Credit Suisse on Life Support – Bail In Alert?

News

|

Posted 24/11/2022

|

13816

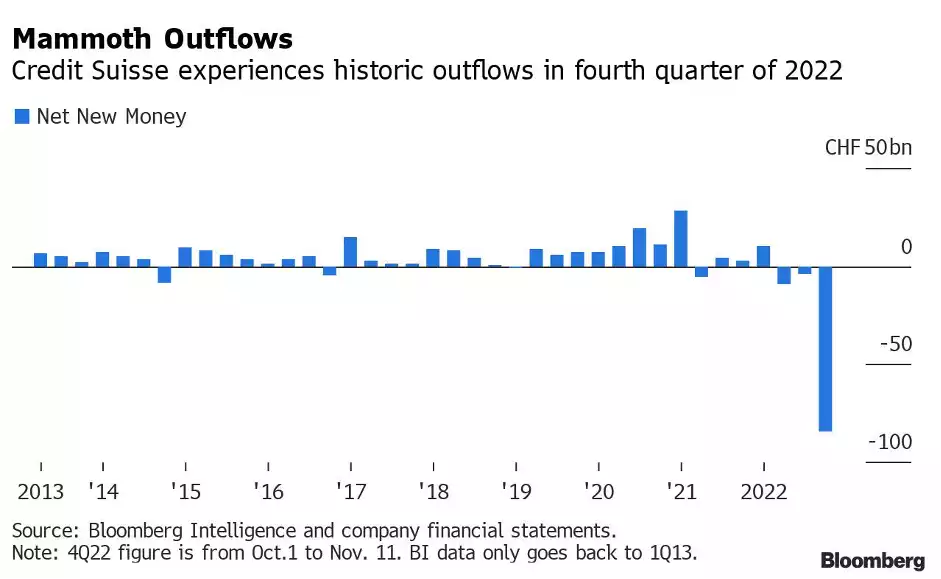

The 2nd largest Swiss Bank, Credit Suisse, is experiencing a bank run of epic proportions. It was announced last night that during the first few weeks of this quarter alone they saw a capital outflow of $88.3 billion, which consequently saw their share price drop to its lowest point in over 30 years.

While we have already discussed the Credit Suisse saga previously, however these most recent developments deserve a further deep dive.

Most importantly, 10% of their total assets under their key wealth management unit were withdrawn. This has led to Credit Suisse admitting that they have “fallen below certain legal entity-level regulatory requirements.”

To put this into perspective, during the Global Financial Crisis, UBS also saw their wealth management outflows reach 10% of assets under management. The difference being however is that it took UBS one year to reach that same percentage of customer outflows, not a just few weeks.

“The massive net outflows in Wealth Management, CS’s core business alongside the Swiss Bank, are deeply concerning -- even more so as they have not yet reversed,” said Andreas Venditti, banking analyst at Bank Vontobel AG in Zurich.

“Credit Suisse needs to restore trust as fast as possible - but that is easier said than done.”

Unsurprisingly, the market reacted harshly to the announcement, which resulted in their share price closing down 6%, at $3.86. Just this year alone, Credit Suisse has lost a staggering 60%.

Interestingly, this saga has been a clear growth opportunity for Credit Suisse’s’ main competitors, namely the aforementioned UBS, as well as Julius Baer, who have seen their assets under management increase by $17 billion and $4.3 billion respectively since June this year.

One key and possibly controversial takeaway from this whole saga is that, if you thought that the heavily regulated risk-taking practises of the traditional finance sector was substantially safer than the wild west of the cryptocurrency space, this might be a wake-up call. At the very least, there are strong similarities between the two (namely the likely use of customer deposits on high-risk financial products).

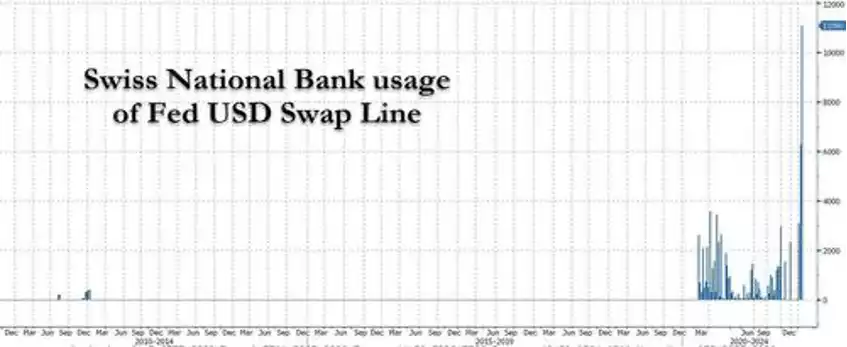

The main difference we have seen between the two is the level of governmental response. With the FTX debacle, we have governments and financial institutions calling for increased regulation. When it comes to Credit Suisse, we have seen these same entities calling for a bailout and the FED specifically providing a swap line of funds to aid them in recovery.

A possible Bank bail in could be on the cards for Credit Suisse if the FED ends its charitable contributions. In the event a bailout is not offered, they might decide to use customer deposits to cover losses. We last discussed bail-in laws as they apply to your deposits in Australian banks here and more completely explained here.

If this were to occur, then expect the trust in Credit Suisse to effectively reach zero, and the trust in the financial markets and possibly broader financial system to slowly but surely do the same.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************