Could FED Tapering Lead to Stagflation?

News

|

Posted 09/12/2021

|

10557

With the FED tapering now well and truly underway, questions still remain regarding its efficacy over controlling inflation. In ‘ordinary’ economic circumstances, any tightening of monetary policy reduces inflationary pressures. However, if the pandemic has taught us anything, it is that we are no longer living in any ordinary time.

Tapering is the process of the FED slowly unwinding and eventually bringing its quantitative easing program to a halt [for more discussion on quantitative easing, refer to this link).

It is conducted to reduce inflation, though it can often come at the expense of lowering economic growth and increasing unemployment.

The issue with tapering in this instance is that it only aims to lower demand-side inflation through restricting the money supply, rather than the supply-side induced inflation which is most likely the larger contributor for rising prices in the US.

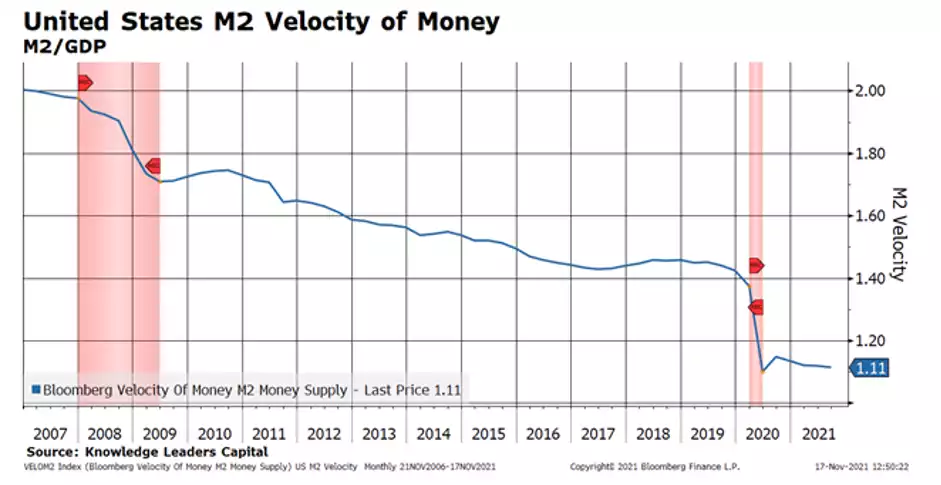

Evidence of this claim mainly stems from velocity of money data, where we see in the graph below that the velocity of money fell substantially in March 2020 and continues to flatline post pandemic.

A low velocity indicates a general reluctance in consumer expenditure, which would go against any demand side inflationary narrative.

The cause of inflation is more likely to be a consequence of global restrictions/lockdowns, labour shortages, and other supply chain issues potentially exacerbated by the pandemic, such as the infamous semi-conductor/microchip shortage of 2020-2021.

Furthermore, any impediment on economic growth and increase in unemployment would not only also lead to traditional stagflation conditions, but disproportionally harm working class Americans. While the nominal wages of American workers increased by 5% in 2021 (so far), their wages in real terms dropped by 1.2% due to inflation.

There is hope however that by mid next year, as supply chains return to normalcy, and covid restrictions dwindle, inflation itself will begin to taper down. There is still a growing belief that those outcomes won’t come to fruition, and inflation then does not go down, and economic stagflation could be on the horizon. In such an environment, defensive assets such as bonds and gold tend to outperform traditional riskier assets such as equities.

Sources:

https://www.bbc.com/news/business-58230388 - Microchip shortage

https://www.advisorperspectives.com/commentaries/2021/11/18/does-the-fed-having-a-brewing-velocity-problem - Velocity Graph

https://www.cnbc.com/2021/11/10/inflation-has-taken-away-all-the-wage-gains-for-workers-and-then-some.html - American Worker Data