Business Bankruptcies Booming

News

|

Posted 03/10/2023

|

1912

New data released by the American Bankruptcy Institute displays a worrying picture for small businesses and their ability to stay afloat in the current economic climate.

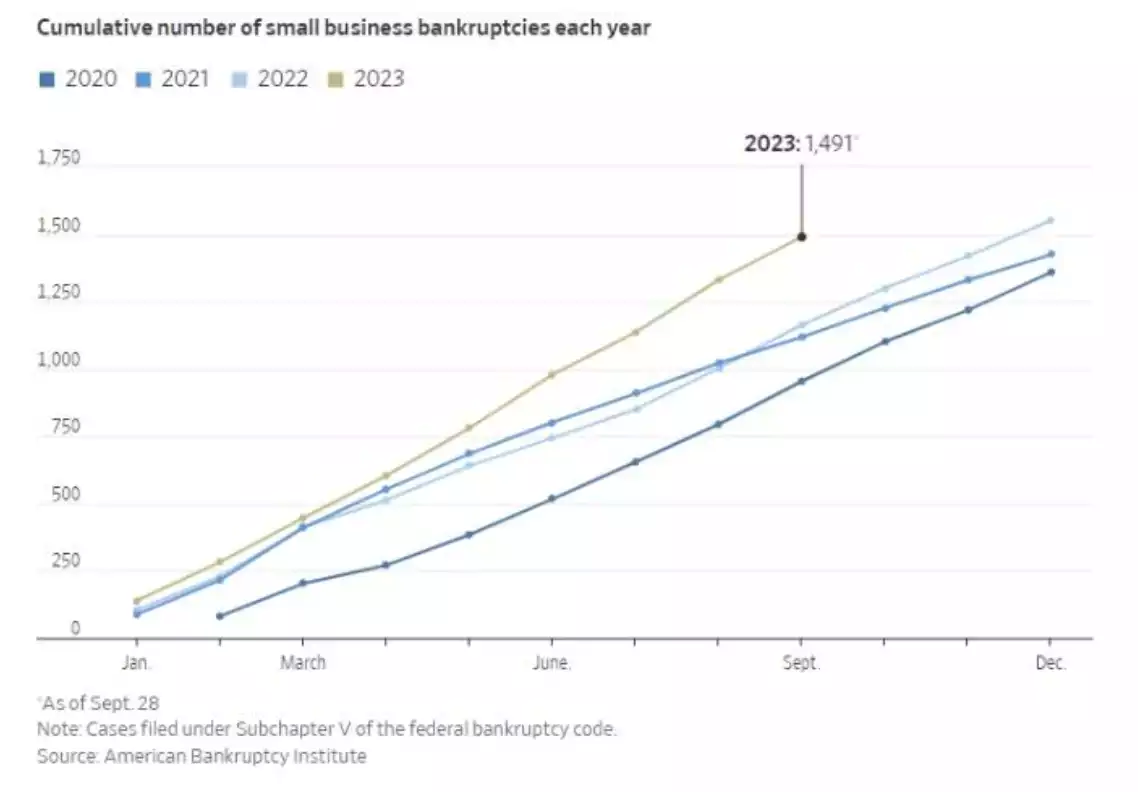

Small business bankruptcies are on the rise, with nearly 1,500 filing for Subchapter V bankruptcy by the end of September, a number already close to the total for the entire year of 2022, as per data from the American Bankruptcy Institute cited by The Wall Street Journal earlier this morning.

Equifax reports that small-business loan delinquencies and defaults have been increasing since June 2022, surpassing pre-pandemic levels. Confidence among small-business owners has also dipped slightly, with concerns about the economy growing.

A survey by Vistage Worldwide, a business coaching and peer-advisory firm, showed over 750 small businesses found that 52% of respondents believe the country is heading towards or is already in a recession.

Robert Gonzales, a bankruptcy attorney in Nashville, said he’s now getting four times as many calls as he did a year ago from small businesses considering a bankruptcy filing.

“We are just at the front end of the impact of these dramatically higher interest rates,” Gonzales said. “There are going to be plenty of small businesses that are overleveraged.”

Several factors are contributing to this surge in small business bankruptcies:

Rising Interest Rates: The Federal Reserve has raised interest rates to 5.25% to 5.50%, the highest level in 22 years, making borrowing more expensive for businesses. Moreover, the expectation of the continuation of these rate hikes only adds to the economic uncertainty and worsening of consumer/business sentiment.

Surging Wages: Minimum wages in the US have seen significant increases, with unions advocating for higher wages. The situation is compounded by factors like California's minimum wage for fast-food workers jumping by 30% to $20 per hour, which is expected to increase costs for restaurants and potentially lead to higher prices for consumers. This specific wage increase trend may extend to other states as well.

Tighter Bank Credit: As we have discussed previously, in the wake of Silicon Valley Bank’s epic collapse, smaller regional banks have reduced credit availability, partly due to overleveraging on interest rate bets.

Overleveraged: Many businesses have overextended themselves financially, and in the current interest rate environment face significantly more financial pressure as a result.

Work-at-Home Impact: The shift to remote work has curtailed demand for some businesses, affecting their revenue and viability.

The outlook for small business in the US is clearly bleak, with the data supporting that not only have many already filed for Subchapter V bankruptcy, but the trend is likely to continue for the foreseeable future given the assortment of qualitative factors mentioned above.