Bitcoin Market Rallies 23.3%, Overcoming Key Technical and On-Chain Resistance Levels

News

|

Posted 17/01/2023

|

8792

Bitcoin's market has seen a significant 23.3% rally this week, with prices rallying from $17,000 to over $21,000. This breakthrough of several widely observed technical and on-chain pricing models is noteworthy because these models act as significant psychological resistance levels during bear markets.

Understanding the 200D-SMA - A Key Indicator for Bitcoin's Macro Market Trends

One commonly used technical analysis tool across all asset classes is the 200D-SMA, which is often used as a litmus test for macro market trends. The Bitcoin market tends to correlate with a macro bullish or bearish trend when the price is above or below the 200D-SMA, respectively. This week's powerful rally overcame the psychological level at $19,500.

The Bitcoin market has a strangely consistent cyclical behaviour. The current cycle traded below the 200D-SMA for 381 days, just five days short of the 2018-2019 bear market at 386 days. The 200D-SMA was sitting just above the Realised Price at $19,700, which is a psychological cost basis model that is widely observed in the world of Bitcoin. Prices are now above this model, indicating that the average BTC holder is back in net unrealised profit.

Bitcoin Bear Market Durations and Fair Value Estimations: Impact on Miners and Market Health

The 2022-2023 bear market has spent 179 days below the Realised Price, making it the second longest duration across the last four bear cycles. Estimating fair value for Bitcoin is the subject of many modelling attempts.

One model, derived from transaction volumes and the NVT ratio, presented by Willy Woo, uses a look-back at the last two years of settlement volume and derives an estimated 'implied fair value' based on network value throughput. This model greatly over-estimated Bitcoin fair value in 2022, likely due to large entities undergoing massive deleveraging events, and wallet mismanagement by FTX/Alameda entities.

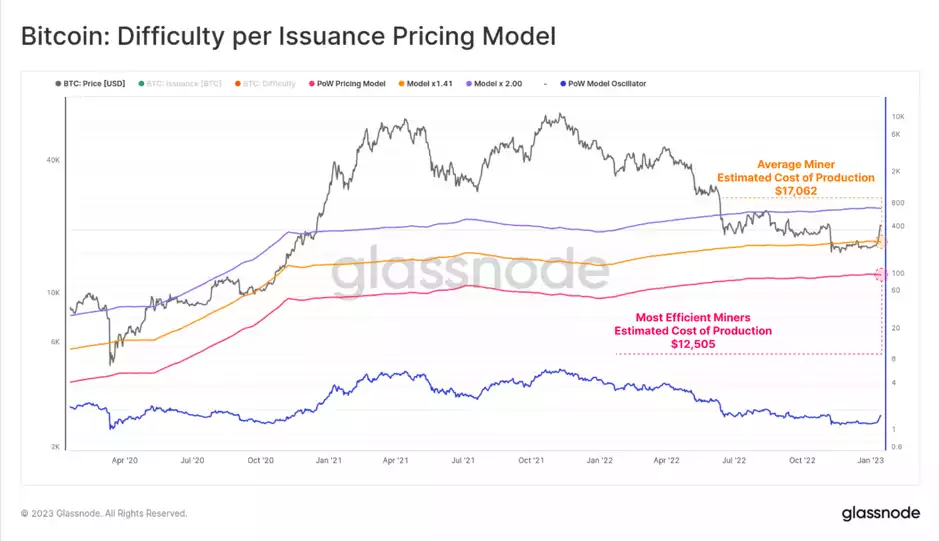

One of the sectors hit the hardest over the last 12 months has been Bitcoin miners, with publicly traded companies seeing major hits to their valuations and stock prices. However, with the recent rally in the Bitcoin market, miners may see some relief. Models estimate the average cost of BTC production at $18,798, with the assumption that Difficulty reflects the ultimate 'price' of the mining sector. This model indicates that miners may have been operating at a loss over the past year.

Miners across the board are seeing more favourable financial conditions ahead with the market providing some much-needed relief. This is good news for the mining sector, as well as for the overall health of the Bitcoin market.

Tracking Profits Return: Analysing the aSOPR Model for Signals of Market Shift in Bitcoin

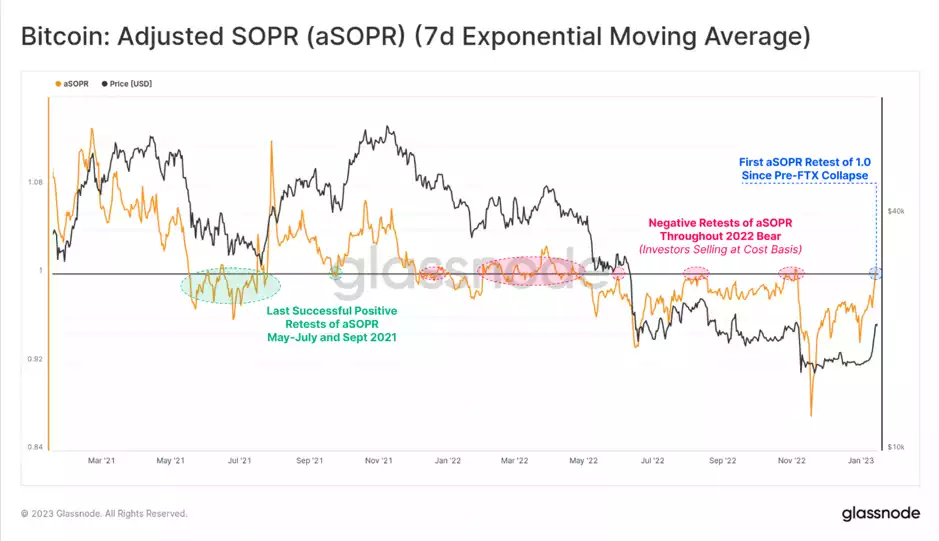

Another key metric to observe is the Profits Return, which is the return of profitable transactions on-chain. The aSOPR model retested a value of 1.0 from below as a key resistance level throughout the bear market. An aSOPR break above and a successful retest of 1.0 often signals a meaningful regime shift as profits are realised and sufficient demand flows in to absorb them.

Conclusion and Future Prospects for Investors and Miners

In conclusion, the 23.3% rally to start the year reflects the impact of strong price appreciation and a high volume of coins changing hands. With the aSOPR and Realised P/L Ratio testing a break-even value of 1.0, the next big question is whether the market can hold onto these gains. A wide cross-section of Bitcoin investors and miners are seeing their net holdings and operations return to a profit, making this an exciting time for the cryptocurrency market.