Central Banks Dumping. What Do They Know?

News

|

Posted 21/09/2023

|

2997

The FOMC this morning has announced interest rates will not change and the funds rate will remain at 5.25-5.50%. Although this was expected, their economic outlook caused the US Dollar to rise, and the S&P 500 to immediately fall. Gold also took a slight hit, since a temporarily stronger dollar allows for easier purchasing of gold.

The Fed still expects another 25 basis point hike this year, which could be the final nail in the coffin for many individuals and businesses. Their famous "dot-plot" also revealed 50 basis points of cuts next year. This means that all the work they have done fighting inflation will start to be undone and the process of currency devaluation will continue to run its course.

“Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation,” added the Fed in its statement. “The extent of these effects remains uncertain.”

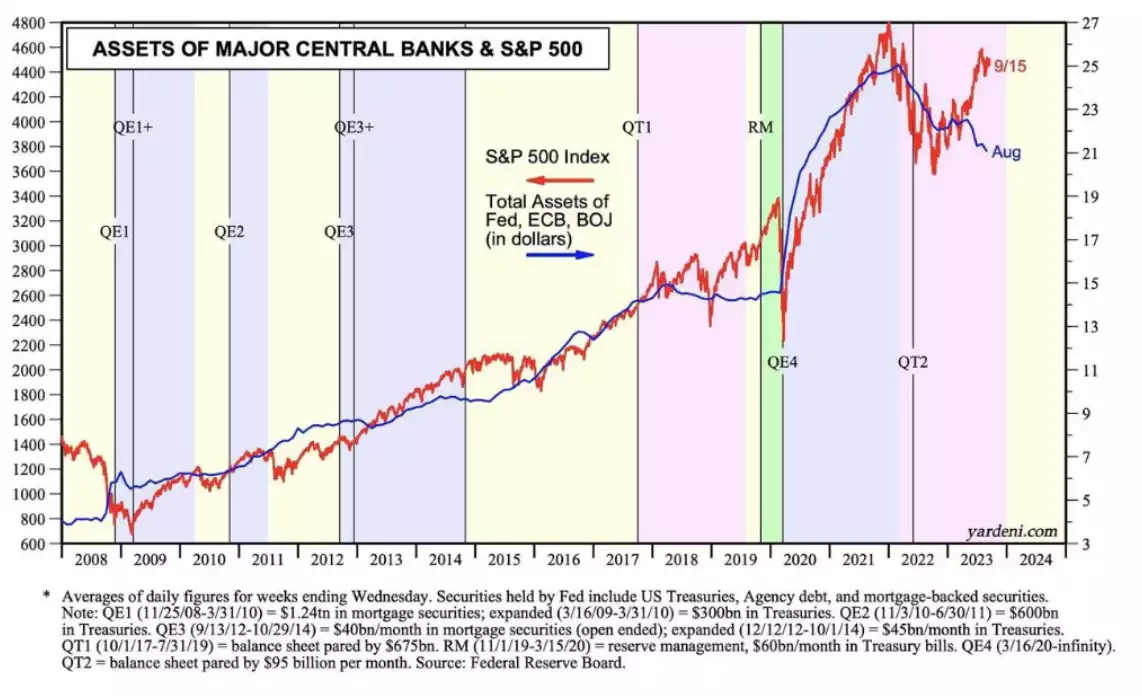

The Fed may be "uncertain", but they may have near-certainty. Why were they and other central banks recently unloading assets while other investors were buying up the S&P 500 as if we are in a bull run?

If one needs any more evidence about the Fed's level of certainty in market movements, they can look to recent history. The New York Times and other large publications covered the fact that Fed officials were performing almost perfect trades before and after the 2020 crash.

They were able to buy at the bottom anticipating their own quantitative easing, and then hold through the incredible bull market rise. When the markets reached their highest peak, they sold for "ethics" purposes claiming that they should not be in the stock market. The Fed had to address this publicly as it caused a media frenzy, however it does reveal that actions speak louder than words. The Fed has detailed insight and control over markets. In the current situation, one can clearly see the divergence between the S&P 500 and major central banks.

The money supply, although having a slight jitter recently, has also not strayed from its descending trendline. It has continued to curve downward while markets have run red-hot with excited buyers (until the penny dropped this morning). Most Fed statements can seem purposefully vague and very diplomatic, but If you want to know what central banks are doing, checking the money supply and what they are doing with their money could prove helpful.

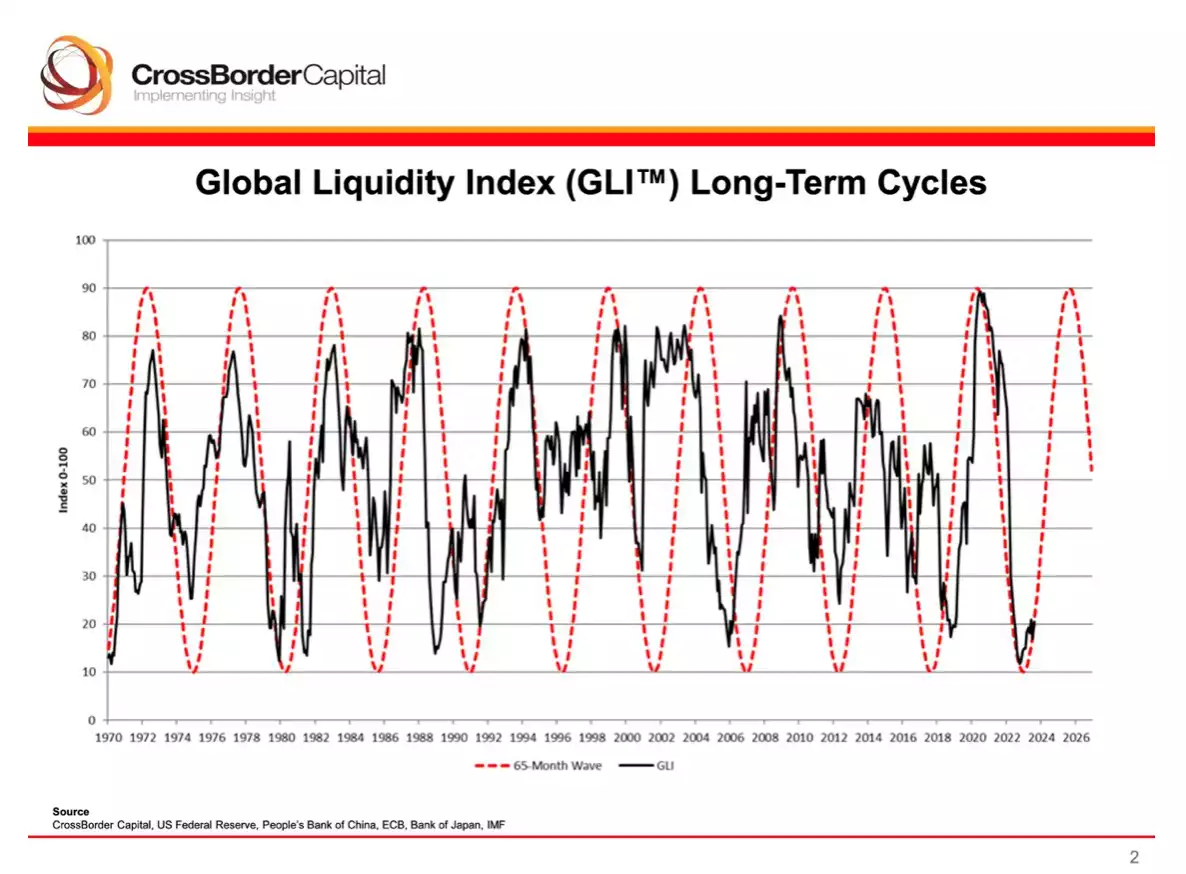

But here is the trap. M2 is a small part of the global liquidity picture. If you zoom out and look at all the money flow globally, we are still looking clearly at having passed the low set in late 2022 (when both gold and bitcoin bottomed). To be fair we are still bouncing out of that low, and yes we’ve just seen a small pull back in liquidity, but global liquidity is broadly on the rise and looking like the next long term cycle of increasing liquidity is in play.

Nothing tracks this better than gold and bitcoin as this is ultimately monetary inflation and they are the perfect monetary inflation hedge. The Fed need to talk up tighter for longer to try and get consumer inflation under control, and maybe, just maybe to tank the S&P500 so they can buy more knowing they are simultaneously warming up their money printers! Maybe too they need to hike again to break the sharemarket, send shudders through our now grotesquely financialised economy, and THEN have the justification to ease rates and start QE. They arguably have to now, but can’t sell that with low unemployment and sticky inflation. They NEED to crash the market.

In a world of record high debt they have little to no choice but to ease and ease big time soon as the economy can’t afford the interest at these high rates. If you want the perfect explanation of all of these factors look no further than watching this 20 minute video by our own Chief Economist, Chris Tipper. It is, in our opinion, a must watch.