China – the Canary in the Global Economy

News

|

Posted 14/06/2023

|

8439

China – the Canary in the Global Economy

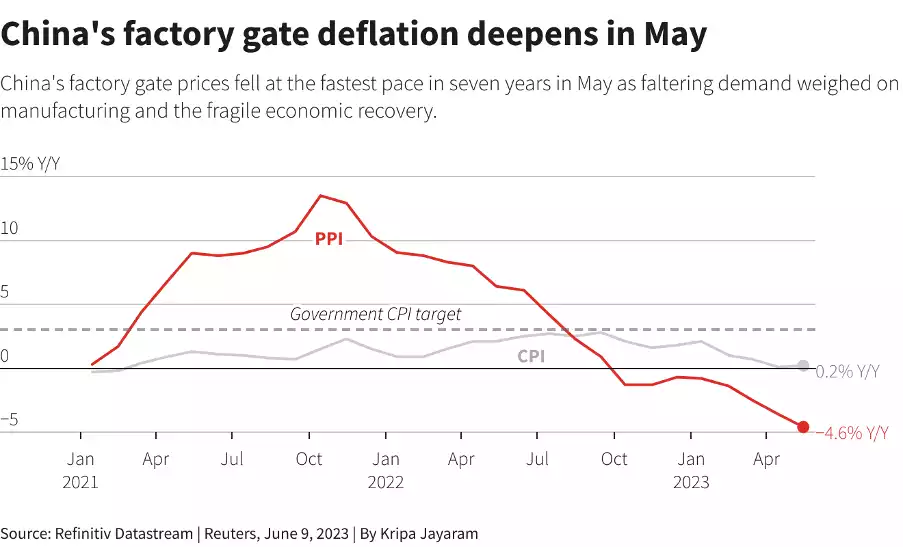

As the West continues to grapple with more interest rate rises and the inflation battle continues to rage, yesterday, the world got to look East at what may be the canary in the world economy with the PBOC dropping its reverse repo rate by 0.1% to 1.9% from 2.0%. That’s right, as the West continues to raise interest rates at the fastest rate in the last 100 years, the manufacturing hub of the world just dropped theirs as the factory gate prices dropped for the 7th month in May and at the fastest rate in 7 years due to a slowing manufacturing sector.

US inflation the Fed is winning the battle will the lift?

In further support for the Federal Reserve’s decision tonight to hold interest rates, US inflation last night continued to drop and came in under expectations, with CPI recording 0.1% compared to an estimate of 0.2%, and 0.4% in May. On a year-on-year basis inflation in the US now sits at 4.1%. The main driver of these falls was electricity and petrol deflation. These inputs will feed through the supply chain and should assist further goods and service price reductions, but depending on the speed they are passed through, this may take several months to show up. Looking East to China the goods deflationary pressure is also building…

China is running the risk of deflation

A bit driver of yesterday’s decision by the PBOC to drop rates was on the back of last week’s contractionary PPI result, coming in at -4.6%. This led Chief Economist, Zhiwei Zhang from Pinpoint Asset management to say ‘Recent economic indicators send consistent signals the economy is cooling’

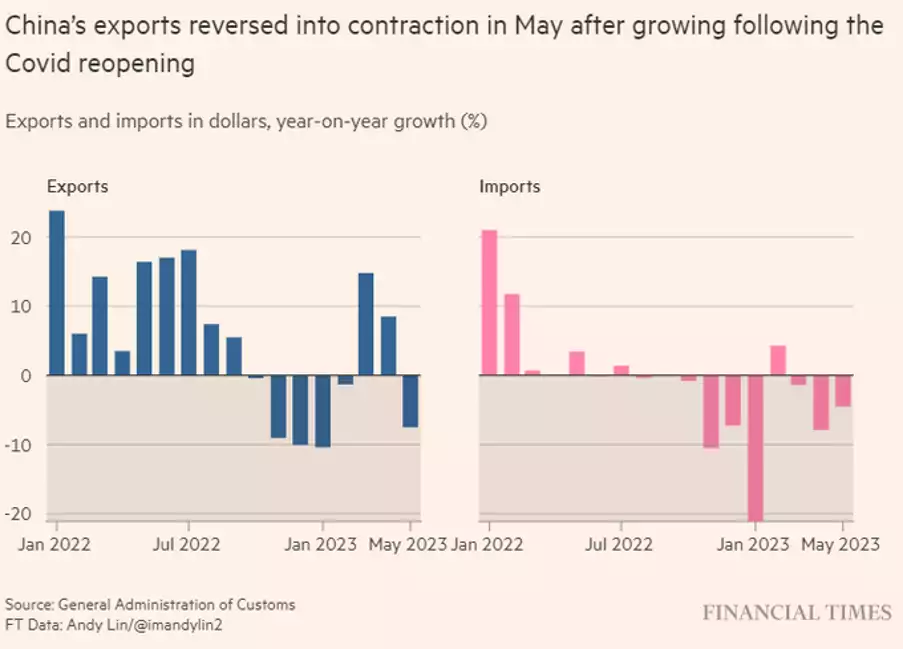

The deflationary impact of the world slowdown can be seen clearly in recent Chinese raw material components import data falling a massive 7.9% in May. Leading these falls is the May export data from South Korea, with shipments falling 20.8% but most revealing was the semiconductor exports to China dropping a whopping 36.2% - one of the main Covid-19 supply chain bottlenecks driving prices of all electronics goods and vehicles higher.

China generally sits at the start of the supply chain for goods – taking materials and turning them into finished goods. They therefore help determine prices for commodities as well, which eventually drives world ‘goods’ prices. These supply chains may take 3-12 months from start to end, but as the May and June data are beginning to show this will not be a gradual decline. This could potentially lead to a negative price supply shock which will help drive deflation in the world economy. Clearly the PBOC and Chinese government are concerned this is happening and yesterday’s rate drop could be a precursor to further stimulus.

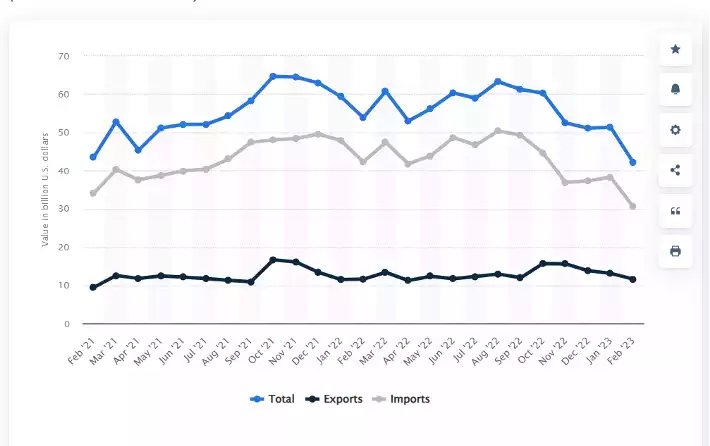

Total Monthly value of US trade I goods (export and import 2021- February 2023

Source: Total value of U.S. monthly trade with China 2023 | Statista

As can be seen in the import/export trade graph with the US, the trade war with the US has been hitting hard with both imports and exports falling from an October 2021 high to a February 2023 low of $30 billion. The question is now as they supply goods to the rest of the world and continue to reduce exports to the US will they need to stimulate their economy further to create growth? Shipping, unemployment and property prices are all feeding into these reductions in inputs – and all indicators show further strong drops ahead.

Shipping

Recent shipping rates will also be feeding through to import prices, with FourKites recently reporting congestion in Chinese ports is down 62%. The rates appear to be dropping rapidly too now with the latest XSI (Xeneta Shipping Index) report showing shipping rates are down 42% and possibly now run the risk of excess capacity driving a bidding war driving prices even lower. In fact last month saw a 27.5% drop with Xenata CEPO Patrik Berglund stating that a ‘collapse’ was the only appropriate descriptive word. The 27.5% drop was the largest drop ever experienced in the XSI.

Chinese Property sales

The property sector in China makes up about a quarter of GDP. So far this year home sales have only reached 64 percent of pre pandemic levels of 2019, so a recent Goldman Sachs report should come as no surprise. The report does not see the market improving, saying ‘based on our estimates, the property weakness will likely be a multi-year growth drag for China.’ ‘We see persistent weaknesses in the property sector, mainly related to lower-tier cities and private developer financing, and believe there appears [to be] no quick fix for them. We only assume an ‘L-shaped’ recovery in the property sector in the coming years.’

Unemployment

With international trade falling, more recently Chinese Policymakers have reiterated their intention to lean further on Chinese consumers, after 2022 recorded the slowest rate of growth in the last 50 years. But with a slowing economy, tight monetary policy and low income growth domestic demand has remained depressed and is not supporting this growth.

The depressed Chinese consumer is heavily impacted by the ‘youth’ unemployment figures with those aged 16-24 hitting a new record of 20.4% - with unemployment levels of 5.2% overall, and the growth in new jobs appears to be faltering with this group of young people graduating from universities and struggling to find employment. No jobs and no income is a significant drag on the Chinese consumer spending.

Deflation is coming

So as the West continues to battle with inflation and push rates up at an a historically accelerated pace, China is clearly starting to see strong deflationary data feeding into their economy. With goods and shipping having a supply chain delayed impact and energy prices falling below Ukraine war pricing, it won’t be long until these prices and extra capacities start feeding deflationary priced goods back into the world economy, and based on the current data this will not be gradual. This is the advanced warning that the canary is in China.