Bubble Trifecta

News

|

Posted 24/03/2015

|

5356

Financial analyst Bill Holter sums up the situation in his usual straight style below.

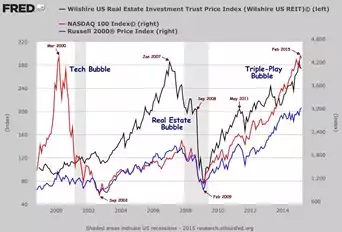

“After viewing the chart, do you see anything that it really is "different this time"? Yes, this time it is not just one sector in a bubble, we now have all sectors at once! This chart shows you real estate, the Russell 2000 and the hot biotech sector. We could of course overlay a chart of bonds (interest rates inverted) and even add in the dollar for a five bagger of bubbles. Globally it is the same story, real estate, stocks and bonds (with interest rates even negative) are all in bubbles. Needless to say, the falls from grace will be at least equal to if not far worse than previous falls. Why is this you ask? There is far more debt now than in 2007 entering recession. As for the U.S., there was no alternative to the dollar as a reserve currency, say what you will but the rest of the world has been working at break neck speed to change this monopoly.

The problem is, there are TOO MANY problems (bubbles) all at one time. We also have these bubbles at a very bad time so to speak. The Fed has already quintupled their balance sheet and the Treasury has now borrowed more than 100% of GDP ...AND, interest rates are ZERO! What tool or tools exactly are available to temper the fall? I guess another obvious question would be "who?". Who exactly has the ability to ride in on a white horse and use these nonexistent tools?”

QE4 anybody??