COVID-10 Pin Meets Everything Bubble

News

|

Posted 16/03/2020

|

24973

At the time of publishing this article, The US FED has announced a further 1% rate cut, as well as a 700B QE Program.

They say history doesn’t always repeat but it often rhymes. Whilst last week’s markets were the worst on record on a number of measures they also followed a well-worn script in others. Friday night’s nearly 10% rebound on Wall Street is certainly not without precedent. This is a market gagging to by the dip on anything resembling good news, even if that ‘good news’ is more of the same stimulus that got the bubble so big just as things were so fundamentally bad. So too gold and silver taking a hit as they were liquidated for USD and to buy that dip.

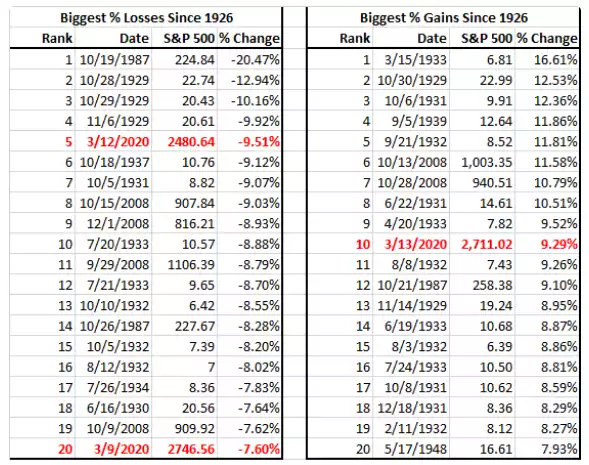

You will recall one of the all time records last week was the weekly jump in the VIX (volatility index) for a week…. ever. This market is whipsawing in panic. Jim Bianco of Bianco Research points this out mapping the top 20 biggest gains and losses since 1926. Last week saw 3 of the 5 days make that list.

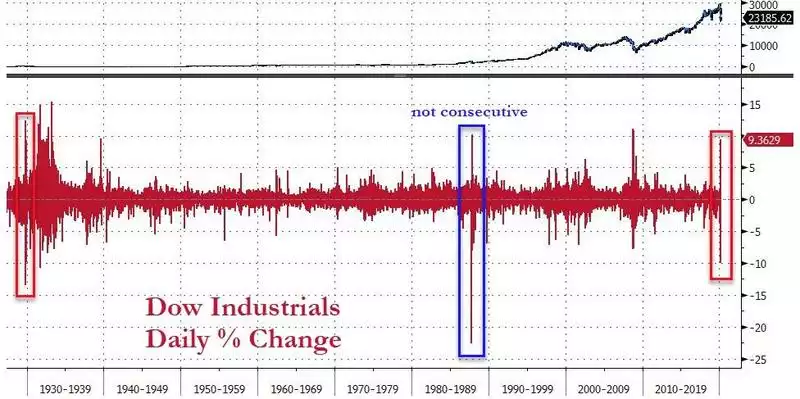

Have a look at how dominated the list is with the Great Depression, 1987 Crash and GFC. Welcome to Crash Club. Graphically that looks like this:

Or comparing now to the onset of the Great Depression:

Tonight when Wall Street opens again the futures market is currently predicting a 1000 point drop on opening. On opening this morning gold jumped almost $100 and silver 85c before retracing.

Goldman Sachs has revised their already weak 0% GDP prediction for Q2 to -5%, the biggest contraction since the GFC citing economic activity is “to contract sharply in the remainder of March and throughout April as virus fears lead consumers and businesses to continue to cut back on spending such as travel, entertainment, and restaurant meals. Emerging supply chain disruptions and the recent tightening in financial conditions will likely add to the growth hit.”

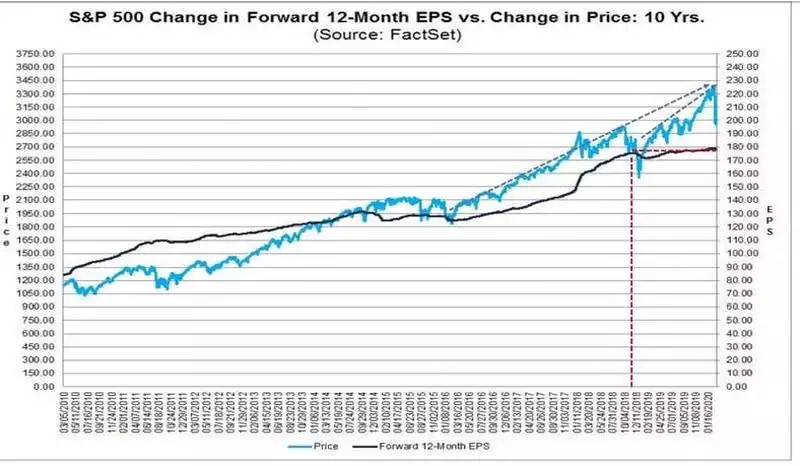

There is one school of thought that sharemarkets look a year ahead of a recession. But that certainly wasn’t the case in the GFC where we barely had a month’s warning:

The reality is though, that if you were actually looking at fundamentals, i.e. forward earnings, the writing has been on the wall for some time.

This has been a central bank inflated bubble looking for a pin. Coronavirus, whether short term or long term or whatever impact it has, is likely the pin that is/has popped that bubble. The market will gyrate as it reconciles this reality against messages of stimulus from central banks and realities of the types of GDP downgrades already playing out. The rush to the US dollar may be short lived as the stimulus of printing it hand over fist sees people rotating out of it into real, un-expandable money… gold.