China Starts Buying Gold Again After 6-Month Break

News

|

Posted 09/12/2024

|

4074

The biggest, most aggressive gold buyer in the world just opened the floodgates after a six-month hiatus. In a move set to excite gold investors, China's central bank has resumed buying and no longer seems confident in a further price dip. The People's Bank of China reported a significant rise in reserves over the weekend, marking a significant shift in its strategy and possibly signalling renewed demand for the precious metal.

The PBOC, the biggest official buyer of gold in 2023, had halted its purchases in May after prices jumped above $2,400. This halt indicated a prudent approach to buying gold in a highly volatile price environment. But China's official gold holdings climbed to 72.96 million fine troy ounces as of the end of November, from 72.80 million ounces where they had stood since May.

The renewed buying comes after a sharp fall in the price of gold on June 7, when news of the initial pause triggered a $100 drop. Now, it seems China's central bank has had second thoughts and might be less concerned about waiting for prices to drop further. While the PBOC rarely discloses details of its gold-buying strategy, sources familiar with the bank's operations say that topping up reserves is a long-term priority, likely as part of broader efforts to diversify away from the U.S. dollar.

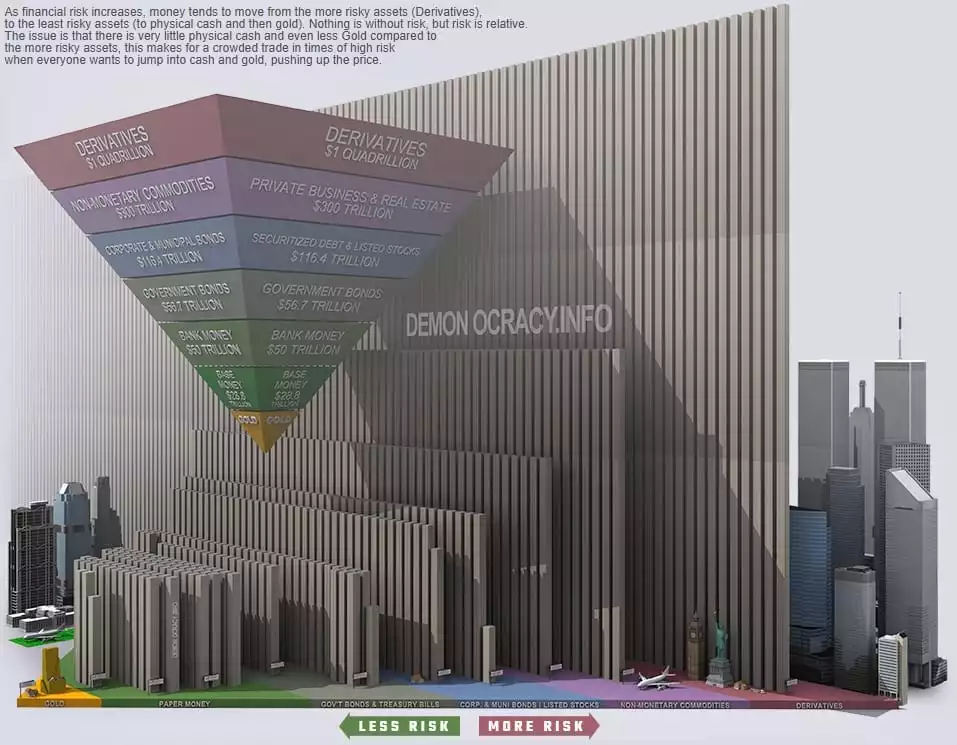

So, why has China chosen gold? It appears that they understand the below graphic all too well:

This development is expected to trigger a positive reaction in gold markets when trading opens. The timing for this restart of gold buying also aligns with a historically strong season for gold. This could further bolster sentiment among investors and traders.

China's return to the market could be just what is needed to kick-off another rally and to reaffirm the status of the precious metal as a hedge against economic uncertainty and currency fluctuations.