Crypto “blood in the streets”

News

|

Posted 17/01/2018

|

10437

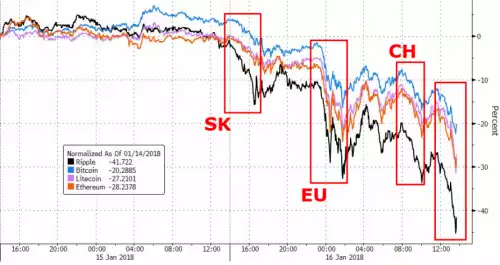

Markets are awash with red this morning with US shares seeing their first falls this year and silver off 18c. But at -0.35% and -0.87% respectively, they pale compared to the correction across the board on cryptos last night that saw Bitcoin down 30% and Ripple more than halve in price. So what happened? Well 3 events one after the other…

First, as we saw earlier this year, we had another South Korean headline about their finance ministry threatening to ‘shut down’ exchanges. Previous headlines have been found to be wrong in that they really just want to introduce more regulation to the space. South Korea is the world’s thirds largest market for crypto.

We then had the chairman of the European Securities & Markets Authority sensationally claim investors “should be prepared to lose all their money” in bitcoin. Again, like JP Morgan’s Jamie Dimon earlier similar claims (which he later recanted) we’d respectfully suggest that such a statement from someone in charge of traditional financial markets is like the head of Australia Post saying email is a fad…

Then, continuing the regulatory headlines of South Korea, a German Central Bank director called for international coordination to regulate the crypto space.

The final blow was headlines in China that a company implementing blockchain concept may have trading halted pending checks. It was, in reality, a minor story but the market was on edge and headed lower.

At the time of writing a 4th leg down was underway with no apparent catalyst other than the start of a new day in Asia and the close of markets in the US. The chart below illustrates how the 4 above played out:

So is this the end of crypto as we know it or a BTD – buy the dip opportunity? Only hindsight will truly answer that but history (albeit with the usual disclaimer of not being an accurate predictor of future events) may be a little instructive…. So let’s look at last night with the benefit of context. First, this is certainly not the first January major correction:

Now lets look at that last January ‘crash’ in context…

So again, history is not an accurate predictor of future events, but it does often rhyme and we are reminded of the 4 most expensive words in investment – this time is different. “Expensive” can be viewed a number of ways. Selling low after buying higher realises a loss. That is ‘expensive’ if nothing about the thing you were confident in has really changed. Others view ‘opportunity lost’ (not buying low to sell higher later) as ‘expensive’ as well. It’s all a matter of perspective.

Baron Rothschild famously said "the time to buy is when there's blood in the streets."

Only you can decide if the streets are sufficiently bloody to BTD….