Consequences of Debt Ponzi Scheme

News

|

Posted 14/11/2018

|

9106

There, frankly, isn’t enough mainstream discussion and recognition that we are in the midst of the biggest Ponzi scheme in history. Lead by central banks, the world is borrowing more and more money to buy economic growth at a rate greater than the economic growth it seeks.

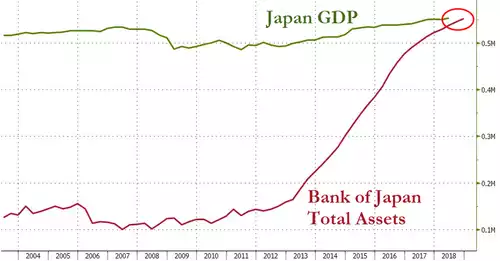

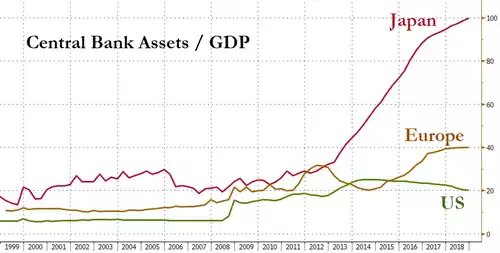

If you want one of the crazier examples, let’s look at Japan. We touched on Japan’s economic history on Monday. To get out of its deflationary trap, the Bank of Japan has, per capita, outdone anyone on the money printing (via QE) game and led the world into negative interest rates too. Having bought all the bonds it could with all that freshly printed money, it has been busily buying up shares as well, to become the biggest owner of ETF’s in the country. As at 10 November, it became the first central bank in history to buy more assets than the country’s entire GDP. Since ‘Abenomics’ was unleashed they have quadrupled money supply…

For context:

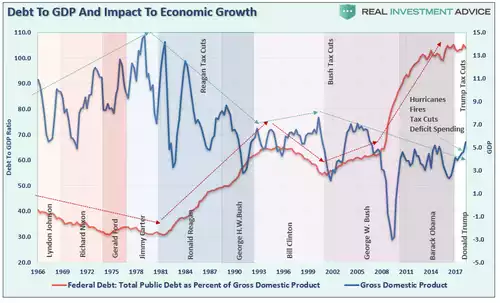

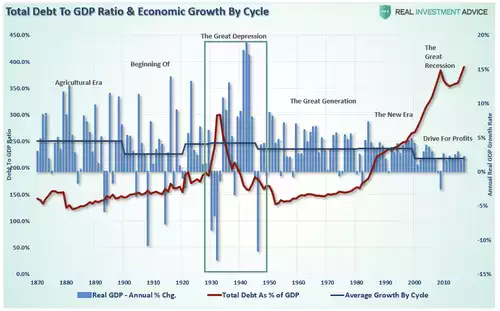

Now central bank debt is only part of the equation. Government debt is another and where the Ponzi-esque nature of what’s going on is so completely evident. We have discussed previously the fact that Governments are borrowing multiples over resulting GDP. The US is borrowing around $3 for every $1 of resulting GDP and Australia is even worse. However a recent article by Lance Roberts of Realinvestmentadvice.com raises an even more alarming fact. Most of the deficits spent in the US is on non productive expenditure, thus debunking any semblance of truth to the argument the results of the deficit spending will, in time, pay back all the debt to start it….

“Through the second quarter of this year, the Federal Government has spent $4.45 Trillion which was equivalent to 24% of the nation’s entire GDP. Of that total spending, only $3.47 Trillion was financed by Federal revenues leaving $983 billion to be financed with debt. In other words, it took all of the revenue received by the Government just to cover social welfare and service interest on the debt.

In the financial markets, when you borrow from others to pay obligations you can’t afford it is known as a “Ponzi-scheme.””

To put this into historical perspective:

Like any Ponzi scheme there must be a day of reckoning. The following from Roberts paints very clearly how this will play out to its inevitable end.

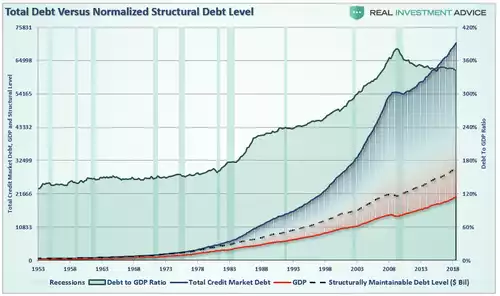

“Debt Doesn’t Create Real Growth

The massive indulgence in debt has simply created a “credit-induced boom” which has now reached its inevitable conclusion. While the Federal Reserve believed that creating a “wealth effect” by suppressing interest rates to allow cheaper debt creation would repair the economic ills of the “Great Recession,” it only succeeded in creating an even bigger “debt bubble” a decade later.

This unsustainable credit-sourced boom led to artificially stimulated borrowing which pushed money into diminishing investment opportunities and widespread mal-investments. In 2007, we clearly saw it play out “real-time” in everything from sub-prime mortgages to derivative instruments which were only for the purpose of milking the system of every potential penny regardless of the apparent underlying risk. Today, we see it again in accelerated stock buybacks, low-quality debt issuance, debt-funded dividends, and speculative investments.

When credit creation can no longer be sustained, the markets must clear the excesses before the next cycle can begin. It is only then, and must be allowed to happen, can resources be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed.Those fiscal and monetary policies, from TARP and QE, to tax cuts, only delay the clearing process. Ultimately, that delay only deepens the process when it begins.

The biggest risk in the coming recession is the potential depth of that clearing process. With the economy currently requiring roughly $3 of debt to create $1 of economic growth. A reversion to a structurally manageable level of debt would involve a nearly $40 Trillion reduction of total credit market debt from current levels.

The economic drag from such a reduction would be a devastating process which is why Central Banks worldwide are terrified of such a reversion. In fact, the last time such a reversion occurred the period was known as the “Great Depression.”

This is one of the primary reasons why economic growth will continue to run at lower levels going into the future. We will witness an economy plagued by more frequent recessionary spats, lower equity market returns, and a stagflationary environment as wages remain suppressed while costs of living rise.”