Conflict Dramatically Escalates

News

|

Posted 12/01/2024

|

2489

Houthis promise more attacks, the UK and U.S. prepare their own strikes, and Iran has seized a U.S. oil tanker.

Last night’s CPI news finally dropped: U.S. December core CPI was 3.9% versus an expected 3.8%. This caused markets to whipsaw, and then the news was soon overshadowed by news of the ongoing Houthi conflict.

Since warnings have failed to stop attacks, the UK and U.S. are planning to conduct an offensive against the Houthis in Yemen. This is expected to happen within 24 hours. The major reason for this was highlighted in our article yesterday about the barrage of drones and anti-ship missiles that were sent to attack a U.S. warship. Although all of them were shot down, the Houthis promised more attacks.

One of the factors that makes these attacks easy is the financial disparity between attacking and defending. Each drone that the Houthis send costs a mere $20,000 at most. Each interceptor missile used to successfully take them out costs roughly $1,000,000. Defending commercial and military vessels from barrages of drones and missiles and having to guarantee to take out every single one is an exhaustive and expensive effort to say the least.

According to former White House Nat. Sec. policy specialist Michael Allen, “If we only sit there in a defensive posture, eventually one of these missiles or drones will get through and kill sailors”.

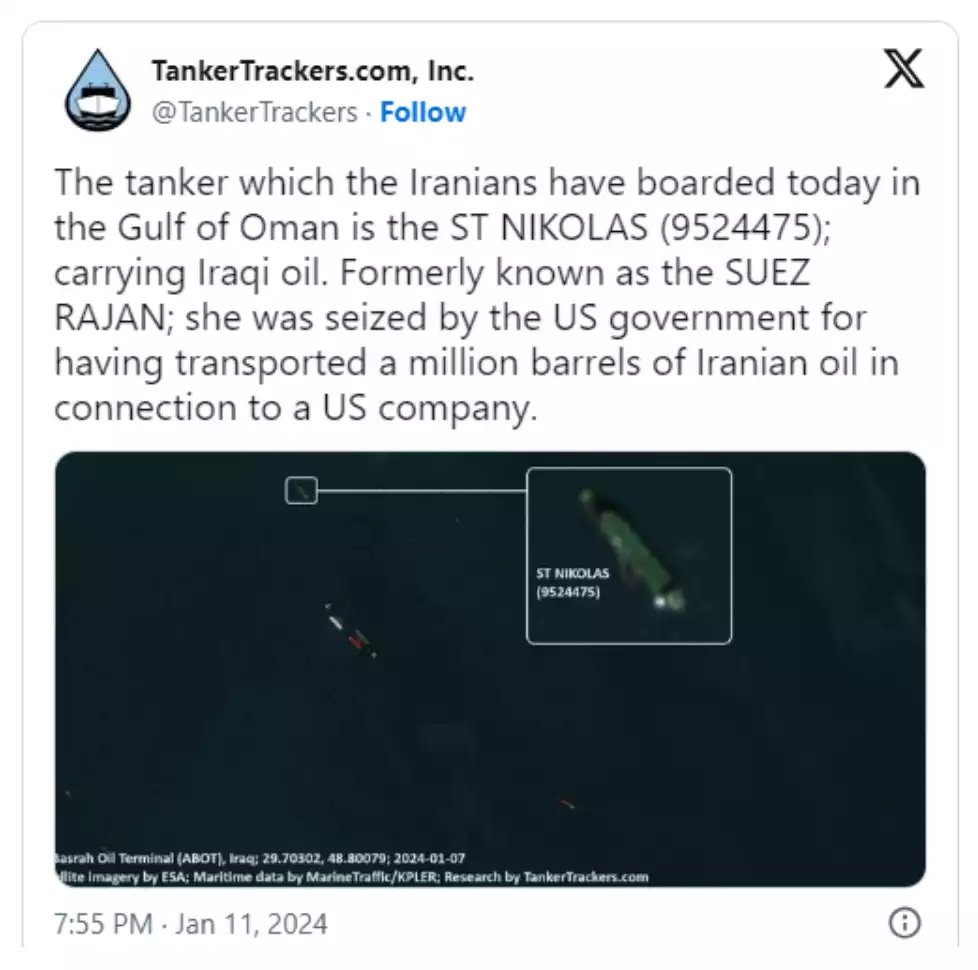

The situation overnight took another turn for the worse, when according to a Bloomberg report, Iran seized a U.S. oil tanker in the Gulf of Oman. The Iranian Navy was acting on a court order when it boarded and hijacked the vessel.

The hijacked ship was the ST NIKOLAS and was flying a Marshall Islands flag. The tanker was carrying 145,000 tons of crude oil. After the hijacking, the ship’s tracking signal was turned off and the vessel eventually evaded tracking.

This is a serious provocation and compounds the imminent offensive planned today by the UK and U.S. against the Houthis. Continued advancement of the conflict could push global markets toward a “risk-off” and support the price of gold.