China’s Grand Gold Plan

News

|

Posted 14/05/2015

|

5451

The following are extracts from a recent article by gold analyst

Dan Popescu where he asserts the next “Black Swan” event likely to push gold strongly higher will be China revealing its gold reserves. He gives a fascinating insight into what many would agree is a grand plan by China…

“Whoever has the most gold is able to control gold’s valuation. Controlling gold’s valuation, you can control the valuation of all other currencies,” and “The more gold China has, the less it’s under the thumb of the United States. China has got all of its foreign exchange in U.S. government bonds that could be repudiated in a minute,” says Chris Powell of the Gold Anti-Trust Action Committee (GATA). China realized this a long time ago and has been doing everything to buy gold and as much as possible.”

“In the Gold Forecaster of April 2014, Julian D.W. Phillips writes, “China is not only the main force in the global gold market, but they control the gold market. … They play their control very cleverly so that it is not apparent… They have found a way to buy gold without pushing up the gold price.” According to Reuters “China plans to launch a yuan-denominated gold fix this year to be set through trading on an exchange…, as the world's second-biggest bullion consumer seeks to gain more say over the pricing of the precious metal.” This will certainly increase China’s control on the gold price.”

“China has confirmed it has asked the International Monetary Fund (IMF) managing director, Christine Lagarde, during her recent visit to China to include China's yuan in the Special Drawing Rights (SDR) basket.”

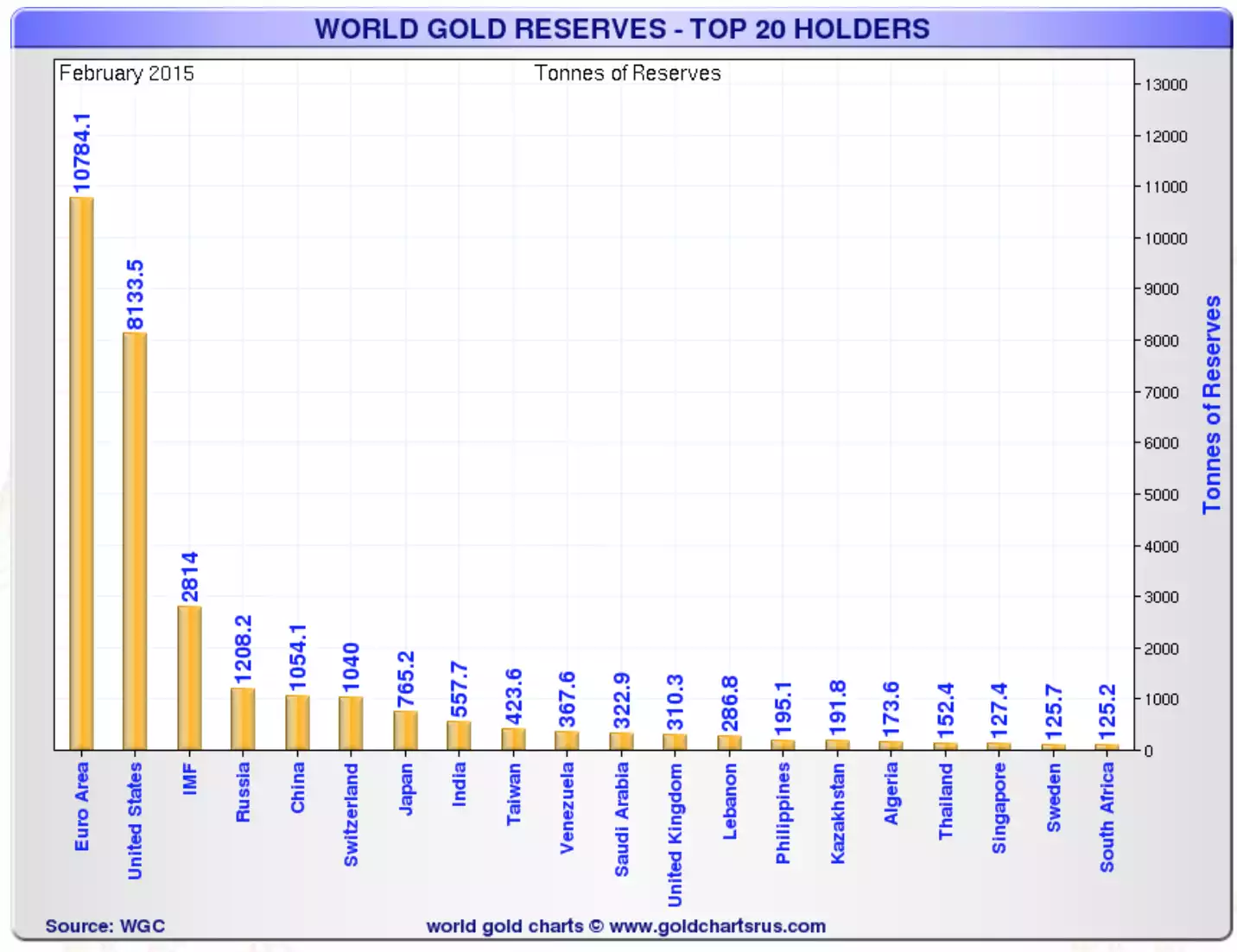

“According to Willem Middelkoop, in his book The Big Reset, as early as 2009 a ‘task force’ team of monetary experts had suggested that China’s gold reserves should be increased to 6,000 tonnes by around 2013 and to 10,000 tonnes by around 2017. 6,000 tonnes would “put the Chinese on a par with the US and Europe on a gold-to-GDP ratio”.”

“China understands the old saying that “He who owns the gold makes the rules.” In his book, The Big Reset, Willem Middelkoop says, “They [Chinese] know, even from their own history, that gold has been used time and again to rebuild faith when a fiat money system has reached its endgame.” People’s Bank of China’s Zhang Jianhua said, in an interview, “No asset is safe now. The only choice to hedge risks is to hold hard currency – gold.” Sun Zhaoxue also said in an article that, “Currently, there are more and more people recognizing that the “gold is useless” story contains too many lies. Gold now suffers from a ‘smokescreen’ designed by the US, which stores 74% of global official gold reserves, to put down other currencies and maintain the US dollar hegemony.”

“What can we conclude from the recent official request by China to include the yuan into the SDR basket? Can we consider that an announcement of the most recent China gold reserves will be made before the inclusion of the yuan into the SDR? If yes than an announcement by the end of the year is almost certain. If the yuan were to be included into the SDR, China would have to show the composition of its foreign exchange reserves. That implies also to furnish detailed information about its official gold holdings.”

Maybe now is the time to be buying gold whilst China allows it to stay low whilst they ‘back up the truck’…..