China's New Way To Buy Gold

News

|

Posted 12/05/2023

|

70104

Word on the street is that Chinese bank account holders are now able to purchase gold directly through their savings accounts. The new change reportedly came in the early hours of Tuesday. Renminbi (RMB) savings accounts at commercial banks in China now have the option of converting directly into gold. As opposed to going through a bullion dealer, it is now similar to transferring from your main checking account to a separate savings account on the same platform.

Obviously, banks as state owned enterprises don’t do anything without the People’s Bank of China’s (PBOC) direct instruction. China has been promoting gold to its citizens for years with a number of reports of TV commercials promoting gold purchases. It’s also common in China for banks to produce their own gold, and customers can buy the bank branded gold in the branch. The actual details of which banks, and how much the bullion costs are not so straightforward however (read more here). The author of this article has verified the ease of over the counter gold sales with three China based contacts.

One Westerner in China described the experience in the following way:

Bank of China had gold in various sizes starting at 10 grams for only a little above spot price. Delivery was available in only 1 or 2 days at the local branch. Since my parents have a big wedding anniversary coming up, I decided to get them something unusual. I bought them a 10 gram bar of gold. Once I decided to buy it, I had a friend call the manager. Two days later, I went there and collected the gold. It even came in a lovely gift box in a nice gift bag. I was impressed with the speed and ease of the transaction. I didn’t need any special paperwork or ID. All I had to do was sign a receipt, hand over the cash, and walk out with the metal.

We can’t imagine being able to walk into an ANZ or CBA branch and walk out with 10g of gold.

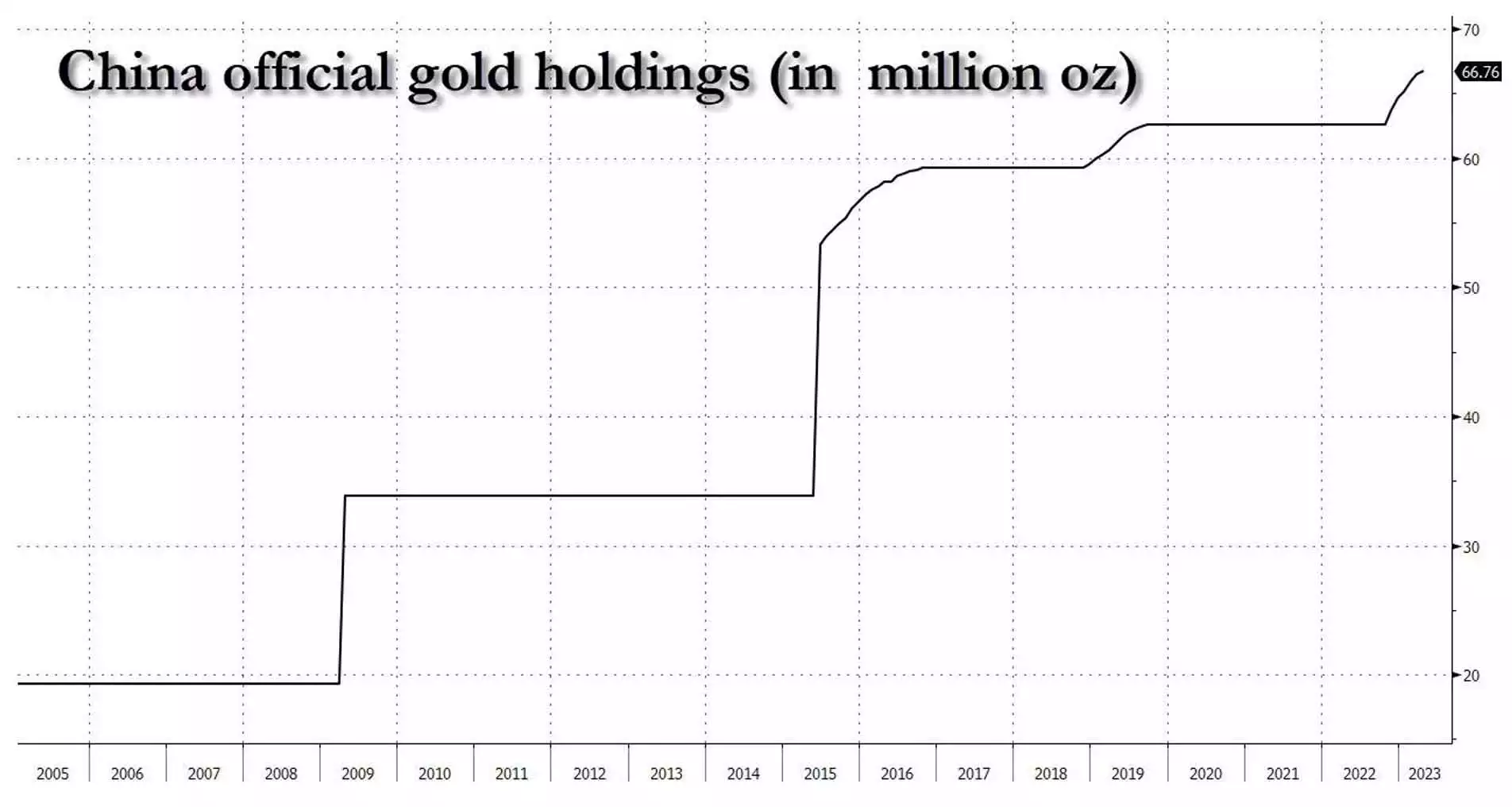

All of this comes off the back of the sixth consecutive month of PBOC gold purchases, adding 8.09 tonnes of the yellow metal in April. The PBoC disclosed that it’s overall gold reserves had risen by 58 tonne in Q1 2023 alone. They were only outdone by “Asian Tiger” Singapore, who increased their holdings buy 69 tonnes.

China who has traditionally not reported it’s gold holdings, is now announcing it publicly every month. The race to de-dollarise and avoid sanctions is on. The other major buyers, Turkey and India are far from friends of the Euro-Dollar system.

As the currencies underpinning the global financial system shift like the sands of monetary time, gold holds value. The race to gold is on, with billions of people all over the planet seeking refuge in precious metals.

For more information on how to purchase gold at a physical store you can visit the following link:

Brisbane:

ainsliebullion.com.au/Brisbane