"Dangerous Divergence" – IMF warns of stagflation

News

|

Posted 13/10/2021

|

9337

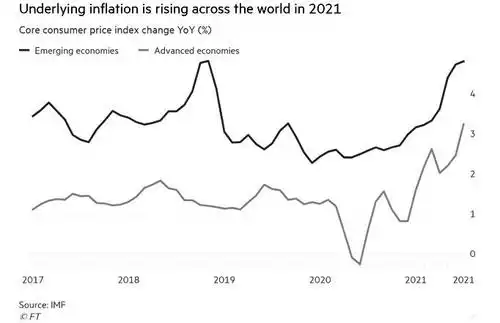

The IMF’s latest World Economic Outlook paints a picture of slowing economic growth and rising inflation. In other words stagflation, maybe the most feared economic environment.

Their summary read as follows:

“The global economic recovery is continuing, even as the pandemic resurges. The fault lines opened up by COVID-19 are looking more persistent—near-term divergences are expected to leave lasting imprints on medium-term performance. Vaccine access and early policy support are the principal drivers of the gaps.

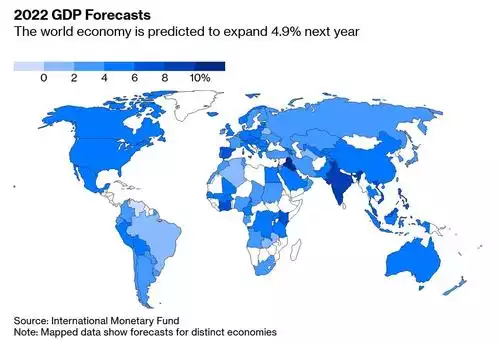

The global economy is projected to grow 5.9 percent in 2021 and 4.9 percent in 2022, 0.1 percentage point lower for 2021 than in the July forecast. The downward revision for 2021 reflects a downgrade for advanced economies—in part due to supply disruptions—and for low-income developing countries, largely due to worsening pandemic dynamics. This is partially offset by stronger near-term prospects among some commodity-exporting emerging market and developing economies. Rapid spread of Delta and the threat of new variants have increased uncertainty about how quickly the pandemic can be overcome. Policy choices have become more difficult, with limited room to manoeuvre.”

The 2021 bounce off the -3.1% contraction in 2020, whilst seemingly modestly downgraded “masks large downgrades for some countries".

The fund is forecasting stronger inflation this year but is maintaining the central bank narrative of it being transitory, predicting a normalisation by the middle of next year but critically only as long as central banks start tightening now.

“Looking ahead, headline inflation is projected to peak in the final months of 2021 but is expected to return to pre-pandemic levels by mid-2022 for most economies. But given the recovery’s uncharted nature, considerable uncertainty remains, and inflation could exceed forecasts for a variety of reasons. Clear communication, combined with appropriate monetary and fiscal policies, can help prevent “inflation scares” from unhinging inflation expectations.”

The key warning from the IMF is that central banks need to be “very, very vigilant” to take early action to tighten monetary policy (taper) should inflation persist (which they say is certain).

IMF reports aren’t always the most up to date affairs and their 6% 2021 GDP forecast for the US, albeit slashed by 1% is in stark contrast to the latest forecast from the US Fed’s own Atlanta branch with its historically ‘better than most’ GDPNow forecast seeing a severe dive to just 1.4% this month…

Herein lies the Fed’s dilemma (again) and, with respect, yours. The economy is weakening and sharemarkets have the wobbles. However, despite the abysmal NFP new jobs figure Friday night, unemployment is still low and inflation high. The rule book, and now the IMF, say they MUST tighten policy. Two different US Fed presidents last night came out saying the Fed must taper in November, the Atlanta Fed President even admitted that inflation is not transitory.

Remember all they are talking about is tapering, buying LESS bonds than the current $120b/month, not stopping QE nor raising rates. Whilst that might be enough to spook markets and cause another ‘taper tantrum’ sharemarket crash it may not be enough to pull up surging inflation, particularly when there are exogenous factors at play like supply chains and weather events as we discussed recently here and here.

From Citi Bank - "Amid recent energy price spikes, power cuts in China, Europe's dependency on imported energy and signs of rising US inflation, stagflation anxiety has intensified” and “Bond market bears are stirring. During the 2013 taper tantrum, 10-year Treasury yield became very sensitive to data surprises, as markets focused on strong growth as a catalyst for higher yields. It's early days, but this is now starting to happen again. A bearish signal..."

From Credit Suisse - "We have clear-cut stagflationary concerns".

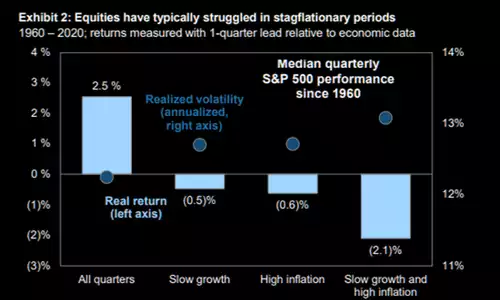

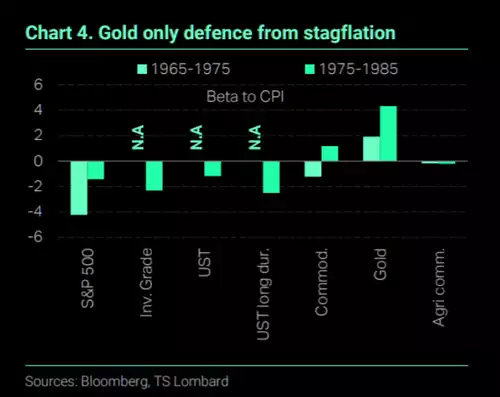

And so stagflation is a very real prospect. The charts below illustrate the historic performance of shares and gold in such an environment.

Source – Goldman Sachs

Source – TS Lombard

Add to the above that shares are currently (still) at historic highs and gold has undergone a sizeable correction and chopping sideways and the investment prospects for each look all the more interesting.