Bitcoin Hits All-Time High of $79,400

News

|

Posted 16/03/2021

|

8187

Bitcoin hit a fresh all-time high over the weekend, almost doubling its price so far in 2021. It took a few attempts to break the psychological 60k USD barrier, but when it did breach it, it did so in spectacular fashion.

While Bitcoin has seen major points of resistance over the past years, the coin has steadily continued to climb in value ever since its crash in 2018 and 2019, with 2021 seeing it raise in value sharply, increasing by more than 300%.

However, the success during 2021 is not limited to Bitcoin as the entirety of the crypto market has experienced increased values and investments from individuals and organisations around the world.

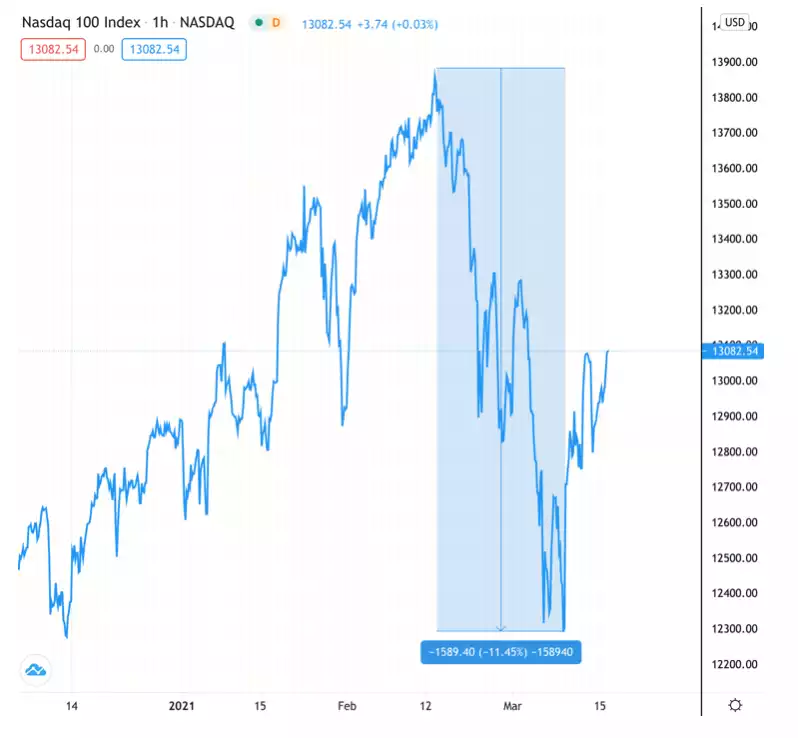

While Bitcoin continues to rocket, just last night it provided us with a 12% “cool off” (hardly anything to flinch at for crypto veterans who have been through years of sudden 30%+ pullbacks) which could be used as an opportunity to top up your “Bitcoin bags”.

Ever-increasing concerns about inflation appear to be driving market participants to Bitcoin. According to surveys, nearly $40B of the latest round of stimulus checks in the US would be spent on BTC and the stock market – continuing the behaviour that we have been seeing for the last few months. This behaviour, alongside incredible institutional investment, has solidified Bitcoin as THE best performing asset of the last year, and the last decade…

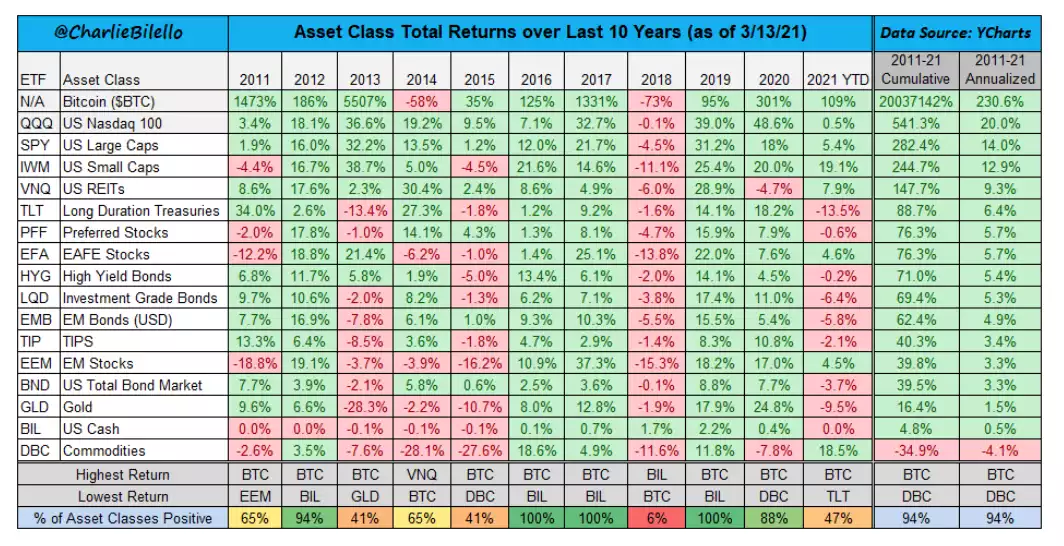

The information above compiled by Mr Talamas on Twitter shows that over the last decade, Bitcoin’s Annualized returns were 230.6%, about 210% higher than the entirety of the Nasdaq 100 and other types of assets.

We have been here before. Dizzying highs and lows are not a new phenomenon for bitcoin. However, the cryptocurrency is now finally gaining institutional support, which eluded it for a long time. The pandemic certainly helped. During the widespread lockdowns, online commerce and payments ballooned, increasing interest in digital currencies exponentially.

Bitcoin has always been volatile. But the past year has shown that every asset class can become wobbly in an uncertain environment – just look at the NASDAQ in the last few weeks…

Bitcoin has always been regarded as an interesting store of value due to the ultimate ceiling of 21 million and the difficulties in mining it. But its wider acceptance is bringing a sense of credibility and stability that was missing.

Despite the short-term blip on what looks to be Bitcoin's meteoric long-term rise, many investors and analysts still consider the cryptocurrency a buy. This makes the current dip a great chance to load up on more Bitcoin investments or get your foot in the door if you haven't already.

This is all the more reason to make a long-term investment. Of course, you want to buy it for the lowest price possible today, but even if you overpay slightly if you hold it for years and Bitcoin appreciates as many expect it to, a few thousand dollars here or there on the price you bought it at will be the last thing on your mind.