Carry On? USD Rocketed Up

News

|

Posted 16/08/2024

|

1388

Last night a stack of U.S. data releases happened. Interestingly, good news was again seen as good news and the U.S. stock market and currency took off upward. The U.S. Dollar disagreed, however. We now have two competing narratives based on assumptions.

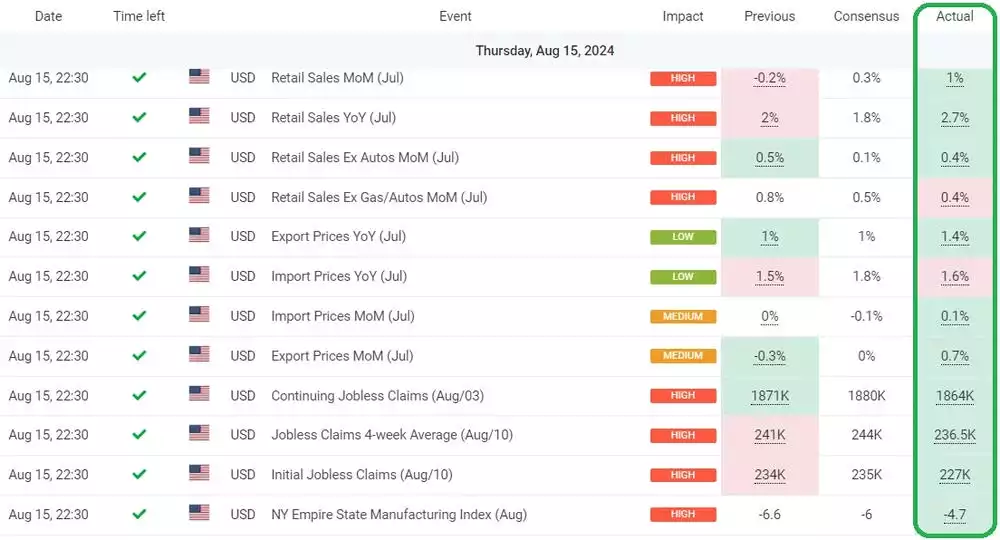

The calendar item that garnered the biggest response was the July retail sales report. As you can see below, there was a surprise 1.0% increase, compared to the 0.3% consensus that analysts had predicted.

-myfxbook

This chart shows the U.S. Dollar's Rise against Japanese Yen in the 30 minutes after the announcement:

This aggressive rise lifted USD/JPY to its major trend line on the following weekly candle chart. Watch out for a break back above or rejection back down to help gauge future USD strength.

Traders returned to carry trades after the data was released. Specifically, the USD/JPY currency pair saw a resurgence.

Jobless claims came in lower than expected by 8,000 claims. This indicates fewer people are seeking unemployment benefits, which is what one wants to see in a strong economy. Empire State Manufacturing Index slightly outperformed expectations, while the Philadelphia Fed Index fell short.

The markets are eating up the good news, but what about rate cuts? The reaction from the U.S. Dollar seemed to be a response to potentially delayed or reduced cuts. The prospect of less money needing to be created caused investors to come back into USD.

The stock market reaction was the opposite, however. New Zealand had a surprise cut this week so are there more surprises to come next month, such as with the USA? Although a 50-basis point cut may be off the table, it appears that a cut may be approaching in September, as reported earlier. This could be one of the reasons that these data releases are starting to have normalised reactions in the stock market rather than the good news = bad news mindset traders have been stuck in. As the degree of speculation on monetary policy shrinks, the financial markets can react to news more traditionally.

One potential worst-case scenario from this recent news would be if the Fed did not want to cut for some reason. This positive data would give them a perfect reason not to, even when some analysts have voiced concerns, they think it's already too late to avert a crisis. In this scenario, the stock market rally happening now could turn out to be misguided.