Central Bank Gold Holdings Survey 2021

News

|

Posted 09/06/2021

|

13109

One of the key determinants in establishing gold’s unwaivable value is the fact that so much of it is held as a reserve asset by most of the world’s central banks. People hence often refer to central banks’ underwriting the value of gold. Afterall they own around 35,400 tonne of the estimated total of 180,000 tonne ever produced.

We’ve often shared the incredibly insightful chart that shows central banks gradually but continually selling off gold since the end of the gold standard in 1971 only to reverse after the GFC from which they have increased holdings every single year, and in no short order. The GFC was the first wake up call that the great credit cycle that started in 1971 was coming to a messy end, as all great credit cycles do. Human hubris and greed mean a Fiat currency system based on credit and the promise of government will always fail. We, and more particularly our popularly elected leaders, simply cannot help ourselves. Central banks, ironically, know that (gradually, despite that hubris) and hence own the pre-eminent asset to protect them for the inevitable end.

The World Gold Council survey these central banks every year. Their paragraph summary says:

“Central banks continue to be positive on gold, with roughly the same number of central banks expected to buy gold compared to last year. According to the 2021 Central Bank Gold Reserves (CBGR) survey, 21% of central banks intend to increase their gold reserves over the next 12 months. Central banks are also increasingly valuing gold’s performance during periods of crisis as this attribute now tops their rationale for holding gold. These results come amidst ongoing uncertainty stemming from the COVID-19 pandemic, a situation which has added significant complexity to central bank reserve management.”

The following charts illustrate their collective motivations and intentions.

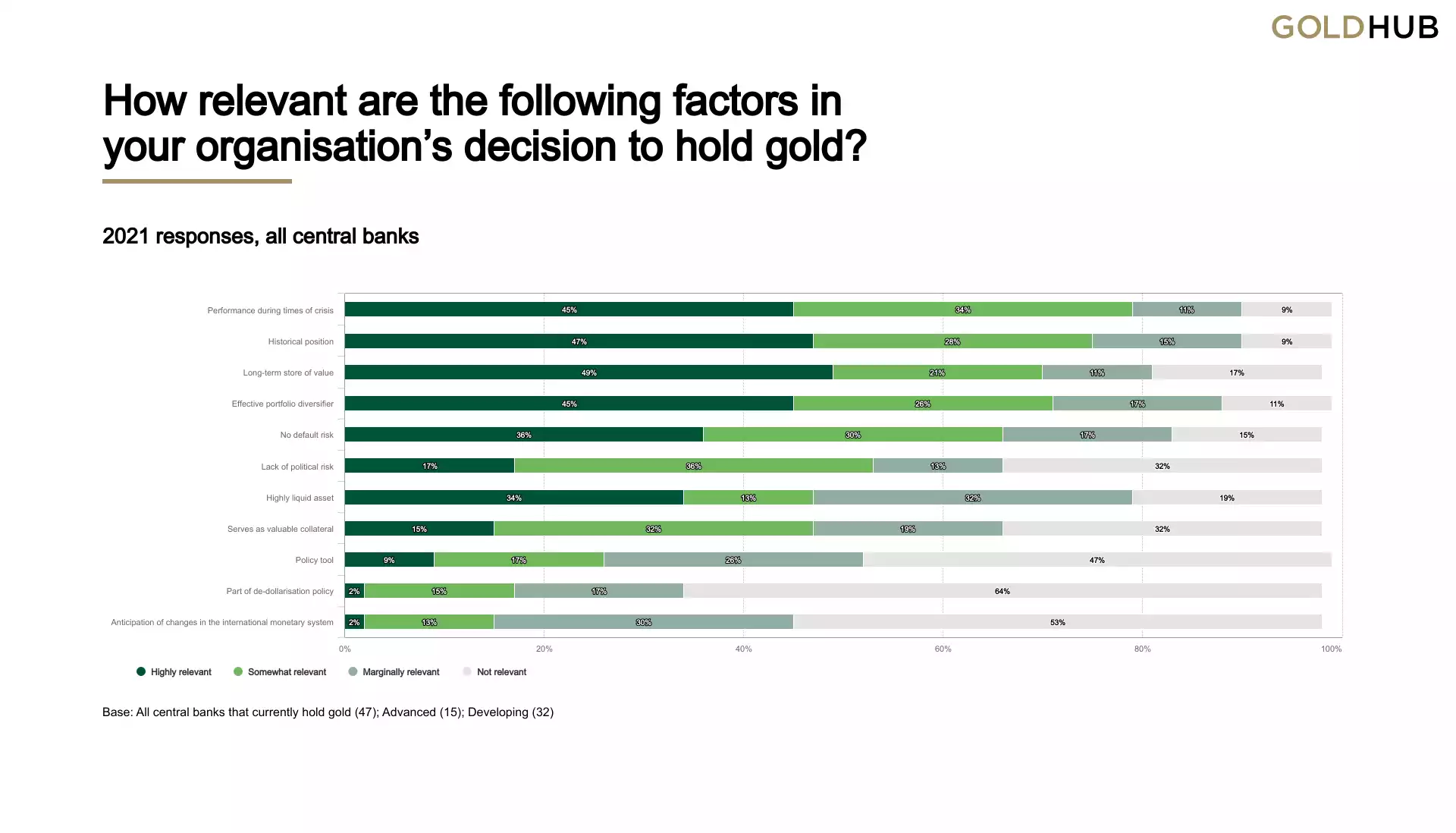

- How relevant are the following factors in your organisation's decision

Responses to this question showed a significant change from the previous surveys, perhaps indicating a growing recognition of gold’s performance during periods of market stress after a year of instability stemming from the pandemic.

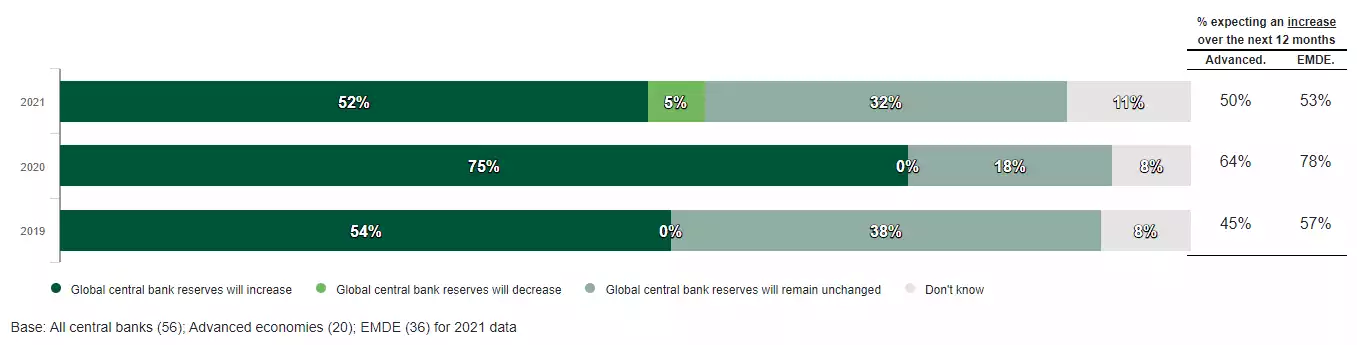

- How do you expect global central bank gold reserves to change over the next 12 months?

The majority of respondents believe that central banks will add more gold over the next 12 months, with 52% saying that global central bank gold reserves will increase. However, this is a decrease from last year when 75% of respondents felt that central banks would add more gold in the next 12 months. [EMDE – Emerging Markets and Developing Economies]

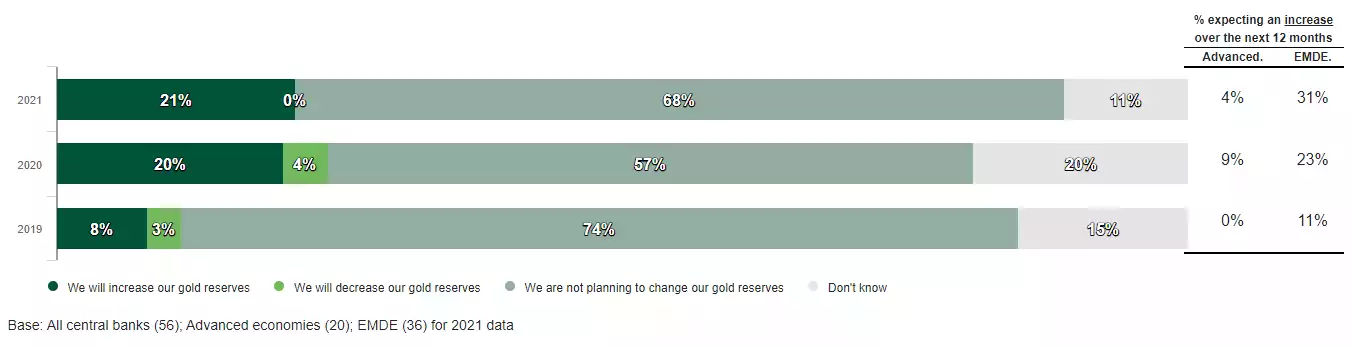

- How do you expect your institution’s gold reserves to change over the next 12 months?

The number of respondents who will increase their own gold holdings has climbed to 21%, compared to 20% last year. No central bank is planning to decrease its gold reserves, a decline from 4% in last year’s survey.

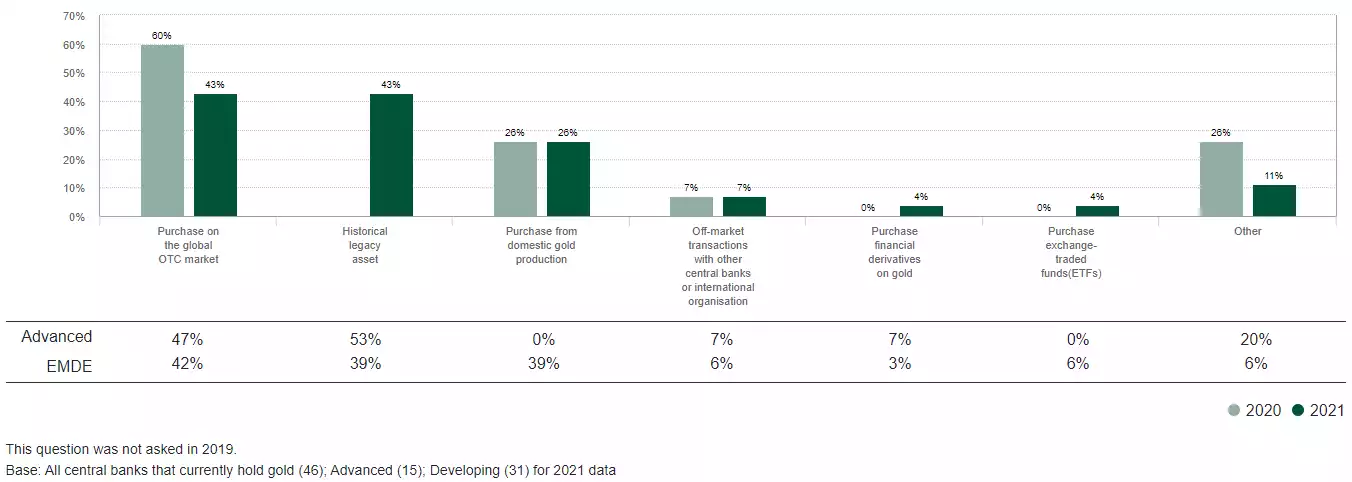

- How do you purchase gold?

Buying gold on the international OTC market continues to be the most common form of central bank purchase, although the figure has fallen to 43% from 60% last year. [note the predominance of EMDE’s using their own mine supply. This gels with the likes of China and Russia doing so]

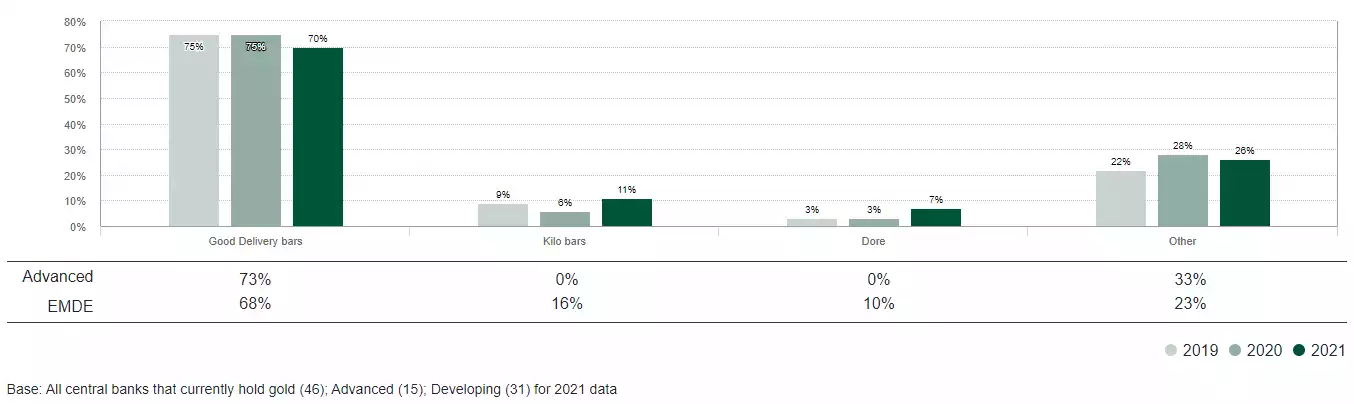

- In what form do you purchase gold?

Good Delivery bars continue to be the mainstay of central bank gold purchases. Kilo bars and doré comprise far less popular amongst central banks, although their proportion has risen slightly compared to previous years.

The trend is still firmly in place this year. We presented the Q1 demand trends report in April here. That showed central bank reserves grew by 95 tonne in the first 3 months of this year. The preliminary figures for April were a healthy 69.4 tonne in that month alone. The only decreases of note were Russia and Germany but both withdrew to convert to minted coins.

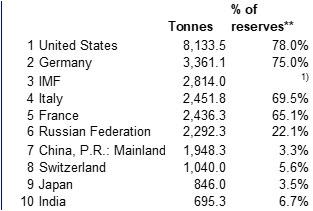

And finally, here are the top 10 holders. Sadly our government sold off most of ours and don’t even hold it onshore. Our 41st placed holding of just 79.9 tonne is held in London and represents just 9.4% of our total reserves.

Interestingly Australia is not alone storing its gold in London. From the report:

“The Bank of England continues to be the most popular storage location, with 63% of respondents vaulting there. This marks a significant increase from last year and may indicate growing importance attached to keeping gold in liquid trading centres. Domestic storage has also grown to 39% of respondents, also higher than previous years.”

As these very same central banks rampantly debase the Fiat currency they are printing hand over fist and making available through fractional reserve banking at near zero rates, it is very telling to know they see gold as a necessary asset to hold.