China’s Dramatic Shift in Stance Towards Crypto

News

|

Posted 18/11/2019

|

12830

A state-run newspaper in China published a front-page story hailing bitcoin as the first successful application of blockchain technology a few weeks ago.

The praise marks a noteworthy shift in Beijing's stance towards cryptocurrency and comes as the country prepares to launch its own digital currency.

China has been slow to recognise the potential benefits of cryptocurrency compared to other countries and has typically taken a forceful attitude towards the industry.

In September 2017, as bitcoin was heading towards its record high price, Beijing introduced a ban on all cryptocurrency exchanges to prevent citizens from purchasing digital currencies with Chinese Yuan.

China's change in policy towards cryptocurrency and blockchain began earlier this year, prompting rumours that the country was close to launching plans for its own state-backed token.

In October, after years of silence on the topic, adverts for blockchain courses began to appear on popular Chinese apps and social media sites. Days later, President Xi Jinping described the technology as an "important breakthrough" that should be further developed.

A law is also set to be introduced in January that will "facilitate the development of the cryptography business and ensure the security of cyberspace and information".

This is expected to precede the launch of China's cryptocurrency, which is being developed by China's central bank. Previous positive sentiment from China has been credited for boosting bitcoin's price, and as the Chinese market continues to join the market, the same sentiment and price increases are set to occur.

Changpeng Zhao, founder and CEO of crypto exchange Binance, says,

“It’s super positive. China’s very pro-technology, so China will invest very heavily in blockchain technology and on the educational front as well. Given that China has now made that move, every other country in the world will have no choice but to follow or move faster. But it’s going to be pretty hard to move faster than China to be honest.”

“You can’t learn just about blockchain without learning about cryptocurrencies. So, I think we’ll see a lot more people who understand Bitcoin, Ether and other cryptocurrencies. So, we’ll see very strong adoption there.”

But what does this all mean for bitcoin and the alts market?

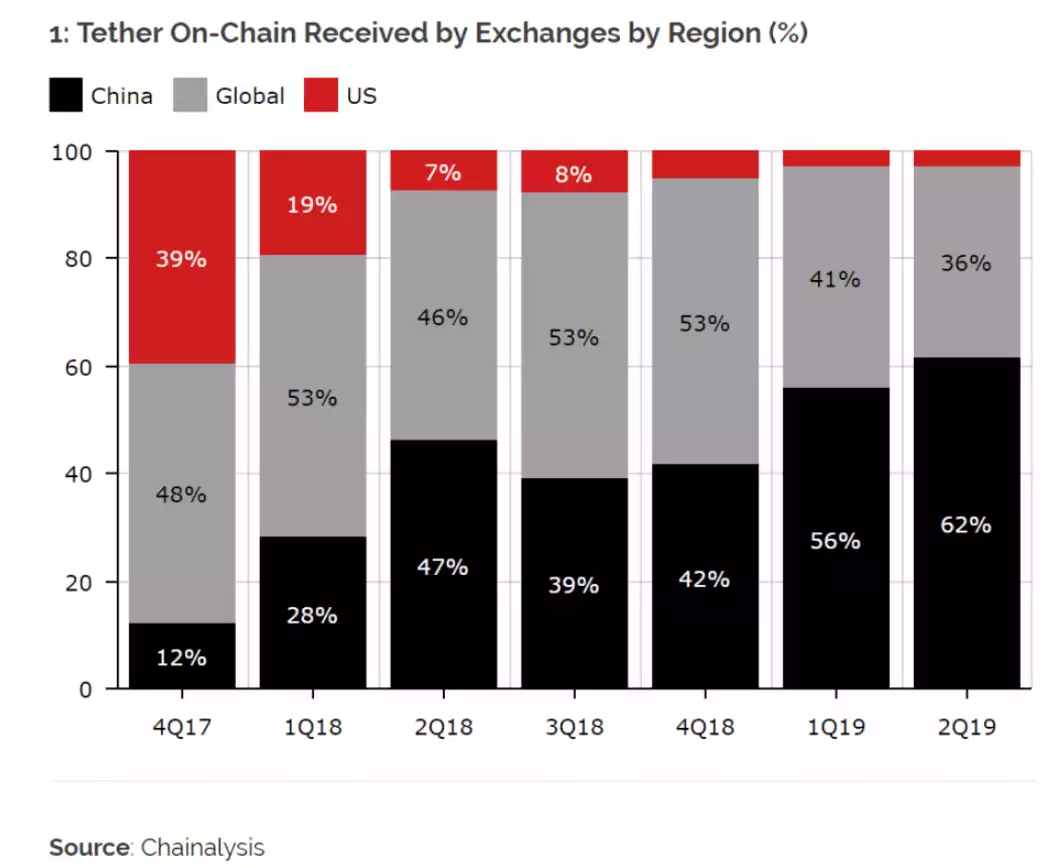

In recent months, reports have indicated that major cryptocurrencies, including bitcoin and tether, have seen rising inflows from China.

The acceptance of bitcoin in China reflects the growing interest in BTC as an alternative store of value. It’s clear that Chinese crypto users view bitcoin as a store of value – not an everyday payment tool. As such, the nation-backed cryptocurrency is highly unlikely to impose any impact on China’s stance towards bitcoin – or stunt investor demand for BTC. If anything, China’s loosening of rules will funnel Chinese investors towards traditional cryptocurrencies, especially those who are looking to distance themselves from the government-endorsed token.

Bitcoin’s recent selling pressure has slowed as the crypto finds some price floor within the $12,400 region, which appears to be holding strong as its price has been able to slowly inch higher in the time since BTC touched its near-term support level.

Analysts are now noting that Bitcoin may currently be expressing a similar pattern to that seen in 2017, which could mean that it is exiting its corrective period and entering another fresh uptrend if history repeats itself.

Bitcoin is trading at a price of $12,550, which marks a slight climb from its recent lows of $12,300 which was briefly set during its recent drop, at which point it incurred a slight uptick of buying pressure which helped slow its decline.

It does appear that Bitcoin is once again entering a fresh consolidation period, which may mean that it will trade sideways around its near-term support level before it incurs another swift movement.

This view is supported by the fact that BTC’s Bollinger Bands have been tightening up in the time following its recent drop to its current levels, which typically signals that a big movement is imminent.

Bitcoins prices reflect the sentiment of the market at large – which is why the current prices are down. However, in the background, everything is coming together - Increased accessibility to the general public and ever-increasing institutional adoption and usage to name a few. All the foundations and fundamentals have been set for Bitcoin and the rest of the market to relive its all-time highs. All it takes is a shift in sentiment (which we know can move quickly – especially in the crypto markets) and increased demand by opening up accessibility. We appear to be heading in the right direction…

-----

Final reminder for Cryptopia, showing for one night on Wednesday 20 November at the Elizabeth Picture Theatre in Brisbane City. Click on the image below to purchase your tickets.