Buy & Hold | “Time in the market” 10 years later

News

|

Posted 20/02/2020

|

18301

Yesterday we discussed the implications on your retirement savings of being largely in equities right now. Today we discuss the implications of the “buy and hold” or “time in the market beats timing the market” thesis. As Lance Roberts of Real Investment Advice rightly points out, that is too often a theory that goes out the window when things get hard and shouldn’t ignore relative value. In yesterday’s article he made the point that “Market downturns are a historical constant for the financial markets. Whether they are minor or major, the impacts go beyond just the price decline when it comes to investors.”

He subsequently addresses this today:

“It is the last sentence I want to focus on today, as it is one of the most important and overlooked consequences of market corrections as it relates to long-term investment goals.

There are a litany of articles touting the massive bull market advance from the 2009 lows, and that if investors had just held onto the portfolios during the 2008 decline, or better yet, bought the March 2009 low, you would have hit the “bull market jackpot.”

Unfortunately, a vast majority of investors sold out of the markets during the tail end of the financial crisis, and then compounded their financial problems by not reinvesting until years later. It is still not uncommon to find individuals who are still out of the market entirely, even after a decade long advance.”

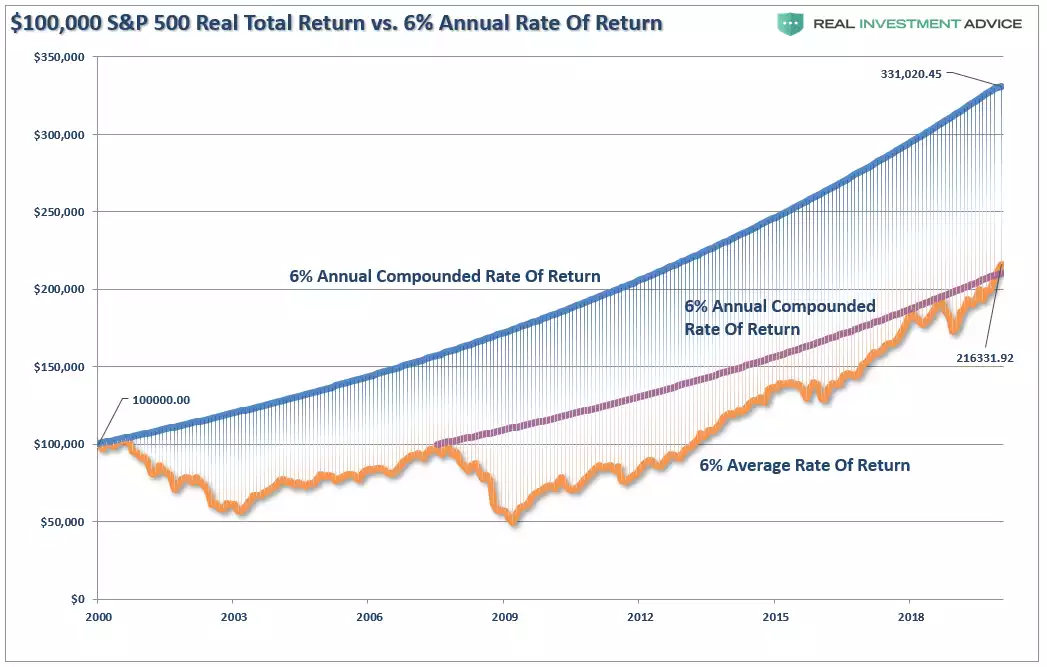

Many of the buy & hold proponents put forward analysis based on being all in at the peak of the market in 2007. The average return on that basis to now is 6.64%. That is close to the Wall Street ‘rule of thumb’ of expectations of an annual return of 6% in shares. Given the run since 2007 has been the longest in history that should not be a huge surprise. If you cast the net back to the previous high in 2000, your inflation adjusted annual return has been just 4%. When you overlay the S&P500 with a 6% return projection from both 2000 and 2007, you can see quite clearly below the comparison. If you take the start in 2000 you are well below that 6% target and if you started in 2007 you’ve just now broken even…

From Roberts:

“Unfortunately, there are few investors who actually saw market returns over the last 12-years. As noted, a vast majority of investors who were fully invested into the market in 2007, were out of the market by the end of 2008. After such a brutal beating, it took years before they returned to the markets. Their returns are vastly different than what the mainstream media claims.

While there is a case to be made for “buy and hold” investing during rising markets, the opposite is true in falling markets. The destruction of capital eventually pushes all investors into making critical investment mistakes, which impairs the ability to obtain long-term financial goals.

You may think you have the fortitude to ride it out. You probably don’t.

But even if you do, getting back to even isn’t really an investment strategy to reach your retirement goals.

Unfortunately, for many investors today who have now reached their financial goals, it may be worth revisiting what happened in 2000 and 2007. We are exceedingly in the current bull market, valuations are elevated, and there is a rising belief “this time is different.”

It may be worth analysing the risk you are taking today, and the cost it may have on “your tomorrow.””

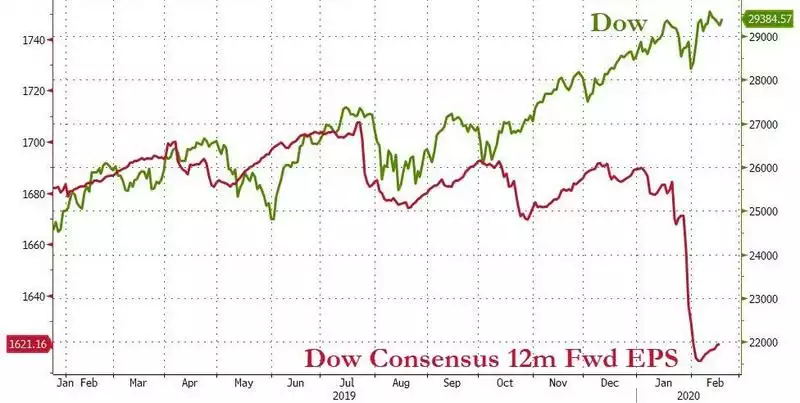

Now of course if you’d bought at the respective dips in 2003 and 2009 you’d be sitting much better. That’s not our point. The point is that there are many still piling into shares right now or maintaining a HOLD strategy in the belief that somehow “this time is different” when every chart before us is screaming 2000 and 2007. The “time in the market” thesis thus becomes highly questionable when you are so very clearly late in the cycle. Now to be clear we are not saying sell everything and go into gold and silver. Our trademark is “Balance your wealth in an unbalanced world”. It’s about diversification into uncorrelated assets, particularly when one asset class is looking so overvalued. (refer exhibit A below for instance)

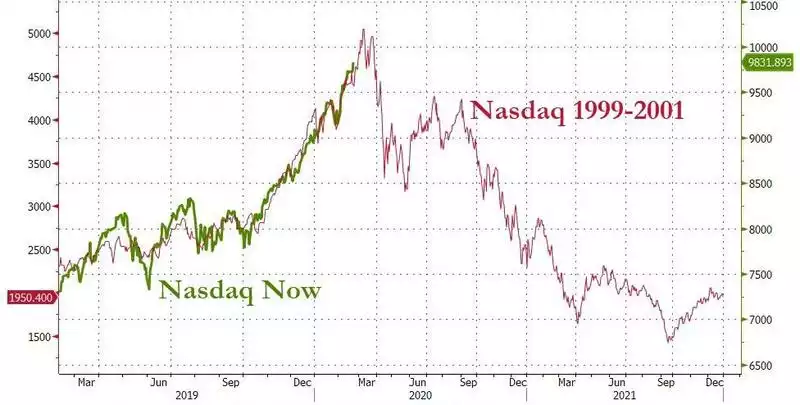

This sharemarket could continue to rally for some time. There is even potentially an element of ‘different this time’ given the roll central banks are playing in keeping ‘value’ out of the equation right now. But history, math, and economics 101 dictate this must end, and given how extended beyond norms it has become, end pretty badly. The scenarios were outlined yesterday but only to a 60% drop. We remind you the NASDAQ dropped 80% in the dot.com bubble. Topically here is a salient reminder of where we are now on that note:

Ken Solow is the CIO of Pinnacle Advisory Group and reminds us “The underlying theory of buy and hold investing denies that stocks are ever expensive, or inexpensive for that matter, investors are encouraged to always buy stocks, no matter what the value characteristics of the stock market happen to be at the time.”