Bonds Hint at Turbulence Ahead

News

|

Posted 18/02/2026

|

770

With the Nasdaq putting in 3 consecutive down days on increasing volume, while the US10Y yield rolls over – it appears investors are flocking to risk off this week.

Meanwhile with Truflation at a zero handle – an initially dismissed deflationary shock amid exponential AI advancements – appears to be becoming mainstream consensus among for stock investors.

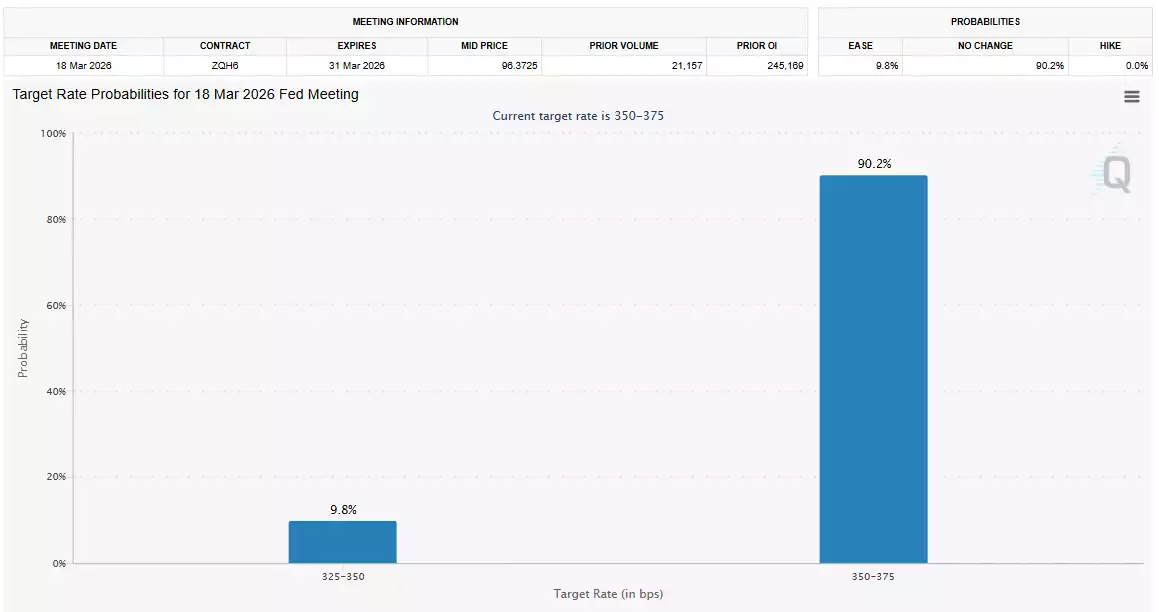

Even with inflation down and unemployment steadily trending up - the Fed is currently expected not to cut interest rates at their next meeting. However, with the US10Y rolling over – a continued downtrend would most likely result in rate cuts coming back onto the table.

With interest rate cuts - context is everything. Historically – cutting into normalisation (strong employment, low inflation) is bullish for most assets looking forward – however cutting into weak employment and recessionary economic indicators - tends to result in a stock market peak coming in a after the first 2-3 cuts, on average. Currently we are in the average timeframe for a stock market peak in an interest rate cutting cycle amid economic weakness.

Highly manipulated employment figures add no comfort to a bullish view looking forward into the next 6 months.

Cyclically speaking a major 4-year cycle low is expected to appear late this year for stocks and Bitcoin – with significant half cycle lows (2022-2030 macro cycle) for precious metals scheduled at the same time. With all these major cycle lows synced up later this year – expecting turbulent corrections in the months leading up to them is reasonable to expect.

While central bank QE feels like a distant memory – a deflationary shock would likely result in full blown QE being back on the table – which would be bearish for the US dollar and very bullish for hard assets like precious metals looking forward. This syncs up perfectly with an expected strong move out of the half cycle lows of 2026 – into the run up of the 8-year cycle peak for gold and silver late this decade.

While timing the turbulence of major markets can churn up even the most seasoned investors – taking a long term view for precious metals shows us plenty of runway ahead- with the best practice almost always being to simply dollar cost average in to hold for the long term. As we navigate the current 8-year cycle for gold and silver, leading into the next, pullbacks present as opportunities and patience serves to yield the strongest results.