Chances of a Recession Keep Rising

News

|

Posted 11/04/2025

|

1728

The chance of a US recession has been rising – Goldman Sachs put the likelihood at 45% yesterday, up from 35% a week earlier and just 20% the week before. However, two nights ago, a shock pause in tariffs saw this fall back to zero. That 45% figure was before China retaliated with 84% tariffs on US goods, and before the US announced a massive 125% tariff on Chinese goods, set to take effect yesterday, then further raised to 145% today, leaving the rest of the negotiating world on pause. Tariffs of 145% on Chinese goods entering the US will see the cost of imports more than double virtually overnight. When will this tariff madness end – and will it cause a recession? Larry Fink from BlackRock has already suggested it has, recently stating, “Most CEOs I talk to would say we (the US) are probably in a recession right now”.

Recession Chorus Getting Louder and Stronger

BlackRock and Goldman Sachs weren’t the only ones predicting a recession by year’s end.

- J.P. Morgan now sees a 60% chance of the global economy entering recession by year’s end, up from 40%.

- The Federal Reserve Bank of Atlanta posted preliminary economic data showing a drop of 2.4 per cent for the GDP in the first quarter of 2025, the first time we've seen a quarterly drop since 2022 during the pandemic.

- The New York Fed's recession probability model suggests there is a 27% chance of a US recession sometime in the next 12 months

- A March CNBC survey of US CFOs found that 60% of them believe an economic downturn is likely this year.

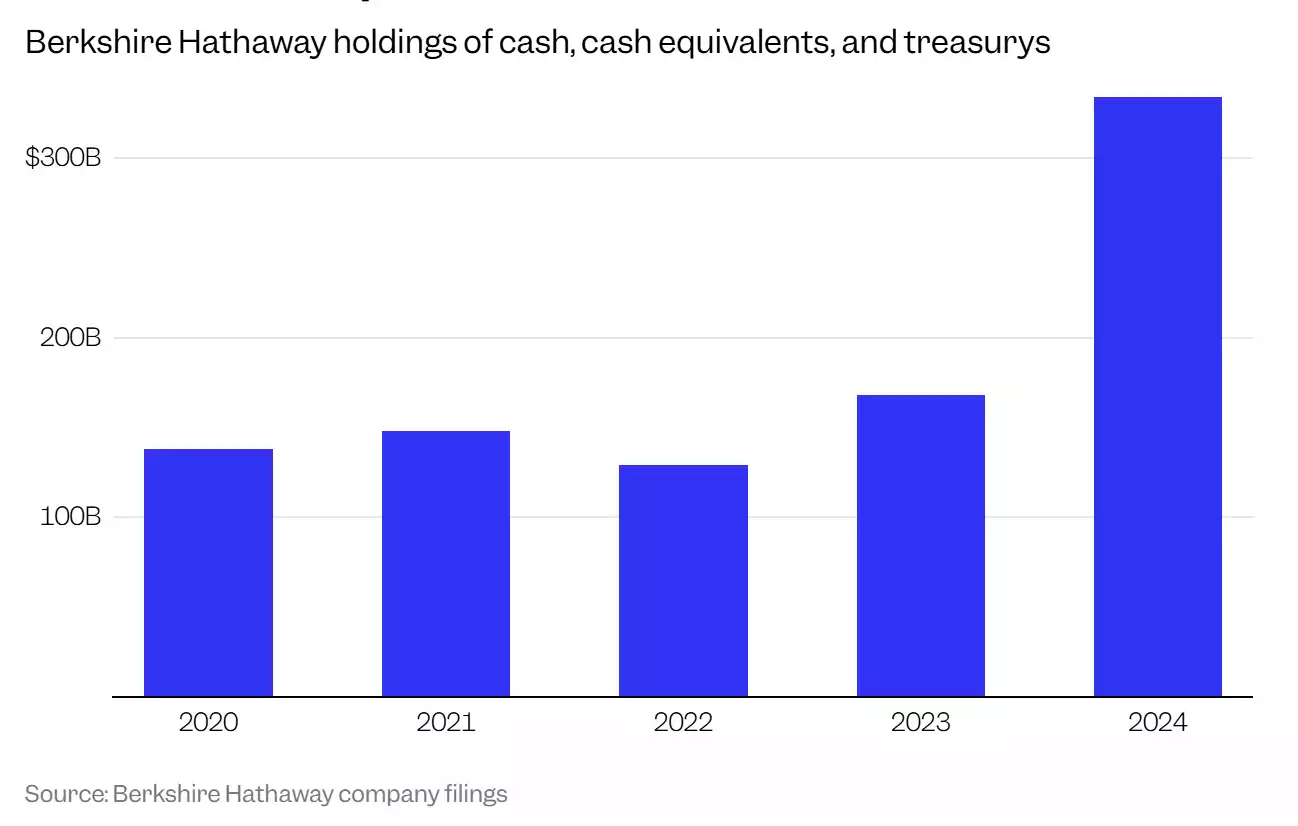

- Warren Buffett is sitting on a record US$324 billion in cash as of the end of 2024, cautioning: 'Be fearful when others are greedy.' A worrying sign, given it’s the largest corporate cash pile ever, exceeding that of the five largest public companies by market cap combined.

In other words – be alert and be prepared. The experts are warning of a downturn, and the indicators are mounting. Flip-flopping on tariffs is not helping the situation, with market uncertainty creating turmoil.

But what does this mean for everyday Australians?

AUD Sinking

With the DXY declining against its basket of currencies since February, down nearly 10% from 110 to 100, the Australian dollar has been one of the weakest-performing currencies in recent months.

Since the announcement of the size and scale of the tariffs on April 8th the AUD has experienced a significant decline, dropping below 60 US cents for the first time since the COVID-19 pandemic—a level not consistently seen since early 2003. Escalating US-China trade tariffs threats to continue to destabilise the AUD. To make the situation worse – Australia’s heavy reliance on commodity exports is seeing it come under even more pressure, with iron ore, coal and energy markets seeing significant declines since the announcement. Iron ore has dropped around 5% since the announcement.

Not helping Australia’s cause has been a slew of poor economic data announcements, including sluggish growth and persistent inflation leading markets to anticipate accelerated rate cuts this year. Global risk aversion, heightened by trade war fears and equity market sell-offs, will continue to favour non-US safe haven currencies including the Japanese Yen and Swiss Franc, with the AUD sinking 12% against the Franc year to date.

In the past week, the Australian dollar has seen daily 2c swings and a near 4c swing on Friday last week. While these kinds of swings have previously occurred on isolated days, their daily occurrence now presents a serious challenge for both businesses and travellers.

Rate Cut Hopes

With the chorus of sentiment now expecting a heightened chance of recession, with tariffs expected to impact world economic growth, analysts are also now predicting more rate cuts this year. The Federal Reserve this year is now priced in at 115 basis point drop between now and Christmas.

Following on from our US counterparts, Australian bond traders have now increased the chances of interest rate cuts, with 3 cuts priced into the next 3 meetings and even a 40% chance of a jumbo rate cut of 50bps on May 20 following the Federal Election on May 3rd.

New Zealand – which appears to always be one step ahead of Australia in regard to interest rates today lowered delivering a 25bps cut, down from a peak of 5.5% during the 2021 transitory inflation period to 3.5% today. In the meantime, the Australian interest rates have barely moved due to continued unprecedented government spending effectively tying the RBA’s hands – with our rates dropping a mere 25 points at the same time.

If interest rates are cut this quickly, your mortgage could become significantly cheaper. With recession risks rising and the cost of goods increasing against a weakening Aussie dollar, this may be the relief Australians desperately need to finish the year.

Gold priced in AUD

Gold continues to serve as a reliable hedge amid economic uncertainty—particularly in terms of the Aussie dollar. So be prepared, and don’t get too scared.