Calm Before the Insolvency Storm

News

|

Posted 09/09/2020

|

13575

Raoul Pal’s “The Unfolding” thesis continues to play out. As we outlined, his thesis plays out in 3 phases. First is the Liquidation phase we saw in February and March, then the Hope phase that has played out in the (until the last 3 nights) sharemarket bull trap rally, and next comes the Insolvency phase.

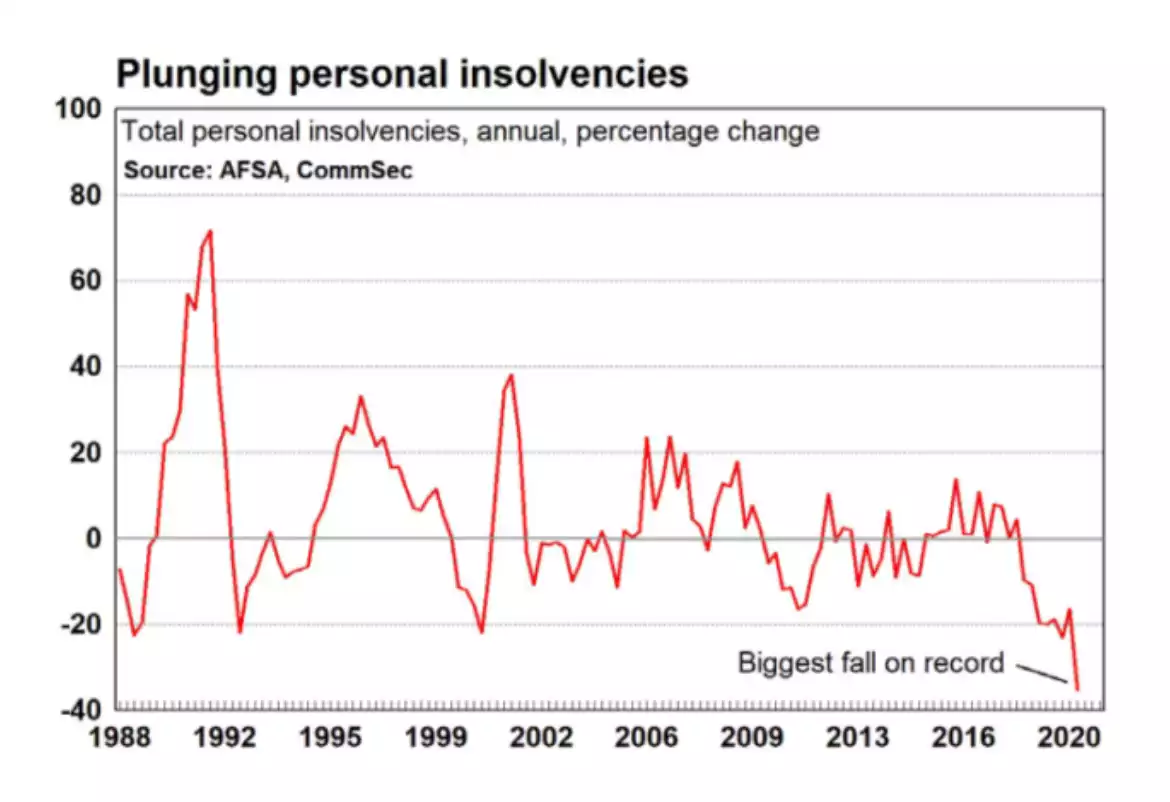

As he points out, no amount of monetary stimulus can prevent the insolvency phase as it is about income and cash flow, not jawboning from the central bank. In Australia that has been delayed but purely through ASIC changing or relaxing the rules around what defines being bankrupt and the government giving relief through jobkeeper, cashboost, debt repayment deferral etc. In fact the irony is that here, during the worst recession in a lifetime, personal and business insolvencies are rock bottom. From MacroBusiness:

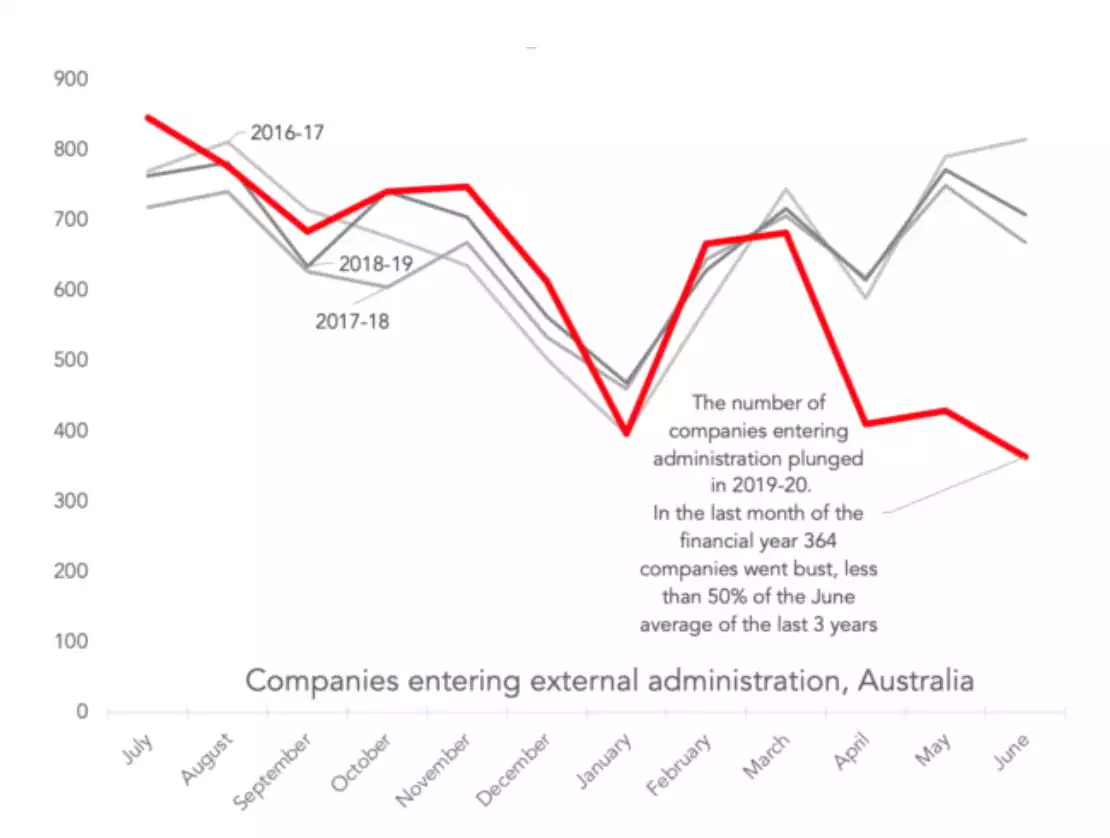

Whereas the number of companies entering administration also plunged to less than 50% of ‘normal’ levels:

From the Sydney Morning Herald:

“The shielding of businesses, including billions of dollars in government stimulus and wage subsidy spending, has resulted in a dramatic drop in insolvencies on CreditorWatch data.

While some employers that have been protected will recover, CreditorWatch chief executive Patrick Coghlan warned there were about 2500 businesses that were no longer viable being kept afloat by the rules.

“And that’s before taking into account we’re in the worst recession in 90 years,” Mr Coghlan said.

Under the insolvency law changes, creditors are unable to issue statutory demands or bankruptcy notices unless the debt totals $20,000 or more, up from $2000 and $5000 respectively. Directors are also protected from personal liability under insolvent trading rules if debts are incurred, except where they break the law.

“Ultimately, all these businesses need to go into administration plus those that have been severely affected by the coronavirus,” he said…”

MacroBusiness goes on:

“Clearly, Australians are living in an artificial bubble right now and insolvencies are likely to surge once:

- Emergency income support is unwound from October;

- Mortgage and rent repayment holidays are unwound over a similar timeframe; and

- Australians can no longer withdraw their superannuation early (or have exhausted their funds), with the expiry date on early withdrawals set at 31 December 2020.

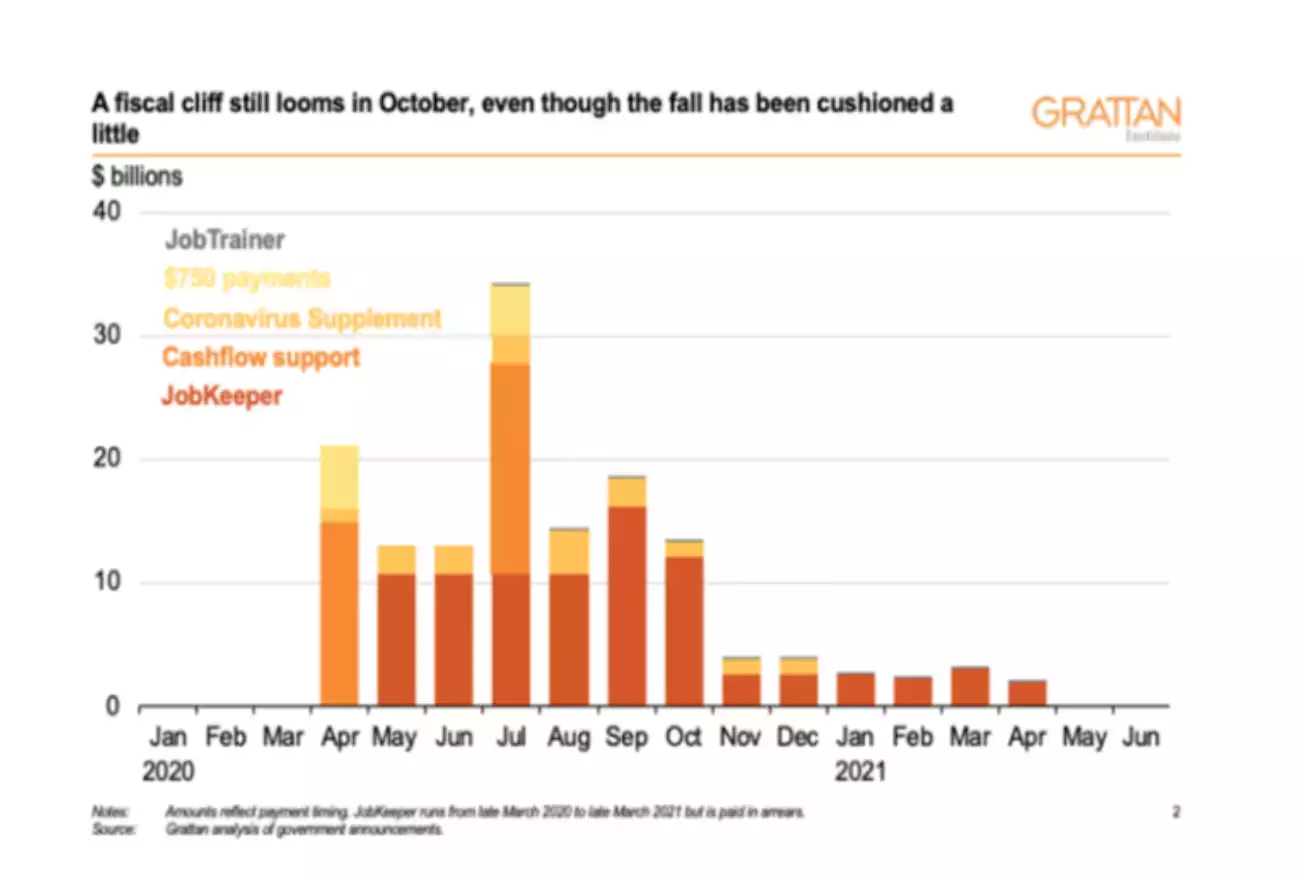

On the first point, the Grattan Institute estimates that income support will fall from $18 billion a month (10.7% of monthly GDP) to $3 billion a month (1.9% of GDP) for the six months beyond:”

“In turn, insolvencies will balloon once temporary safe harbour rules for companies expire.

Last month, [ABC Chief Economist] Alan Kohler noted that:

“Insolvencies caused from the GFC peaked in 2012, four years later. And that’s what always happens. The average time between a business going insolvent and admitting it is 18 months…

“There’s gonna be a long, catastrophic wave of insolvencies that will lead to higher unemployment and pressure on the banks”.

In other words, this is the calm before the insolvency storm. The Morrison Government can delay, but not prevent, the economic pain.”

The Insolvency phase appears locked and loaded. Only time will tell whether the rout again last night on Wall St (NASDAQ -4.1% and S&P500 -2.8%) will be the end of this Hope rally before the long leg down we wrote about on Monday. That article reported a well proven algorithm that predicted we are 100% due for that now. Any dispassionate look at the US sharemarket must tell you we were just witnessing the usual ‘blow off’ stage of such a bubble. Companies like Tesla priced at over 1,000 earnings, institutional and ‘insider’ money exiting whilst retail crowded in, and ALL valuation metrics at all time highs is screaming a warning those same mums & dads and Robinhooders, that always come in to take the bag at the end, ignore.

Whilst this phase will likely be deflationary when ‘the crowd’ is worried about inflation, the setup is still very bullish for gold where it’s proven safe haven role as a hard asset without counterparty risk further bolstered within an ultra low interest rate environment will come to the fore. There will be a lot of money looking for safety all of a sudden. That is usually gold and bonds but there are a growing number worried about entering bonds when rates are already near zero.

A vaccine does not miraculously change what is already largely baked in and not what was already weak before the virus even pricked the bubble. IF one becomes available it might fix your health but it will take a very long time to fix the economy.