De-Dollarisation Fuels Silver's Bullish Outlook

News

|

Posted 27/03/2025

|

6606

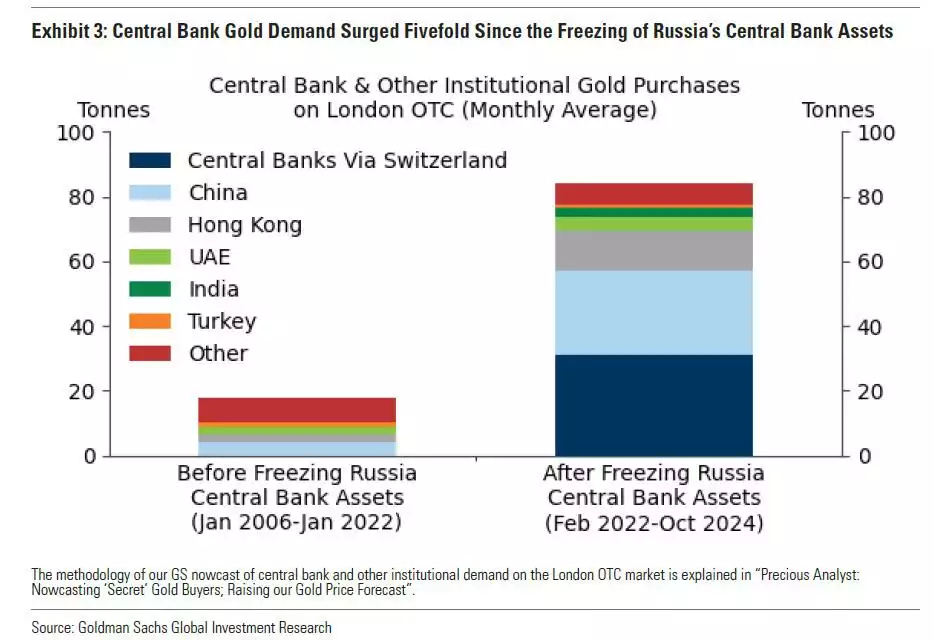

As Central Banks diversify away from The US Dollar towards gold, silver is primed for a generational bull run. It is no secret that central banks have been stockpiling gold at 5x their usual speed since the US dollar was weaponised, in response to the Russia-Ukraine conflict, in 2022.

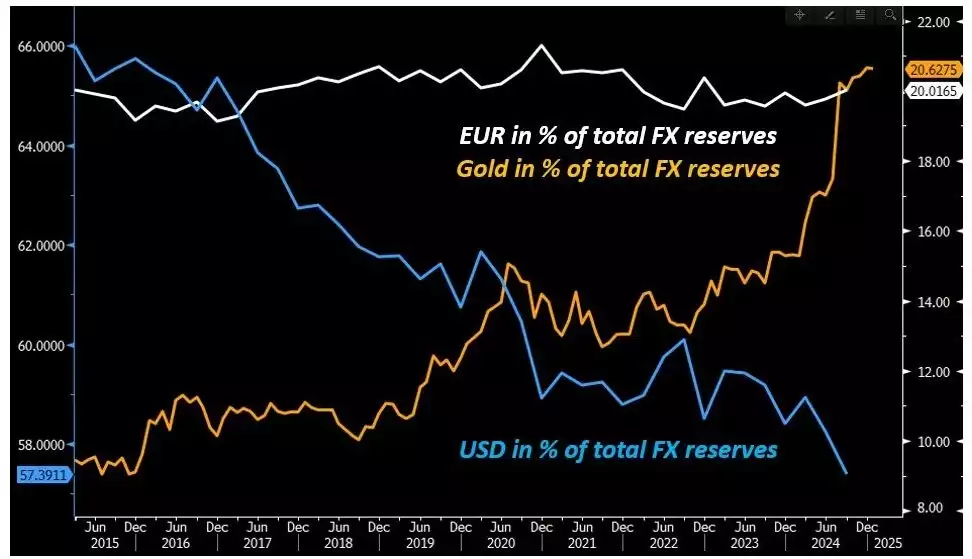

However, viewing this exponential gold stockpile by central banks relative to their US Dollar holdings, we can see that they have not just been moving into gold, but for quite some time, have been actively diversifying away from the US Dollar.

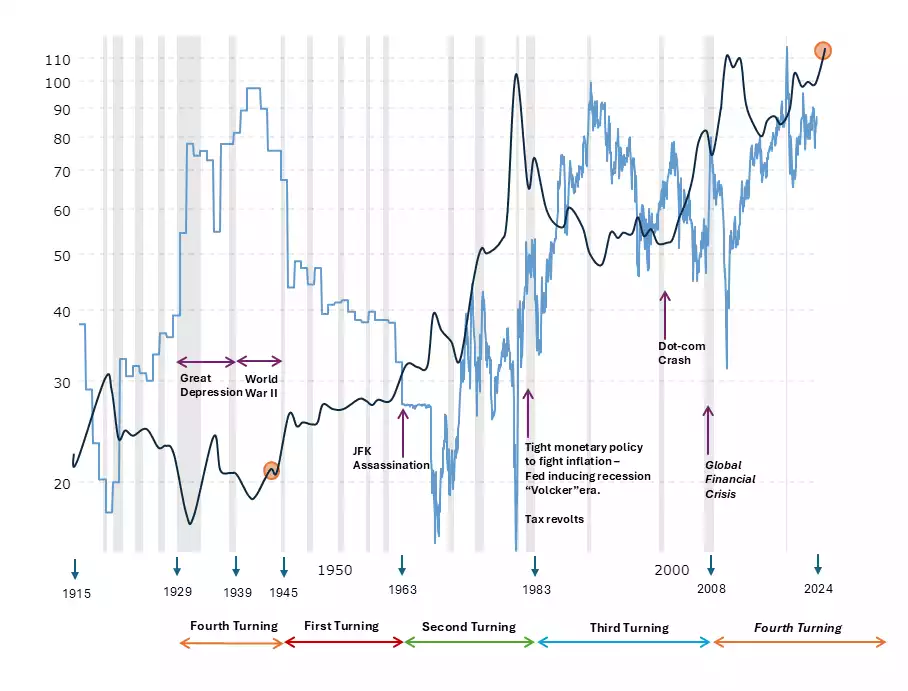

The chart above shows the per cent of USD held has been dropping well before the rate of gold stockpiling accelerated. This trend is not surprising as we are currently transitioning from one 80-year socio-economic cycle to the next, we expect a major shakeup of global dominance. As new systems are set up for the next 80 years, major nation-states stockpile resources of all kinds to enable geopolitical sovereignty during a transition filled with competition and chaos.

The last time we saw such a transition it concluded with the end of WWII after which US financial dominance took hold, in conjunction with the Bretton Woods accord, the IMF and the World Bank.

As we approach the final stages of the fourth turning of this current cycle we anticipate increasing hostility between key global players with a decline in globalisation - before we can look forward to the first turning of the next cycle – which should be characterised by unified direction, under new systems, for the next 80-year cycle.

A major financial factor in the current transition is also the Basel III endgame this July where gold will now be classed as a Tier 1 asset, on par with cash and high-quality government bonds as collateral. This further encourages larger players to move away from US government debt as collateral and towards gold for improved sovereignty.

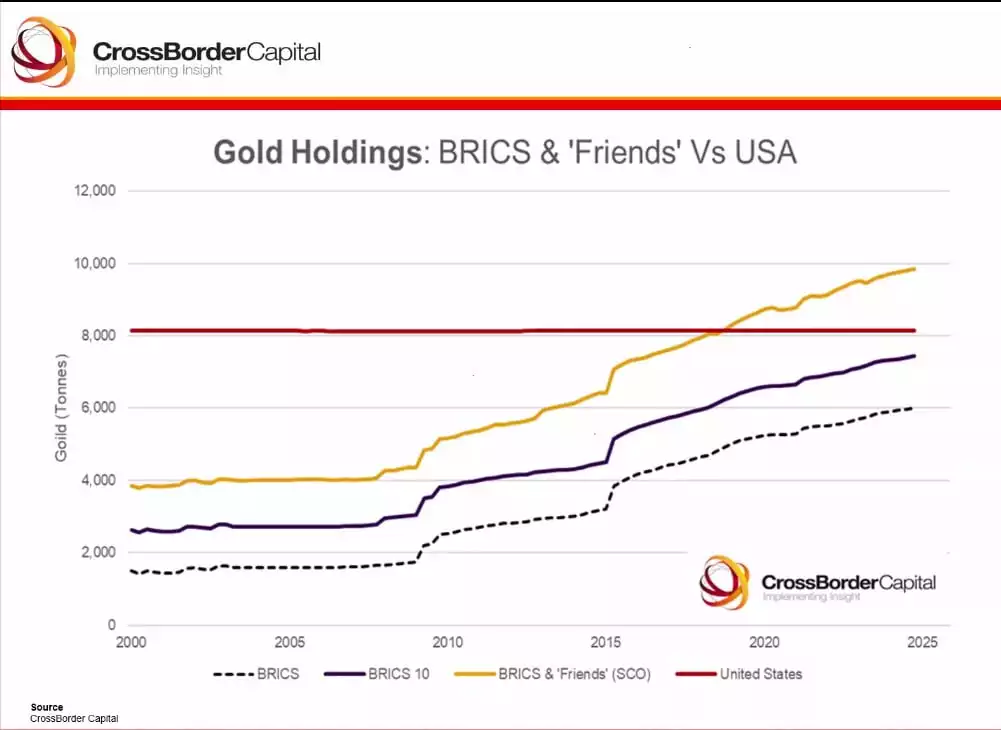

Exactly what the new 80-year cycle will look like is the topic of wide speculation; however, during this transition major nations stockpile resources of all kinds – gold and silver included – in preparation.

While gold stockpiles help with financial sovereignty, silver stockpiles empower industry, in addition to their monetary use case.

Today, silver’s main industrial use case would be for energy sovereignty (with its application in solar panels and batteries) - as well as in military (for its use in missiles). Both these areas are crucial during this transition phase - where we not only see a decline of free trade and globalization, but also an increase in global conflicts.

To better understand silver’s performance during this centennial transition, we can look at the gold-to-silver ratio. This ratio tells us how many ounces of silver, will give us one ounce of gold. When it is higher than average - silver is cheap (as priced in gold).

After the previous fourth turning, we saw the gold-to-silver ratio fall from the 70-90 range to the 20-40 range and spend decades there while silver went on a 35 year long bull run.

The chart below shows the gold-to-silver ratio (light blue) and the silver USD price (dark blue) over these four turnings, making up one full 80-year cycle.

Are we on track for a repeat of this, as we move into the next 80-year cycle?

With nations stockpiling at a record pace, a shortage of 1 billion ounces of physical silver over the past five years, a bullish cup-and-handle pattern playing out on the silver USD chart (seen above in dark blue), a paper-to-physical ratio of about 400:1, and the gold-to-silver ratio around 90, a generational bull run for silver appears to be imminent.