Common sense investing

News

|

Posted 05/12/2013

|

5367

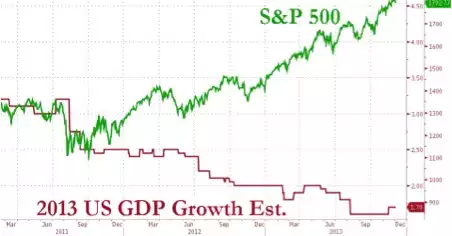

In a world of daily economic data flip flopping from recovery to recession indicators, all in an unprecedented era of the massive stimulus of printed money and near zero interest rates, one graph (below) can paint a thousand words. Then simply ask yourself, when the easy money making “Wall Street” richer stops (or tapers, or explodes), what happens next and where would you want your wealth stored. Gold and silver have always been the hedge against this because it is real money, period. There is nothing ‘real’ about this picture…