Central Banks Are Buying Gold to Protect Themselves

News

|

Posted 25/01/2023

|

12172

Central Banks Are Buying Gold to Protect Themselves

According to the World Gold Council, Central bank gold purchasing throughout 2022 reached a new level not seen since 1967. While the reasons behind this can often be multi-faceted, one of the most likely causes is to increase their reserves and lower their risk profile, which of course has only become a concern thanks to record rates of financial loss that Central Banks have experienced as a direct consequence of their own extensive global quantitative easing programs we saw in early 2020.

Prior to 2020, Central banks had operated at net outflows of gold i.e they were selling more than they were purchasing. However, the past 3 years we have seen the tide significantly turn, as in the third quarter of last year alone we saw banks buy over 400 metric tonnes per month on average.

As we discussed last week, for countries such as China, which are strategically motivated to weaken the US dollar, it might make sense to become significant net purchases of gold. However, for most western nations this is not the case, as record rates of gold buying came only on the heels of record rates of Central Bank financial ruin. For example, last financial year we saw The Federal Reserve and Bank of England lose $$720 billion and $200 billion respectively.

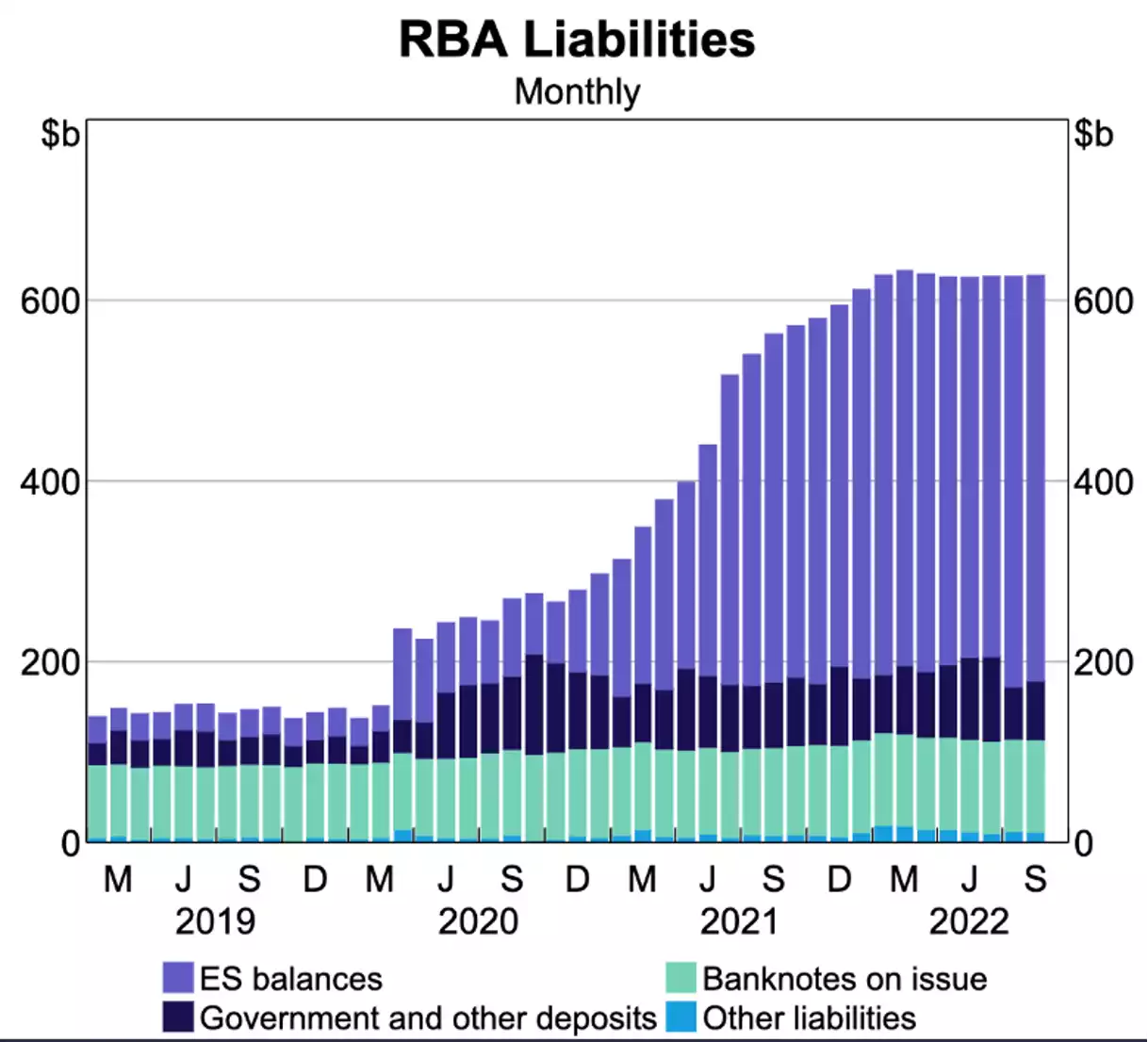

Here in Australia, we were not immune either, as our destructive monetary policy set during the pandemic has caught up to the RBA relatively quickly. The once profitable government bonds bought during 2020-2021 to stimulate the economy quickly turned into enormous liabilities once inflation inevitably skyrocketed and the large interest rate hikes ensued.

After accounting for years of profit and reserves, the RBA would still be left with $12.4 billion in negative equity. Obviously, if the Reserve Bank of Australia was a private business, and not merely an arm of government policy, they would be bankrupt.

Thus, in order to save themselves from the erosion of purchasing power that they themselves have created, Central Banks have ben forced into buying gold. Purchasing European or US sovereign bonds does not lower their risk profile, as in the event inflation stays high, they are still exposed to a 4%-5% in annual loss. Precious metals however can achieve this, and while they have made plenty of mistakes in recent times, Central Banks are smart enough to know it is one of their few hopes left.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************