De-risking the USD risk

News

|

Posted 17/04/2023

|

10798

We’ve all seen the volatility in the USD over the past 2 years, the almighty USD, backed by the deepest financial system in the world, the Reserve Currency the world has used since World War 2 is not what it used to be…. With the US political system, weaponization and snow balling debt ceiling issues the USD is becoming a risk. The volatility in the dollar has helped see debt defaults in nations like Argentina, Sri Lanka and Lebanon, bank runs and near miss collapses like SVB and Credit Suisse’s. So is it any wonder the world continues to look for a new Reserve Currency or at least a removal of a medium of exchange that is no longer stable? If you missed our article and video Friday, it is well worth watching now.

So what is the US currency risk?

The US currency risk is the fact that since World War 2, most trade between countries and companies are conducted in the US. If Australia buys silver from Mexico, a company changes their Aussie dollar currency to USD then sends this money to Mexico, where they change their USD back to Peso. In doing these transfers there are 2 costs. The first is the USD trade costs both companies incur in moving money to USD. Now let’s say this trade happened on last Friday and this money therefore arrived in Mexico on Monday. On Friday Fed Member Waller decided to jawbone the USD – moving the USD around 0.8% higher on Friday night, on Monday when the Mexican company receives their money it is now 0.8% worth less – this risk in volatility has grown in the last 2 years. The second cost is moving the currency overseas, and due to the depth of the USD financial markets, this cost is usually minimal.

In the last 2 years with the political and economic instability of the US rising and an ever strengthening USD, has meant that the cost has become greater or at least harder to manage with this volatility risk.

So its seems inevitable that countries such as India, China, Russia and now France have started questioning why the middle man – if the cost and risks have grown not shrunk.

Weaponization and Russia

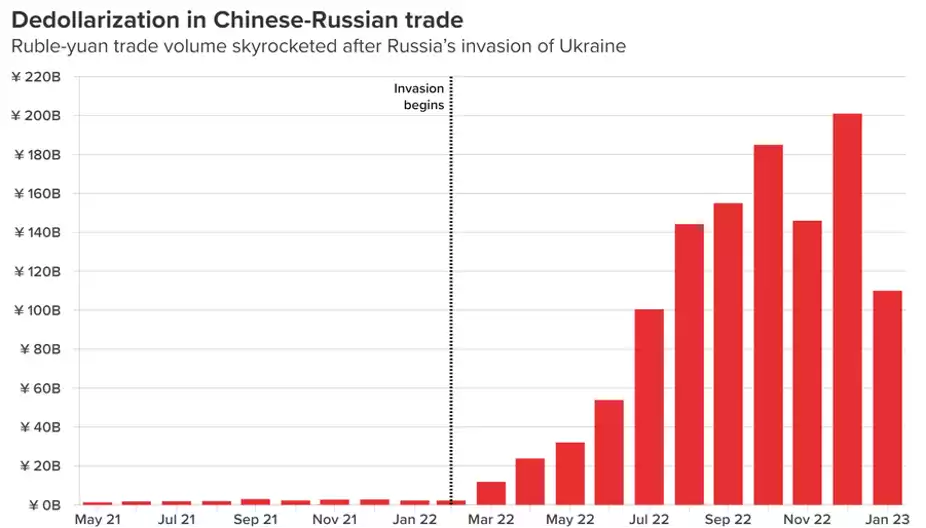

The weaponization of the USD has meant that countries like Russia and Iran have sought other trade mediums in order to avoid sanctions. In ‘weaponsing’ the USD and not allowing these countries to trade on the SWIFT system these countries have found new currencies to trade with. Most notably this can be seem in the Ruble-Yuan trade volume increase.

Brazil and August 23 BRICS meeting

The President of Brazil, Luis Inacio ‘Lula’ Da Silv has recently become a strong outspoken opponent to the USD. He has called for the abandonment of the USD and the development of a ‘BRICS Bank’. He stated ‘I ask myself every night why all countries have to base their trade on the dollar. What can’t we trade using our own currencies? Who decided the dollar would be the dominant currency after the gold standard disappeared?’

Last month China and Brazil inked an agreement for the integration of the Chinese yuan cross-border settlements with no ‘middle currency’, and last Friday this agreement took effect with Brazil and China processed their first Yuan-Real transaction. Not talk, real action.

India trade

Despite the US being India’s biggest trading partner (as of today 😊) India has spent the last 2 years trying to move away from the USD. They started this with Russian trades to get around sanctions bought in due to Russia’s invasion of Ukraine and not they have a Rupee-Ruble mechanism for trade settlements. More recently India gave permission to 18 countries including UK, Germany, Russia and the UAE to trade in Indian rupees. They do this as noted by economist Nouriel Roubini in hope of becoming one of the global reserve currencies in the world…..

August 23 Meeting

The BRICS meet in South Africa in August of this year, and one of the topics being discussed is the introduction of a BRICS currency. Being led by China and Russia, this proposal is growing traction among BRICS members. Zhou Weidi, deputy director of the Institute of Economics and Business Administration Central China Pedgogical University has stated the introduction of a BRICS currency can be used to fight unilateral sanctions and the hegemony of the US dollar in International markets. He acknowledges this will not cause the immediate collapse of the USD, but its gradual substitution into International markets. This will create a ‘basket’ of International Reserve Currencies. The BRICS International Clout is only going to keep growing as these counties develop faster than the West, with Saudi Arabia and Iran proposing to enter the BRICS bloc of countries, this trend is likely to continue

Its not just the BRICS

Last week French President Macron visited China and started discussing ‘strategic autonomy’ with Macron acknowledging Europe had no possibility of influencing the future possible conflict between the US and China over Taiwan. What he said that didn’t make these sensational headlines was the suggestion that Europe should reduce its dependence on the ‘extraterritoriality of the US dollar’.

Even France and possibly Europe are now starting to acknowledging this USD risk…..

In Response….

Last week Brad McMillan CIO of Commonwealth Financial Network wrote a blog about the overblown assumptions of the replacement of the USD and therefore its collapse being spruiked by companies or people trying to sell gold in this blog post. As a gold seller we’d respond with this; we are not saying gold will be a new Reserve Currency, in fact looking at what has been going on with the BRICS they are not even proposing this. The new reserve currency as can be seen with what India has been trying to achieve is a basket of currencies with no trade medium allowing for a derisking of the USD middle exchange. Gold may or may not be one of these ‘currencies’ but it won’t be the only one, if it were to be the only medium its current price would be much higher – around $50,000 USD per ounce. What we are saying is the world is moving away from the USD middle man, which will overtime reduce the USD dominance and reduce its ‘price’ and when the USD goes down gold goes up. It cannot however be ignored that these new participants have been buying gold.

As McMillan said "As long as the US is the largest open trading economy, as long as everyone in the world wants access to the US economy, and as long as it is a lot of work and a great inconvenience to switch, the position of the dollar as the global reserve currency is secure," This we agree with but in order to maintain being the largest open trading economy, the US will need to derisk their growing risks - politically and economically and also ensure that the weaponsation makes this inconvenience a ’necessity’. The trend is there now and this is looking harder to unwind.

In the recent IMF Currency Composition of Official Foreign Exchange Reserves, the data pointed out the move to multi currency reserves; ‘The dollar’s share of global foreign-exchange reserves fell below 59 per cent in the final quarter of last year, extending a two-decade decline’. “Strikingly, the decline in the dollar’s share has not been accompanied by an increase in the shares of the pound sterling, yen and euro, other long-standing reserve currencies… Rather, the shift out of dollars has been in two directions: a quarter into the Chinese renminbi, and three quarters into the currencies of smaller countries that have played a more limited role as reserve currencies.”

In Conclusion….

Repeating on Lula’s comments Ask yourself ‘why’? Why was the USD used as a medium of trade, and are these reasons still needed and still relevant? The USD was a stable behemoth with deep financial capabilities that allowed for stable, cheap and efficient transactions. Will this trend continue or has the weaponization, debt acceleration and destabilization of the US political system turned this on it head?