Bond Yields and DXY Drop Amid Weak Jobs Report - Monetary Easing Anticipated

News

|

Posted 06/08/2025

|

1021

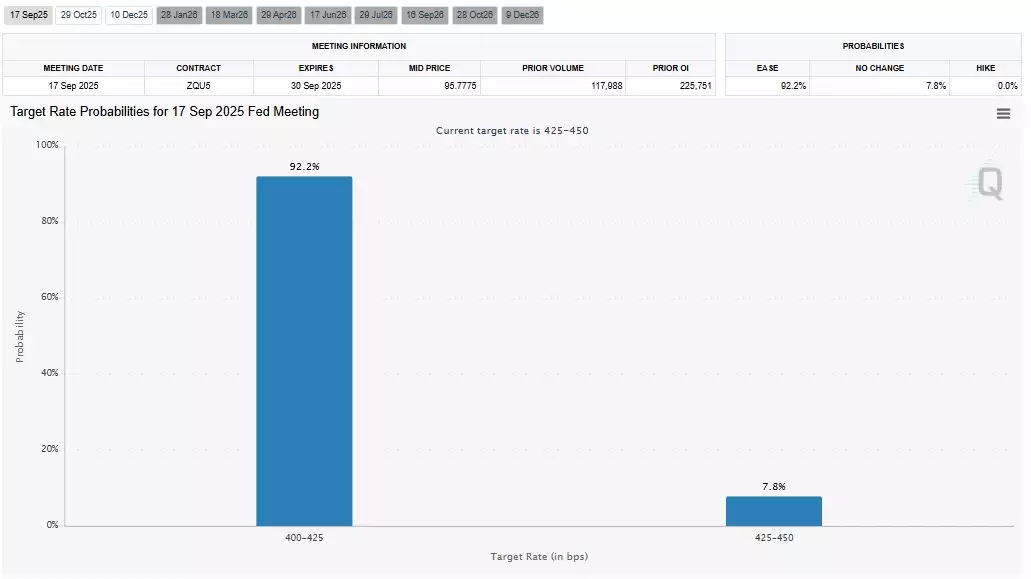

Markets are now pricing in strong expectations of a rate cut this September, following a weaker-than-expected US jobs report. This has prompted a notable pullback in both the DXY and US 10-year bond yields, signalling a boost in global liquidity. Rate cut probabilities have surged to 92.2%, up sharply from around 50% just a week earlier.

July’s jobs data showed only 73,000 jobs added—the weakest in five months—while nonfarm payrolls were revised down by 258,000. Adding to the market turbulence was Donald Trump’s abrupt firing of the Labour Statistics Commissioner in response.

The US 10-year yield dropped significantly, while the MOVE index (which measures bond market volatility) ticked higher. However, the broader downtrend in bond market volatility remains intact. While falling bond yields support liquidity by lifting the value of bond collateral, it’s sustained low volatility—as measured by the MOVE index—that would be key to maintaining this liquidity. Together, low yields and low volatility provide a strong tailwind for global markets.

The last time the US Fed attempted to cut rates—in August 2024—yields spiked, likely pricing in renewed inflation fears and reflecting scepticism around what some viewed as a politically motivated decision ahead of the US election.

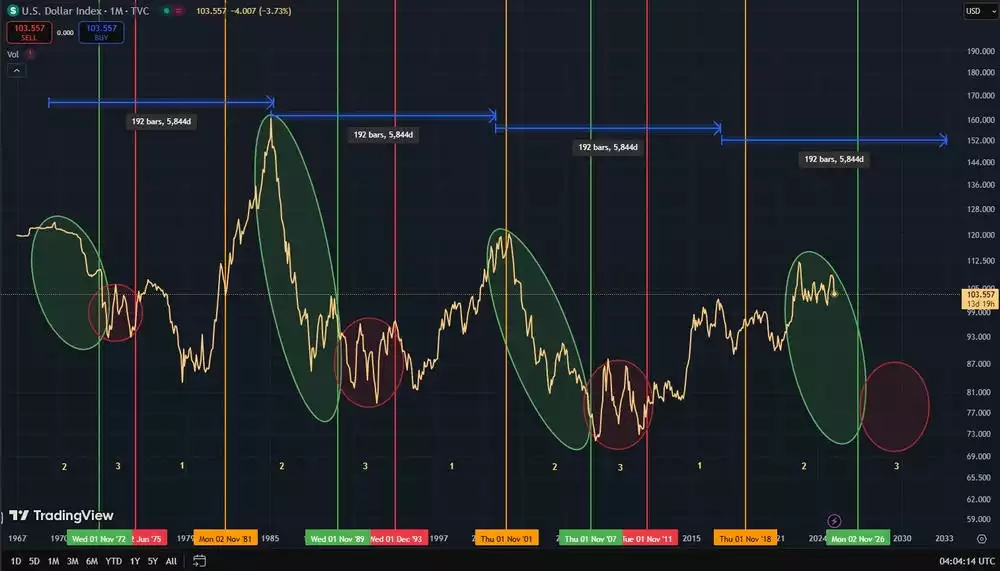

Meanwhile, the DXY has reversed lower following a brief counter-trend rally, and the broader downtrend is expected to continue through the final "blow-off" phase of the 18.6-year land cycle, highlighted below in green.

During this final phase—characterised by a falling DXY—markets generally rise together on the back of abundant liquidity. But this often brings with it over-leveraging and investor complacency, setting the stage for a broad-based financial correction. In the aftermath of such a crash, the DXY typically enters a sideways consolidation phase (red). While most markets

(property, equities) struggle to recover during this period, gold and silver tend to continue outperforming.

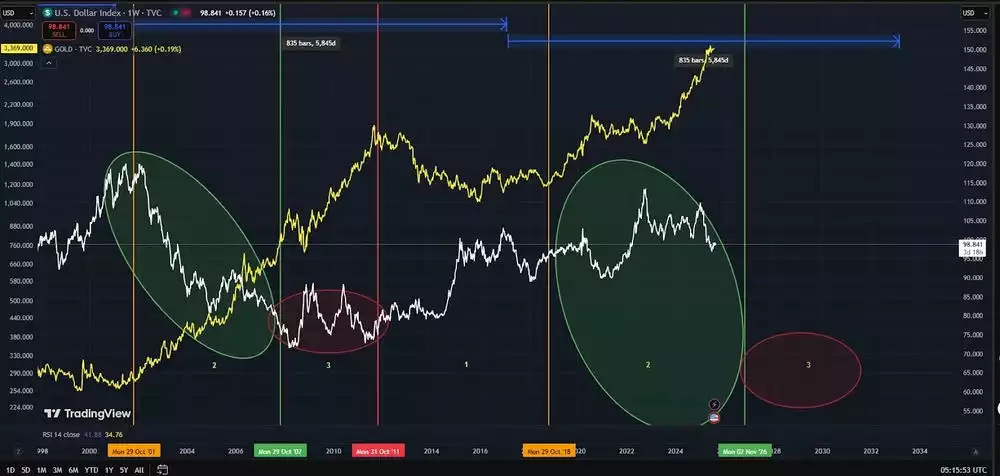

Gold's behaviour across these two phases is shown below.

The volatility of this final uptrend may appear chaotic, but it aligns with expectations for this late-stage phase of the 18.6-year cycle. Historically, this is when cracks in the system widen, leverage expands, and volatility intensifies—set against a backdrop of investor greed and complacency.

Trump’s unpredictable style contributes to this volatility. While most market participants are caught reacting to each headline, long-term investors are better served by stepping back, recognising the macro environment, and positioning in assets with long-term resilience.