Copper Tariffs and the Silver Short Squeeze

News

|

Posted 30/01/2025

|

4094

What does a proposed copper tariff in the U.S. have to do with a silver short squeeze? Months of speculation that the Trump administration will apply tariffs to all metals, including silver, have disrupted the metal markets. This has led to a widening gap between futures and spot market pricing as traders look to arbitrage on the tariffs.

As a result, premiums rose about 90 cents per ounce for silver and approximately $40 per ounce for gold. At this point, Trump has proposed tariffs on steel, aluminium and copper leading to an initial decline in copper prices based on the possibility of a trade war slowing international trade. Two questions remain – will the tariffs be broader and apply to the precious metal market, and what will this mean for the price of precious metals?

Trump Metal Tariffs

After months of speculation on the possibility of tariffs, two days ago Trump said, ‘plans to impose tariffs on copper, aluminium and steel, as well as computer chips and pharmaceuticals, to boost domestic production.’

With 13%, 44% and 46% of steel, aluminium and copper being imported into the U.S., there is significant speculation that these tariffs could slow global demand for these metals. This saw the price of copper drop below US$8,000 per tonne after the statement. More broadly, he has stated that he is likely to apply a tariff greater than 2.5% across the board, which may also affect other metals including gold and silver.

Comex Rush

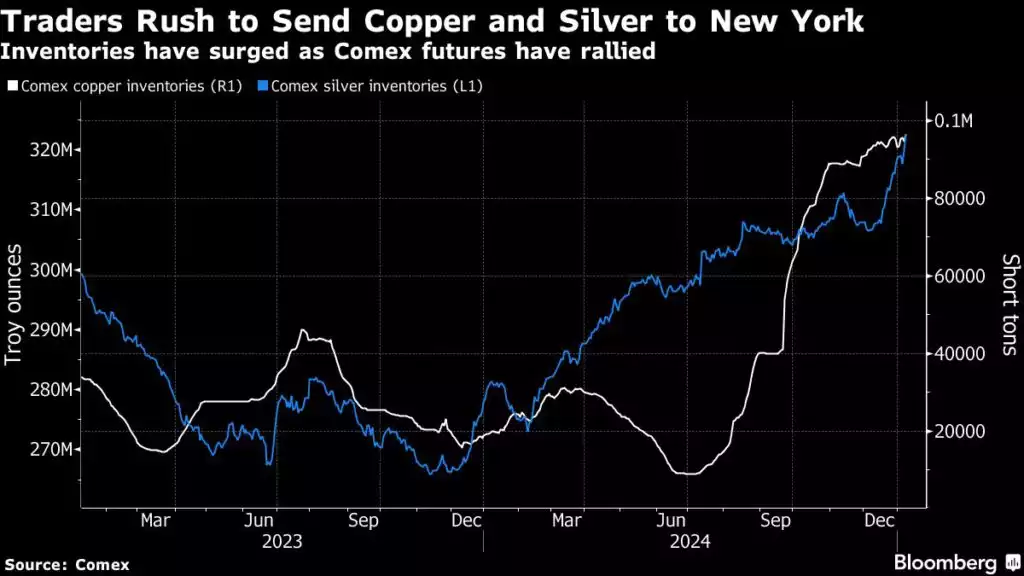

Since Trump's win in November, huge stockpiles of silver have been moving from the LBMA vaults in the UK to the Comex vaults in the U.S., in anticipation that a 10% tariff on the import of silver would allow traders to arbitrage the price. But the question remains, will Trump apply a tariff to gold and silver as he has proposed over copper, aluminium and steel?

As Ghali from TD Securities recently stated, “Historically they haven't – precious metals have been considered money in effect – but if they were to be subject to tariffs, then traders holding short positions against metal that they actually hold somewhere else in the world would be subject to substantial losses.”

What this means is that in to fulfil their short positions, traders will be required to pay the tariff upon entry of the metal into the U.S. In order for traders to hedge against this risk, these shorts have been covered by moving metal from LBMA vaults to Comex vaults causing a rush.

This has led to an inventory depletion in LBMA vaults, as new silver supply and existing LBMA silver have been redirected to COMEX in the U.S. Holding shorts in LBMA could lead to a short squeeze from this stock out.

“A stock-out is a moment in time where the inventories of the metal cross a critical threshold below which the [market] structure is challenged,” Ghali explained. “If you think about how the world trades physical precious metals, the global venue for that is sitting in London but most people actually use U.S.-based contracts to hedge price risks. So the challenge here is that the threat of universal tariffs is leading metal to go from the world's largest venue into the U.S., depleting that inventory buffer that traders use for over-the-counter transactions every day.”

Why could precious metals react differently to other metals?

Trump's tariffs have seen copper prices drop. There are two main reasons for this decline. Like silver, copper has been moving to the US in anticipation of tariffs, driving prices and speculation higher since last November. The introduction of tariffs may have given traders direction, reducing speculation. Additionally, copper, often seen as an economic bellwether, has reacted to concerns about a potential trade war, causing its price to drop alongside fears of an economic slowdown Unlike copper, precious metals typically rise in value during economic slowdowns, making them less likely to react in the same way. Additionally, both gold and silver are byproducts of copper refining. If copper production slows due to oversupply, the supply of these byproducts will also decrease. This would be particularly bullish for silver, which is now in its fourth consecutive year of deficit.

Just one week into the Trump administration, market uncertainty remains high. From renaming gulfs to international trade disputes, the global landscape is shifting, and even inflationary pressures on everyday goods, like eggs, are being attributed to Trump. Tariffs are just another unknown factor influencing global markets.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=M3KKMtJlhXs