CPI Market Surge – Sticky or Transitory?

News

|

Posted 11/08/2022

|

12564

Last night’s US CPI print came in at a softer than expected 8.5% (8.7% expected), down from that 40 year high 9.1% last month. The market’s reaction was strong, with shares, crypto and gold surging and the USD tanking and maybe best captured by the following meme..

Looking for any signal for a Fed pivot, the market odds for a 0.75% hike in September dropped from 80% to 30%, with 0.5% the favoured outcome now. For context that would still see the Fed funds rate at 2.25% amid over $30 trillion US debt, inflation at over 4 times the target rate, and an economy already in recession. As we discussed in yesterday’s Gold Silver Standard Insights, that is a very difficult position the world’s leading economy finds itself in. But hey, lets pile into shares!

Looking briefly under the hood (break up below), we see that most of the improvement in the headline CPI print was energy and used cars with fuel prices coming down considerably in the US through a combination of government directive and falling oil prices. The critical ‘shelter’ component (rent) continued to rise. Core CPI (less food and energy) was steady at 5.9%.

What remains concerning too, just as here in Australia, is that real wages are getting worse and worse. The US just printed its 16th straight month of real average weekly earnings declining, backwards at nearly 4%. Combine that with the nasty chart we shared on Monday and discussed in that days’ Gold Silver Standard Insights, showing surging credit card debt and falling savings, and you can see where this is heading at the personal level, in combination with the servicing of that record $30.6 trillion debt pile at the sovereign level.

The talking heads at the Fed were very quick out of the block to water down any notion of this meaning they will stop hiking in what is already the strongest tightening cycle in a very long time, if ever. They lead with their most historically dovish member with a decidedly hawkish message. From Bloomberg:

“Minneapolis Fed President Neel Kashkari, who prior to the pandemic was the central bank’s most dovish policy maker, said Wednesday that he wants the Fed’s benchmark interest rate at 3.9% by the end of this year and at 4.4% by the end of 2023.

“I haven’t seen anything that changes that,” Kashkari said, responding to a question about a Labor Department report published earlier that showed consumer prices rose 8.5% from a year earlier in July. The print was slightly less than the 9.1% increase in the prior month that marked the highest inflation rate in four decades.

His Chicago counterpart, Charles Evans, welcomed the news at a separate event Wednesday, but added that inflation remains “unacceptably high.” He said he expects “that we will be increasing rates the rest of this year and into next year to make sure inflation gets back to our 2% objective.””

Cynics might call this jawboning, some wilful reckless blindness, some necessary pain to fight the inflationary pressures the inevitable result of 15 years of reckless loose monetary expansion well beyond any ‘supply side issues’. There are compelling arguments for all. What is hard to ignore is that they are and will keep hiking at some level (whether less than expected or not) into a fundamentally weak economy. Macro Insider’s Julian Brigden, an old and respected advisor to many funds, thinks we are heading to an exceedingly bad recession. On the comments last night:

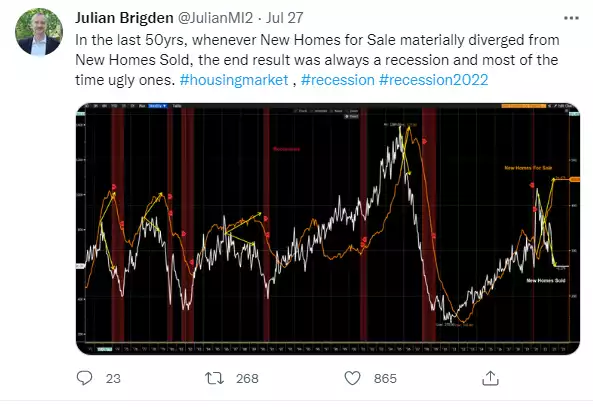

And in light of the shelter component still rising, this too is likely to see downward pressure amid the combination of crashing house prices and a deep recession. He tweeted the following a couple of weeks ago:

The likelihood of the Fed aggressively continuing to hike into an economy in the early stages of what could be a very deep recession just appear to make the depth and severity of what’s coming even worse.

Beware the fake rally. Cover all bases.

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.