Deal or No Deal – Why the US Debt Limit “Deal” Is great for Gold & Silver

News

|

Posted 29/05/2023

|

15343

Start the printing press engines!! Prepare for the sound of Brrrrr. Yep, an in principle agreement has been reached to, surprise surprise….. lift the debt ceiling in the US! Now before we go on, this is yet to pass both Congress and the Senate, and both parties will be “furious” at the compromises made by Biden and McCarthy and it may not pass (sorry, we have to use inverted commas as this is all just Kabuki theatre).

The in principle agreement, the details of which are not exactly known, sees the current $31.4 trillion government debt ceiling increased for 2 years. The “deal” sees non-defence spending stay relatively flat in fiscal 2024 and increase by just 1% in fiscal 2025. For that saving of something like $50-100 billion, they get, wait for it… $4 trillion increase to the debt ceiling. That’s around 0.2% ‘saving’ for nearly 13% increase. So how about a bit more context then..

The US Government spends around $17.4 billion per day. This deal saves $60 billion on what the Democrats wanted to do. The “deal” therefore saved the US around 3.6 days of spending.

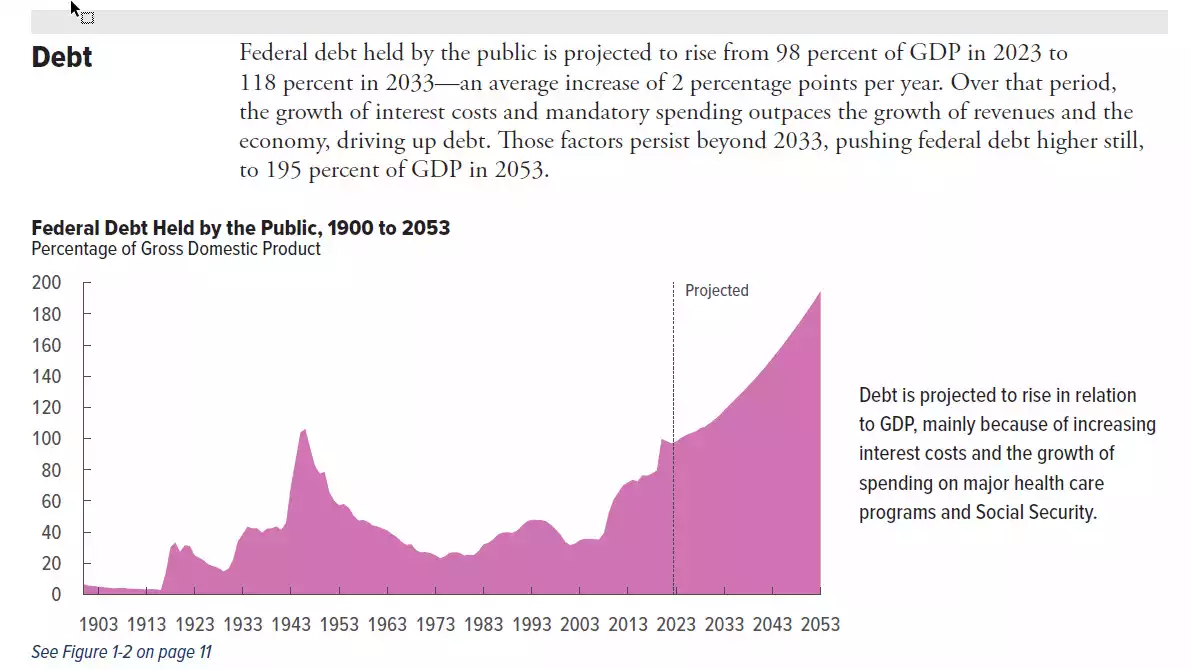

From the US Government’s very own Congressional Budget Office on JUST the interest cost:

“The Congressional Budget Office (CBO) projects that interest payments will total $663 billion in fiscal year 2023 and rise rapidly throughout the next decade — climbing from $745 billion in 2024 to $1.4 trillion in 2033. In total, net interest payments will total nearly $10.6 trillion over the next decade”

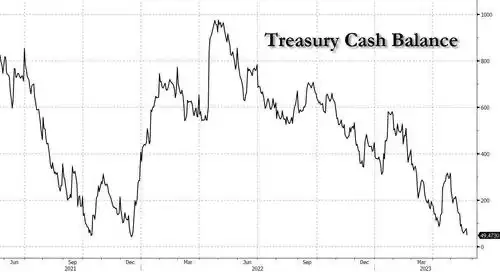

The irony is that the weekend announcement of this deal saw gold and silver dip on the open this Monday morning. Should it pass the necessary votes it may well dip again. However such a knee jerk ‘everything’s fixed’ reaction misses the key point in this and that is the US Government is now about to issue a tonne of Treasury bonds to create new money to fill up the Treasury General Account again and recommence spending. That TGA account is of course empty with US Treasury Secretary Yellen last week saying they run out altogether on 5 June, less than a week away from Wednesday’s vote.

But as we have repeatedly reported, the world has reigned in its purchases of Treasuries. Who exactly is going to buy all these bonds, these very bonds that have come within a week of being defaulted on? You guessed it, the US Federal Reserve in the form of QE, the last buyer standing.

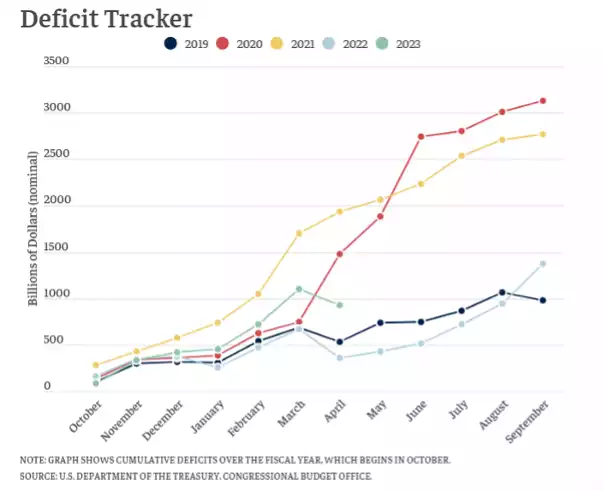

Remember too that the above numbers are all on the status quo. There is next to no doubt the US is heading toward a recession. Recessions see lower tax income and the temptation for more fiscal spending to overcome the downturn and prop up employment. None of that is allowed for.

Finally lets remind ourselves of the level of deficit spending the US has gotten used to these last few years as we showed you here.

In Thursday’s Insight interview, Sam gave us great explanations into what is driving the silver price and made the insightful observation that we are all guilty of talking about the ‘silver price going up’ without understanding it is as much about the currency value going down. What this new ‘deal’ absolutely locks in is more currency debasement as more needs to be created and injected just to keep the Ponzi scheme going. His calls for 300-400% increase in price over the medium term are not remotely fanciful when you consider the CBO’s very own projections above. At the risk of sounding like a broken record, its ALL ABOUT LIQUIDITY and the Governments of the world are now completely trapped into injecting more and more just to keep it afloat as, in the US’s case alone, interest payments alone exceed that of the entire defence budget, arguably the biggest defence budget in the world.

Of course should that 3% chance of a default actually happen, then the catastrophic global financial ramifications will also see gold undoubtedly moonshoot.