Bitcoin Prices Consolidate as Market Pauses

News

|

Posted 28/03/2023

|

10324

After weeks of out-performance, Bitcoin prices are consolidating, with the market currently experiencing a pause. The price range for Bitcoin sits between US$26.7k to $28.7k. In this week's article, we will gauge investor confidence using on-chain tools such as exchange flows, profit taking, and coin holding times.

Strong Price Appreciation and Investor Activity

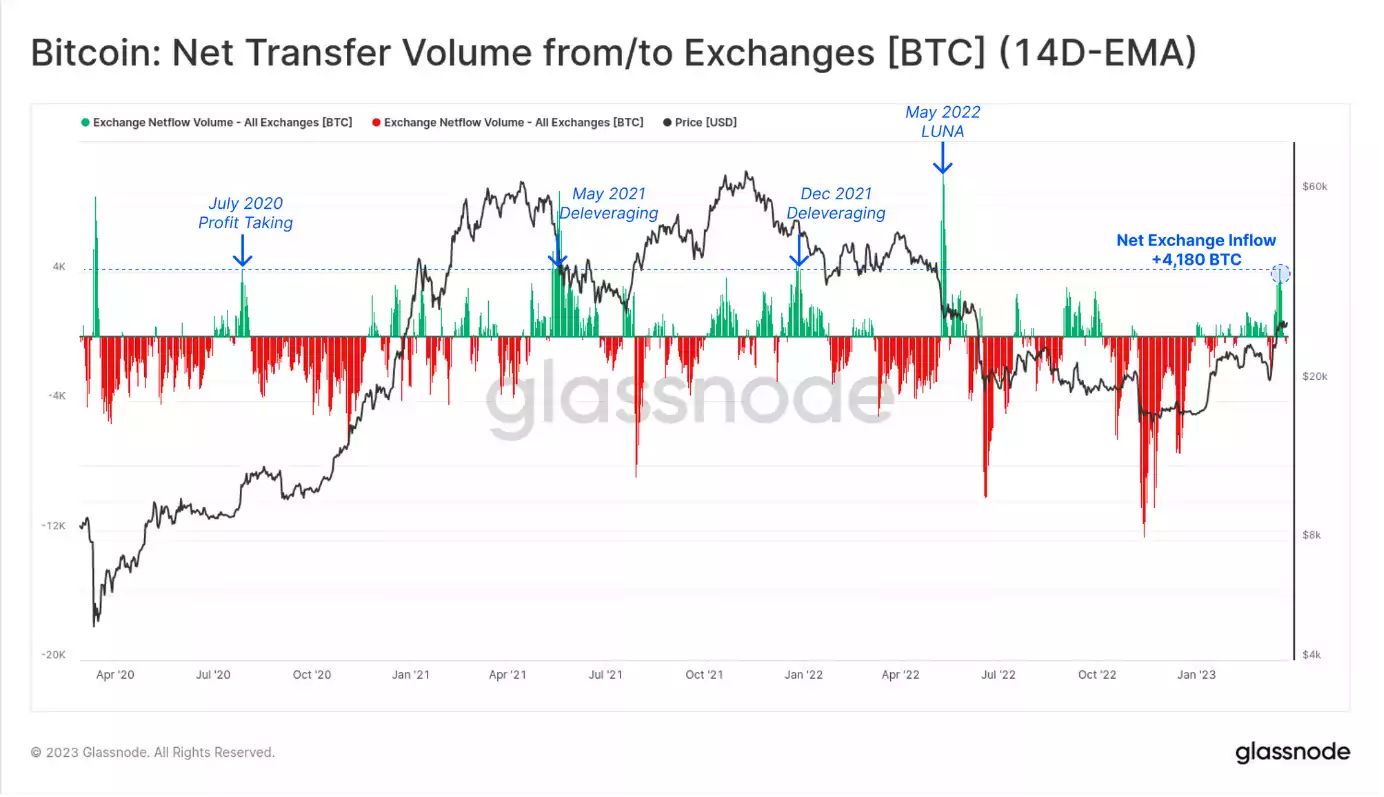

Bitcoin has seen strong price appreciation in recent weeks, which has led investors to increase the volume of coins deposited to exchanges. Net exchange flows increased by 4.18k BTC this week, marking the largest net increase since the LUNA collapse in May 2022. This suggests that profit-taking is underway. Prior instances with similar or larger net inflows have aligned with major market volatility events, usually on the downside, suggesting the market is in a much stronger position this cycle.

Breakdown of Coin Deposits by Holder Types

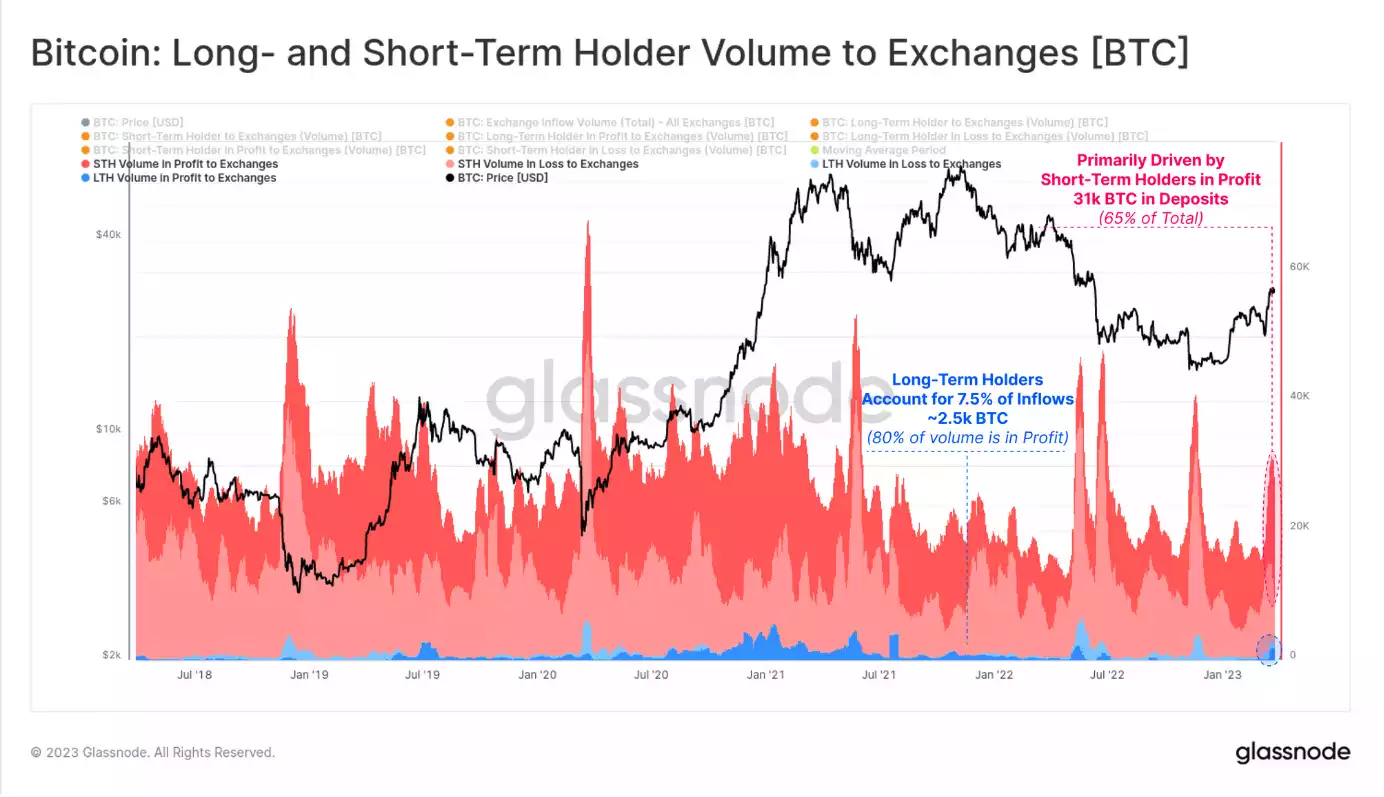

The breakdown of coins sent to exchanges by Long-Term and Short-Term holders shows that both groups experienced an uptick, peaking at 31k BTC this week. Short-Term Holders accounted for 92.5% of total inflow volumes, with 65% of the total being STH coins in profit. Long-Term Holders made up 7.5% of the total deposit volume, with 80% of their volume in profit, marking the largest uptick since mid-2021.

Realised Profit/Loss and Market Momentum

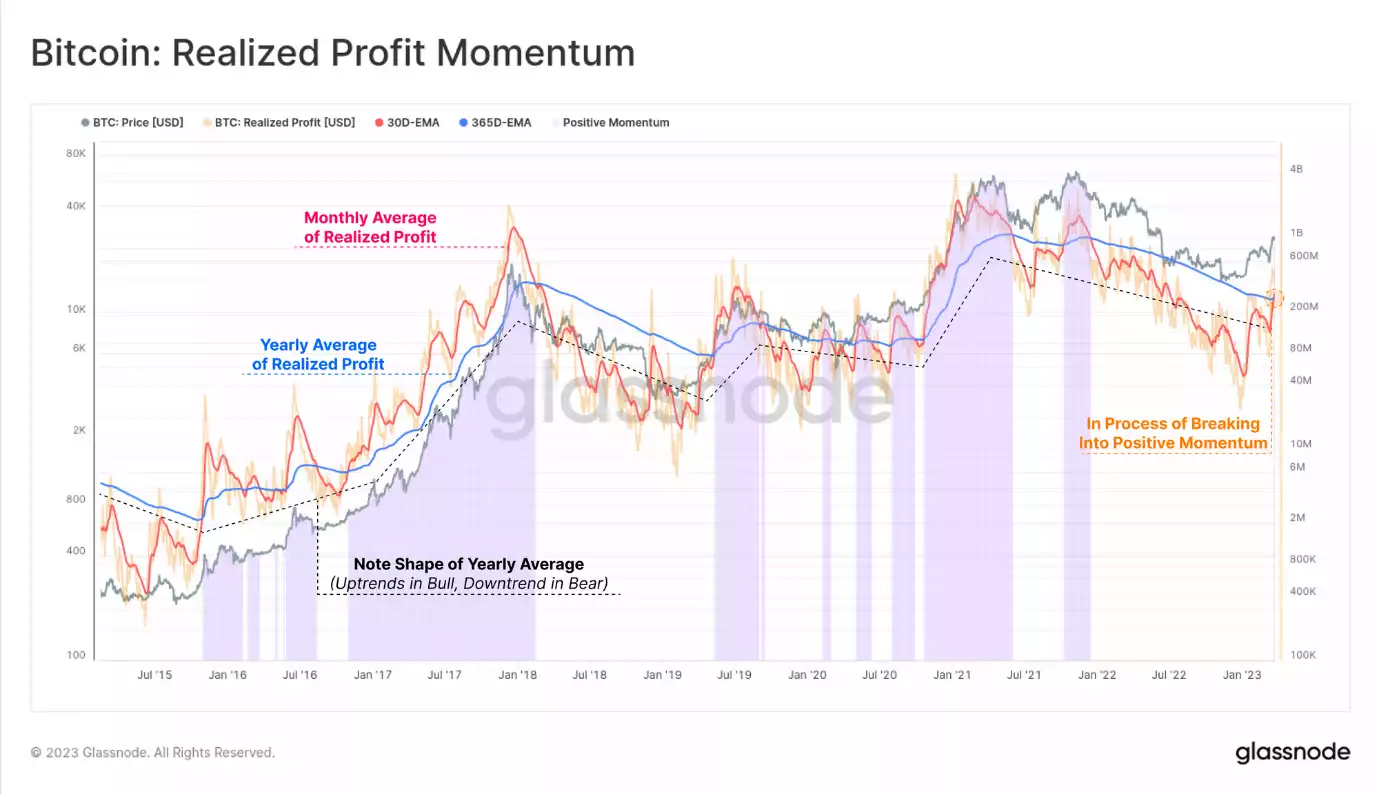

Realised profit/loss, a crucial aspect of on-chain analysis, involves pricestamping coins during on-chain movement and comparing profit over the last month to the yearly average. The first positive momentum cross-over since the Oct-Nov 2021 all-time high (ATH) indicates heavy profit-taking in bullish markets and light profit-taking in bearish markets. The yearly moving average shapes trends up in bull markets and down in bear markets.

Lifespan Analysis and Market Confidence

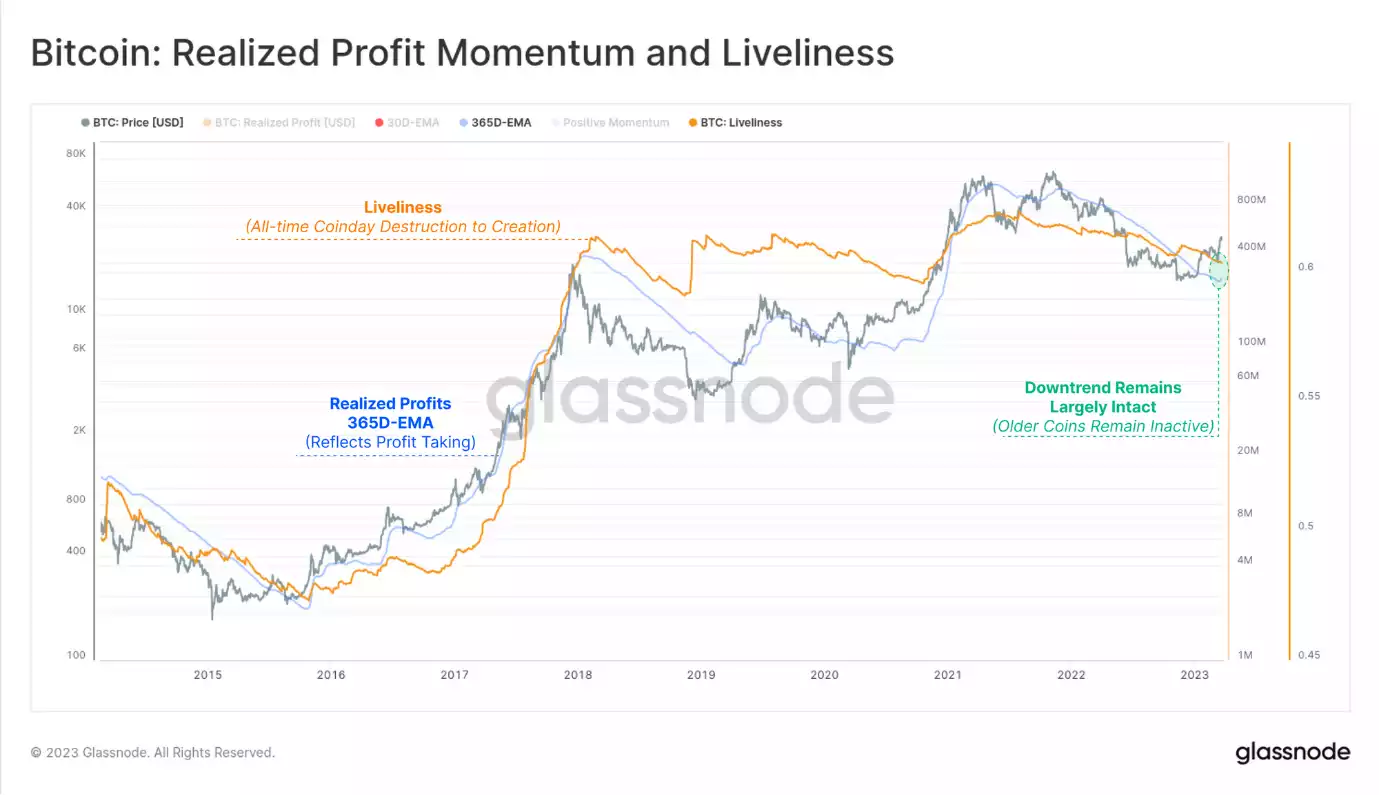

To supplement profit/loss analysis, we can use Lifespan tools. Lifespan measures the holding time between coin acquisition and disposal. Heavy Lifespan destruction indicates older coins moving and experienced investors exiting. The Liveliness metric assesses the macro landscape through the ratio of all-time Lifespan Destruction and Creation. Decreasing Liveliness suggests market accumulation and HODLing, indicating confidence in the asset, while increasing Liveliness suggests the distribution of old coins, hinting that the asset is considered expensive.

Market Behaviours and Current State

The yearly average of Realised Profits closely mirrors Liveliness, as they describe similar market behaviours. In bull markets, long-term investors spend dormant coins and realise large profits, resulting in oversupply and a macro market top. In bear markets, long-term investors accumulate slowly, taking fewer daily profits and establishing a cycle floor. The current state shows both metrics in macro downtrends, indicating that the majority of coins are inactive on-chain.

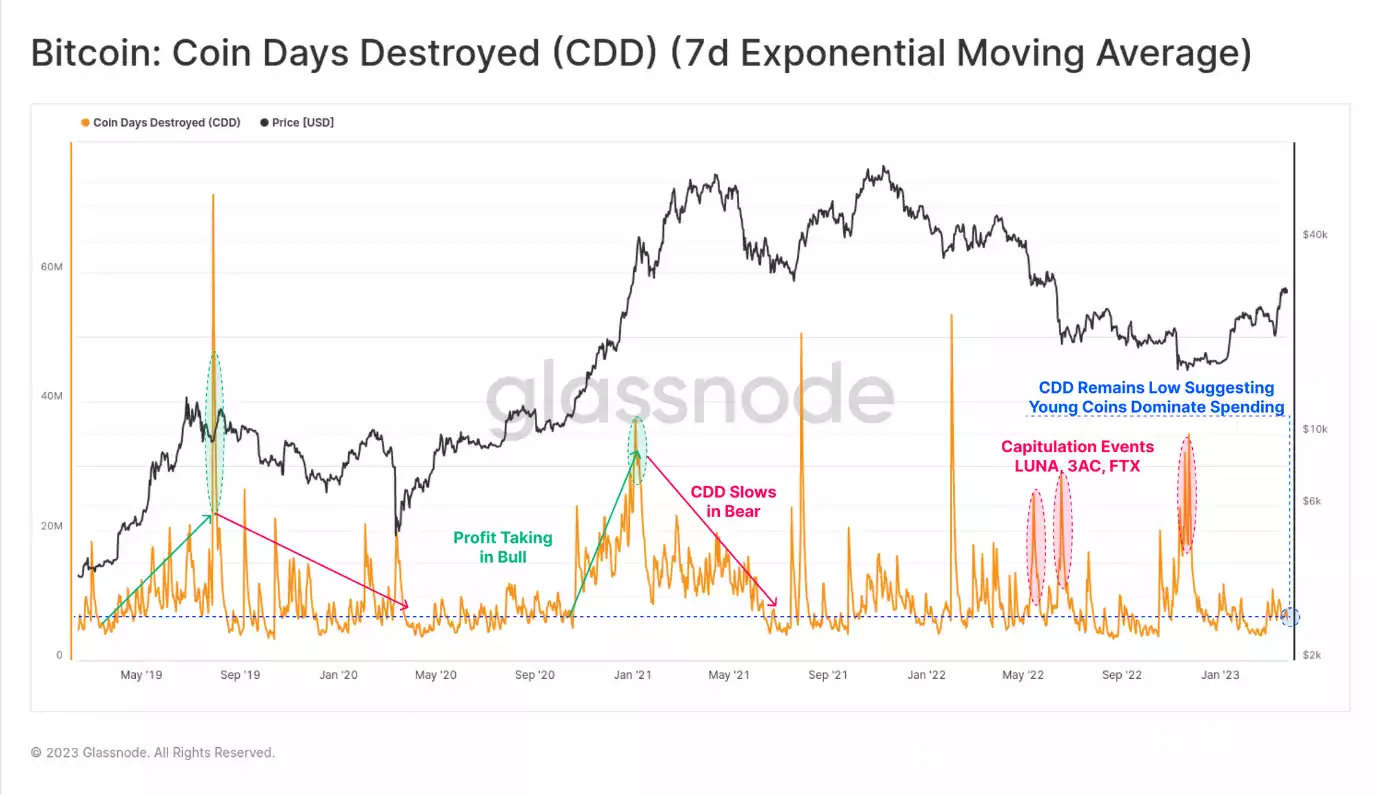

Coindays Destroyed and Short-Term Holder Dominance

The metric for measuring Lifespan, Coindays Destroyed (CDD), represents investor holding time spent daily. CDD upticks fall into two categories: sustained uptrends in bull markets (long-term holders taking profits) and sharp peaks in high volatility events (bear market sell-offs, widespread panic). In recent weeks, there has been a modest CDD uptick, with destruction magnitude below typical bull market levels. The average spent coin is still relatively young, and Short-Term Holders currently dominate profit-taking.

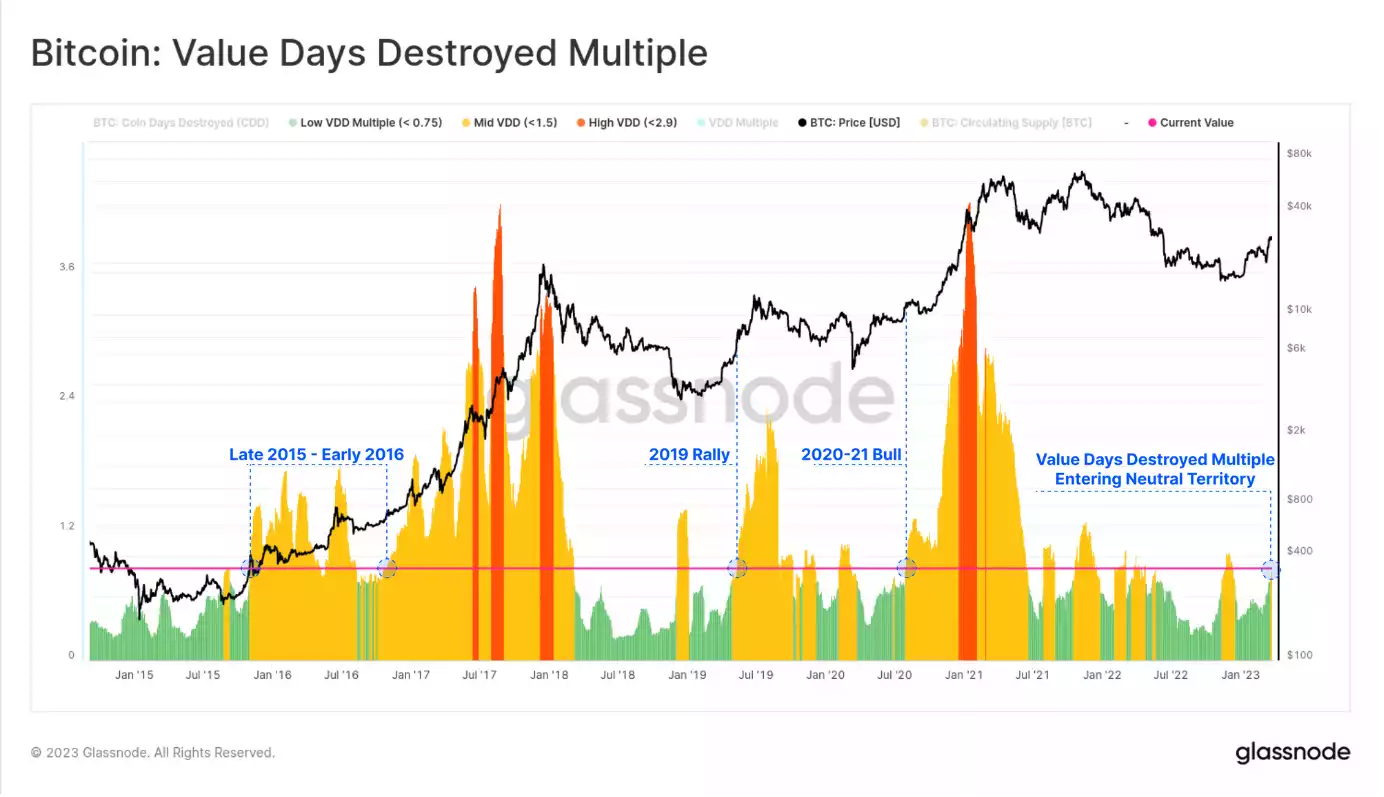

Value Days Destroyed Multiple and Market Transition Points

Lifespan is brought into the price domain using the Value Days Destroyed Multiple (VDDM), which compares the monthly dollar value of CDD to its yearly average. The current VDDM value is accelerating, leaving typical bear market territory behind. This indicates that there is sufficient demand to absorb the profits being taken, similar to market cycle transition points observed in late 2015, 2019, and 2020.

Conclusion and Market Outlook

In conclusion, the Bitcoin market is currently pausing, with profit-taking by investors on the rise. Short-Term Holders dominate spending behaviour, but a willingness to hold coins for longer periods is also observed. The majority of BTC remains inactive on-chain, suggesting confidence in the prevailing uptrend. Coin Lifespan metrics indicate that the market is in a strong transitional period, as growth opportunities lie ahead.