Borrowing from the Future

News

|

Posted 07/11/2019

|

16332

The fixation of central banks pumping markets to prevent an overdue correction simply leads to inflated assets and an effect of borrowing from the future to live large today.

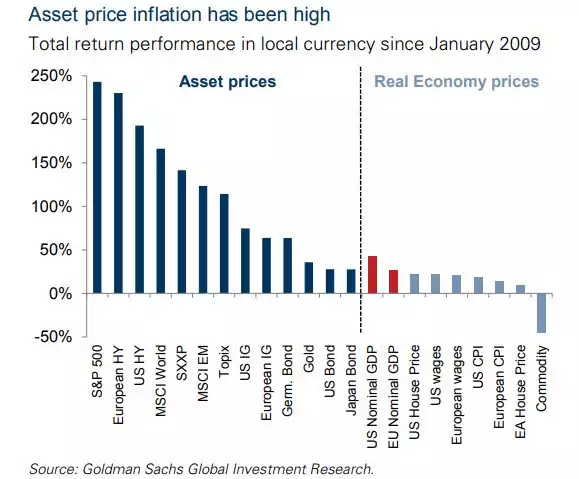

The Fed says current monetary policy is appropriate because inflation is contained near its 2% objective. This completely misses the fact that their monetary stimulus and ultra low interest rates have facilitated, through leverage, record setting inflation in financial assets benefitting the ‘top 10%’ who play in such spaces but leaving the rest behind.

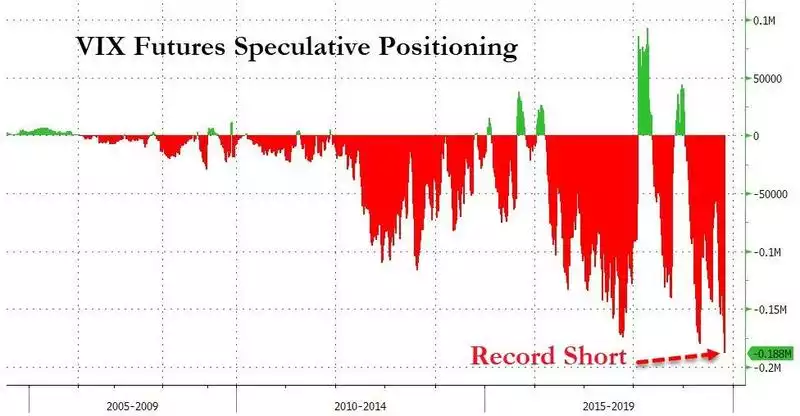

This constant support, the so called Fed Put, leads to ever increasing share prices and complacency in markets without anyone asking why that support is there in the first place. As you can see below we are again at a record short positioning for the VIX (volatility index) meaning bets are piled high on low volatility. Such positions have preceded each crash beforehand.

As stated earlier what seems to be missed by this crowd is WHY that support is there. Real Investment Advice yesterday noted:

“Which brings us to the ONE question everyone should be asking.

“If the markets are rising because of expectations of improving economic conditions and earnings, then why are Central Banks pumping liquidity like crazy?”

Despite the best of intentions, Central Bank interventions, while boosting asset prices may seem like a good idea in the short-term, in the long-term it harms economic growth. As such, it leads to the repetitive cycle of monetary policy.

- Using monetary policy to drag forward future consumption leaves a larger void in the future that must be continually refilled.

- Monetary policy does not create self-sustaining economic growth and therefore requires ever-larger amounts of monetary policy to maintain the same level of activity.

- The filling of the “gap” between fundamentals and reality leads to consumer contraction and ultimately, a recession as economic activity recedes.

- Job losses rise, wealth effect diminishes, and real wealth is destroyed.

- The middle-class shrinks further.

- Central banks act to provide more liquidity to offset recessionary drag and restart economic growth by dragging forward future consumption.

- Wash, Rinse, Repeat.

If you don’t believe me, here is the evidence.

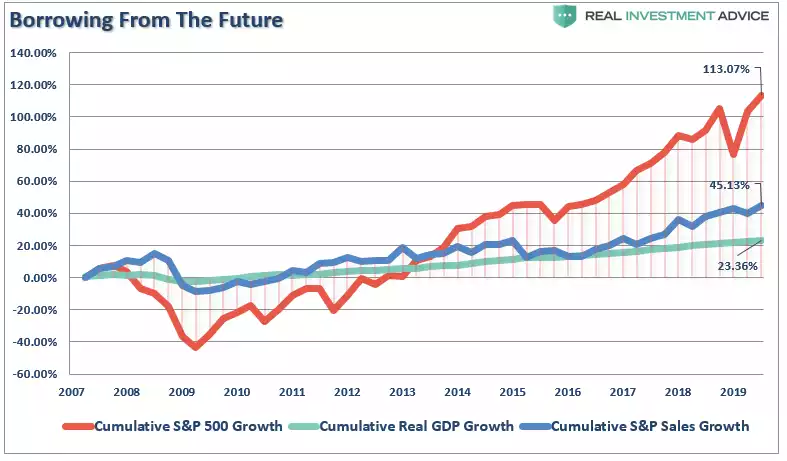

The stock market has returned more than 100% since the 2007 peak, which is more than 2.5x the growth in corporate sales and almost 5x more than GDP. The all-time highs in the stock market have been driven by the $4 trillion increase in the Fed’s balance sheet, hundreds of billions in stock buybacks, PE expansion, and ZIRP.”

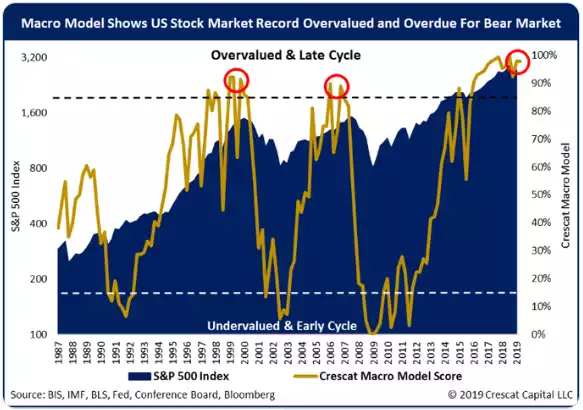

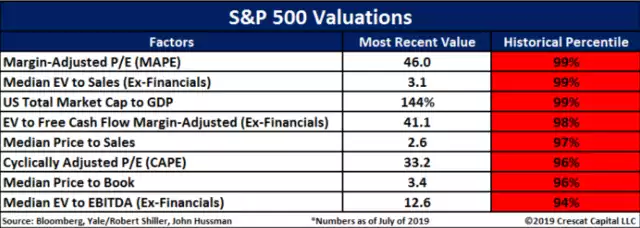

That red line is very clearly supported by ultra high valuations against fundamentals. Crescat map this below against a full range of valuation measures that collectively have us right now at the most overvalued on the S&P500 since their model began in 1987.

The more you pull forward from the future, fundamentally, the bigger the correction.

Ponzi schemes by their very architecture must fail. This market is no different.

Arguably we are watching this play out in Australian property right now. Since we lost manufacturing and in the throes of the drought we have been completely reliant on mining and our own property market. The pullback in house values has spooked the government, yet again, into action to prop it up again with first home buyer grants (again pulling forward from the future), jawboning and looser lending. Euphoria of rising property prices again needs to be considered very sceptically as a long term proposition.