government spending was included as part of the bill, which the Biden administration is now asking to have removed.

As a result of the Republicans standing strong on their government spending demands, the Biden administration is reportedly considering whether there is scope within the constitution for the president to continue issuing new debt without Congressional approval.

The debt ceiling has been raised, extended or revised 78 times since 1960, with negotiations often going down to the wire. It should, quite frankly, be called a debt target not ceiling as it always gets hit..

The last significant standoff occurred in 2011, where we saw large-scale market turmoil and America’s Triple A credit rating getting downgraded by Standard & Poor as a result.

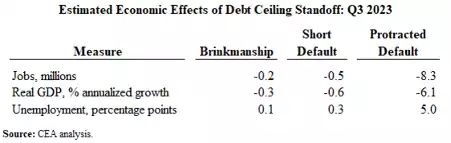

A recent Council of Economic Advisors report discussed the impacts of this most recent Debt Ceiling chaos.

“An actual breach of the U.S. debt ceiling would likely cause severe damage to the U.S. economy. Analysis by CEA and outside researchers illustrates that if the U.S. government were to default on its obligations—whether to creditors, contractors, or citizens—the economy would quickly shift into reverse, with the depth of the losses a function of how long the breach lasted. A protracted default would lead to severe damage to the economy, with job growth swinging from its current pace of robust gains to losses numbering in the millions.”

As shown in the table below, the current level of brinksmanship is still likely to result in 200,000 job losses and a -0.3% reduction in real GDP, a large portion of which can be attributed to a sizeable reduction in consumer confidence.

And of course, the worst-case scenario looks like a Great Recession.

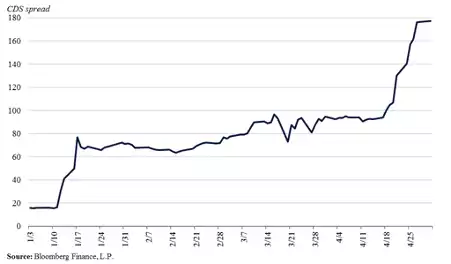

The cost of insuring US debt has also substantially increased and is now at an all time high, reflecting increased worries about a US default.

Credit Default Swaps (CDS) – insurance premiums paid to insure US debt – started to increase dramatically in April in the lead up to the debt celiing date.

The big takeaway is that not only is the worst-case scenario obviously catastrophic, but even in the likely event this all gets resolved in Congress, market confidence is clearly beginning to shake.

And as we have seen with respect to the banking collapses as of late, market confidence, and the consistent degeneration of belief people have in their monetary/economic systems, is a powerful predictor of future economic turmoil.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************