Central Banks Bankrupt

News

|

Posted 13/01/2023

|

12306

Its reporting season for Central Banks, and it doesn’t look pretty. 2022 was one of the worst years for the 60/40 stock bond portfolio strategy on record. For Central Banks propping up both asset classes, the losses have been catastrophic.

It was a year to forget for bond holders in particular, with rates ramping up worldwide, the effects reverberated across sovereign, high grade and junk bonds. 2022 being the worst year recorded by a wide range of metrics globally. For example, the iShares 20+ year Treasury Bond ETF cratered by 31.4% in the calendar year.

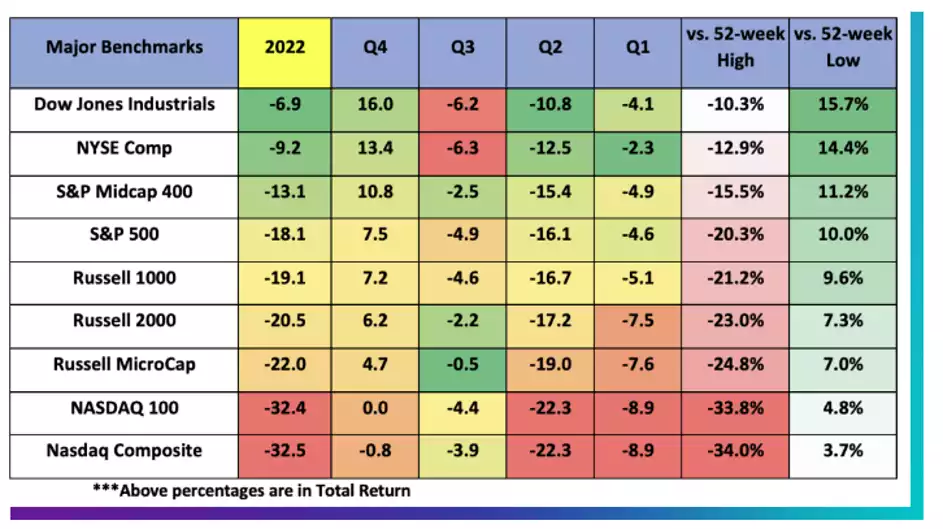

Stocks didn’t do much better, with major indices down: NASDAQ (32.4%), Russell 2000 (-20.5%) and S&P 500 (18.1%). Internationally the Nikkei was down 9%, Euro Stoxx down 13% and the ASX 200 down 3.2%. Are things looking better in 2023? On Wednesday we covered how every major multilateral institution and mega hedge fund are slashing expectations.

Sweden’s Central Bank, the Riksbank, expects to report a loss of 81 billion Swedish crowns (US$7.72 billion) yesterday. "The unrealised loss is mainly due to globally rising market interest rates, which has reduced the market value of the Riksbank's assets," it said in a statement.

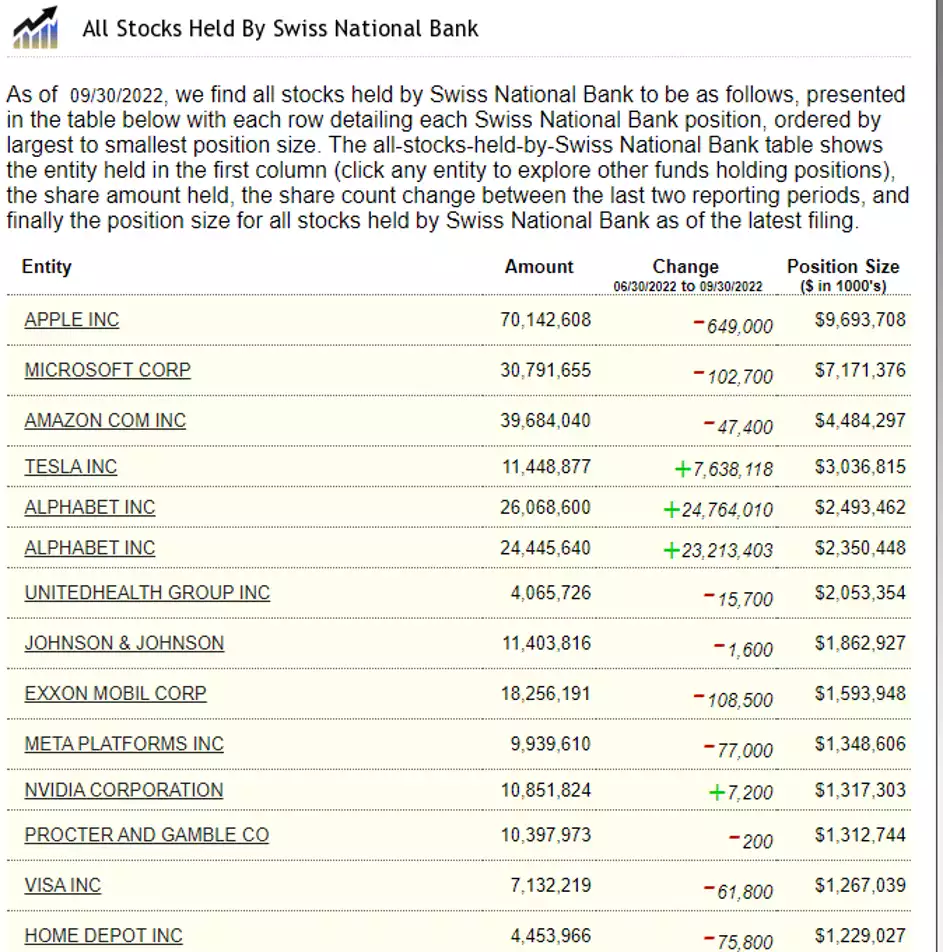

Earlier this week the Swiss Central Bank made waves with their own reporting. On Monday they posted a 2022 loss of 132 billion Swiss francs ($142.2 billion). The Swiss Central bank is famous for having large holdings in individual stocks on the New York Stock Exchange (NYSE). They have the who’s who of US tech stocks.

The 2022 loss represents the biggest in its 115-year history. The pain came from a falling stock and bond markets. As they have significant holdings in US denominated stocks, the strengthening of the Swiss Franc also affected their results.

Not to be out done, in September, Australia’s own Reserve Bank of Australia reported a 2021-22 loss of AU$36.7 billion (US$25.5 billion). At the time, the bank’s deputy governor, Michele Bullock revealed that the Reserve Bank’s accumulated profits could only absorb part of the losses, and that the central bank now has negative equity of 12.4 billion. Fortunately, the government is able to provide a guarantee, and they can print money to meet their obligations. Looks like the tax-payer is riding in to save the day for banking elites again.